April 14, 2011 - Paris Strategy Luncheon Review

Featured Trades: (PARIS STRATEGY LUNCHEON REVIEW), (FXE)

2) Paris Strategy Luncheon Review. The full force of soaring oil prices really hit home when I took a taxi to the Paris airport yesterday. As we passed a gas station, I mentioned to the driver that I didn't know that they sold gas by the gallon in France. He answered that they didn't. France depended on Libya for much of its oil supplies, he explained, and those were the prices in liters I was seeing. He then voiced concerns about the future of his taxi business as fuel prices ratcheted up from $10 to $15 a gallon! It makes our own bleating that our prices may edge up from $4 to $5 a gallon appear somewhat feeble.

The first Paris strategy luncheon, held at the Cercle National des Armees, or the French Army Officers Club, was one of the best yet. You know, the place where Napoleon used to hang out at. I gave my talk under the watchful eyes of Charles de Gaulle, President Nicolas Sarkozi, and the French Foreign Legion. Renditions of the battle of Waterloo were nowhere to be seen.

The event turned in to something of a reunion for me, with my former institutional clients from the 1980's dropping by, as well as some of my French staff from the London office of Morgan Stanley. Claude won the prize for the greatest distance traveled, some 5,680 miles from San Diego, CA. Spend your Zimbabwe dollars wisely, Claude. Maybe you can offload your holding to Muammar Khadafi.

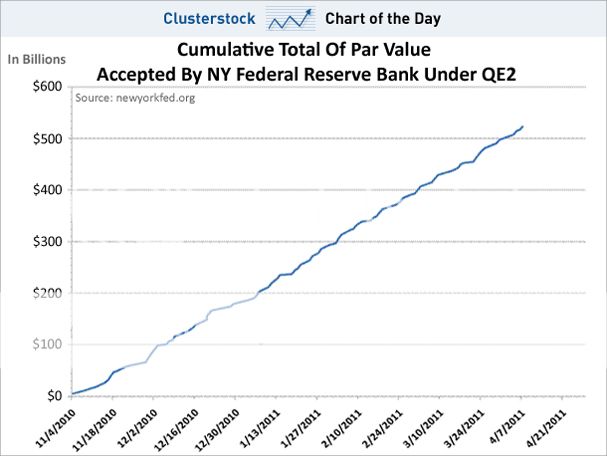

The big question at all of my recent lunches is what will happen when QE2 ends? I offered the simplest of all possible explanations. Asset classes that prospered from the $600 billion infusion from the Federal Reserve, like stocks, commodities, precious metals, and oil, will suffer the most from its demise. Asset classes that suffered from the rapid expansion of the monetary base this encouraged, like the US dollar, should see a rebound. The political balance in Washington makes a QE3 impossible, unless the stock market crashes first, vaporizing Ben Bernanke's wealth effect.

Everyone present complained that the Euro was insanely overvalued at $1.42, but conceded that momentum could take it as high as $1.46 before it sees a reversal. An overvalued currency was acting as a drag on the European recovery, especially in export sensitive Germany. I brought an extra suitcase to Paris, hoping to fill it with goodies for those on the home front at the department store Gallarie Lafayette. Mon Dieu! Thanks to the collapse of the greenback, prices were so high that I only purchased a few postcards, knowing I could buy the same products at home on line for half the cost, with free shipping.

I spent the weekend playing tourist and visiting my old favorites, such as the Louvre, the Musee d'Orsay, Sacre Coeure, Montmarte, the Eiffel Tower, and a fine dinner floating down the Seine on the Bateaux Parisienne. The food is so good that even the local corner brasserie produced a meal to remember. A stylish people make it impossible to be overdressed, no matter where you go. In Paris, even the homeless have taste. A search for my front teeth on the Left Bank, which I lost in a riot there in 1968 when a flying cobblestone hit me in the mouth, yielded no results.

-