April 19, 2011 - Macro Millionaire Portfolio Blasts to New All-Time High

Featured Trades: (MACRO MILLIONAIRE PERFORMANCE)

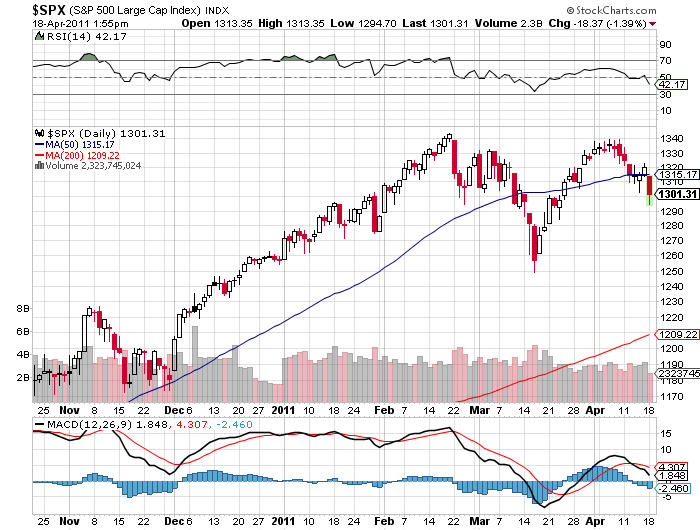

1) Macro Millionaire Portfolio Blasts to New All-Time High. Followers of the Mad Hedge fund Trader's Macro Millionaire model portfolio hit an all-time high on Friday, reaching a five month return of 25.35%. That compares to a much more modest return of 10% for the S&P 500, and 0.05% for cash. It also puts the trading mentoring program in the top 1% of all hedge funds. According to the research boutique, Hedge Fund Research, the average hedge fund brought in a gain of only 1.6% in the first quarter of 2011.

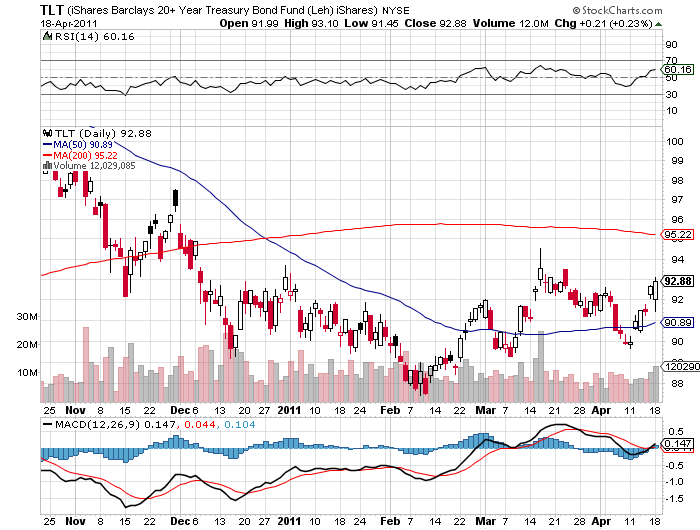

What pushed us over the top was the unexpected rally in the Treasury bond market last week. While most analysts were expecting a selloff of Biblical proportions in the waning days of Ben Bernanke's QE2, I was willing to bet that bonds would do nothing, at least for now. And nothing was exactly what we got. That allowed the June puts on the Treasury bond ETF (TLT) that I sold two months ago for $1.02 to close at $0.35 on Friday, adding 3.77% to our total return. If I run this position all the way into expiration on June 17, it will add 5% to our portfolio.

The early Macro Millionaire followers were stunned by their initial performance from the end of November, 2010, with big longs in financials, commodities, the grains, and energy, and shorts in the Treasury bond market producing immediate double digit profits. This enabled Macro Millionaire to become the fastest selling new trading program available on the Internet. I was busier than the proverbial one armed paper hanger, tracking the markets, pumping out trade alerts, responding to readers' questions, delivering strategy luncheons, and working my 40 year accumulation of industry contacts for everything it was worth.

Recent months have been quiet ones for Macro Millionaire traders, as global market began a medium term topping process in February. A short volatility position in the bond market seemed the only low risk, high return trade out there. I leave high risk, low return ideas for competing newsletters to promote. Premature short positions in the yen and the euro cost us a few bucks and a lot of frustration, but at the end of the day, 19 out of 21 realized and unrealized trades have been profitable.

I have a feeling that our brief period of inaction is coming to an end. A global risk reversal appears to be at hand, and a plethora of trading opportunities are about to present themselves. With only a single position in short bonds tying up margin, we have more than ample dry powder to take advantage of sudden opportunities.

If for some reason you have suffered the misfortune of missing the Macro Millionaire trading program until now, let me address that shortfall. Just send me an email, and I'll send you the details about this unique, and highly profitable mentoring program at madhedgefundtrader@gmail.com . With any luck, you'll cover its $2,000 a year cost on the first trade, and then more.

-

-

Meet the Proverbial One Armed Paper Hanger