April 25, 2011 - Meet the 'Risk Off' Portfolio

SPECIAL 'RISK OFF' ISSUE

THE 'ANTI QE2' PORTFOLIO

Featured Trades: (BAC), (XLF), (SDS), (TLT), (JNK), (CU), (FCX), (ABX), (AMR), (FXE), (UUP)

1) Meet the 'Risk Off' Portfolio. I believe that several asset classes are in the process of making important medium term tops, and that it is time to start building short lists of trades to execute when the big turn comes. Of course the driving factor will be the end of QE2, Ben Bernanke's massively stimulative monetary program to prevent the economy from falling back into a double dip recession.

You don't have to execute these today, this minute, or this second. But sometime in the next month, we are going to see a 'sweet spot' for a reversal in the trends we have been coining it from for the last eight months. I call this my 'RISK OFF' portfolio. You can also think of this as the 'Anti QE2' portfolio. That means taking out short positions on everything that has prospered from QE2, and buying the assets classes that have been punished severely. Like that great hedge fund manager, Wayne Gretzky, you have to aim not where the puck is, but where it is going to be. This is the next trading portfolio you should have.

When it is time to pull the trigger, the markets are going to be wild, volatile, and chaotic. So consider this a 'to do' list that I am giving you in advance. I am not predicting the end of the world here, just a three to four month summer correction in major long term trends. The 'Dow 5,000' crowd is going to have to wait until 2012 or 2013'? or go find another newsletter. I'll let you know when it is time to break the glass by sending out a trade alert.

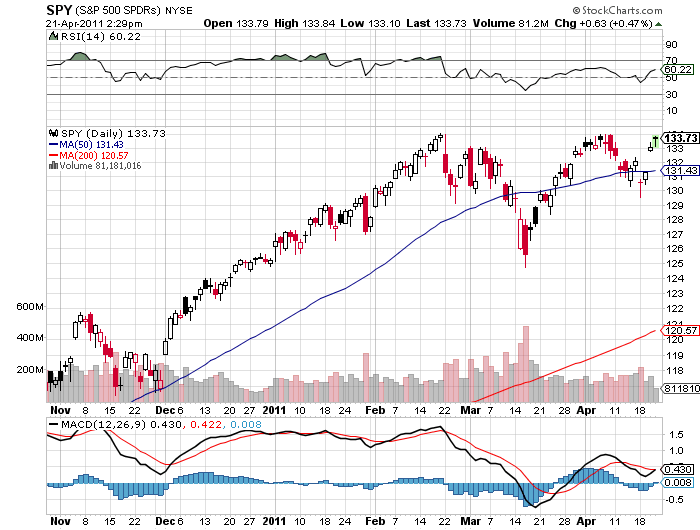

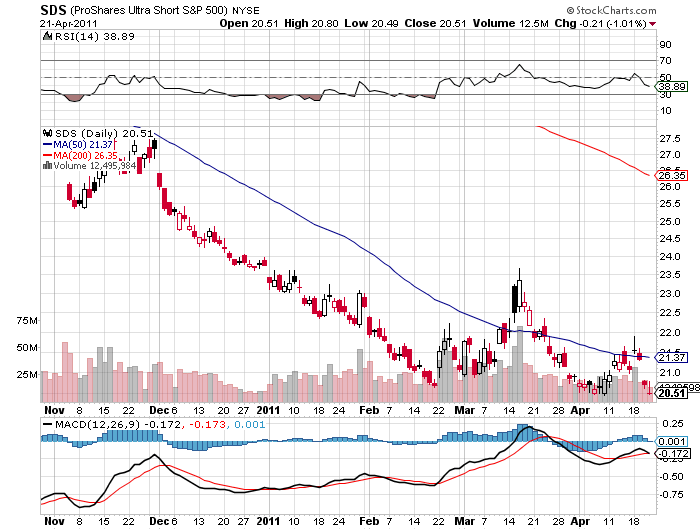

Stocks '? Count on a three to four month sell off bottoming sometime in August, when summer liquidity is at a low ebb. Unload whatever long positions you have left and start piling on the downside exposure. The chip shot here is to buy the (SPY) August $130 puts. That is the April low, and is the first place that nervous investors will start paying up for downside production. My initial target will be the March low of $125, and below that the November low of $118 if the market really gets the bit between its teeth. ETF players may want to look at the double short fund (SDS).

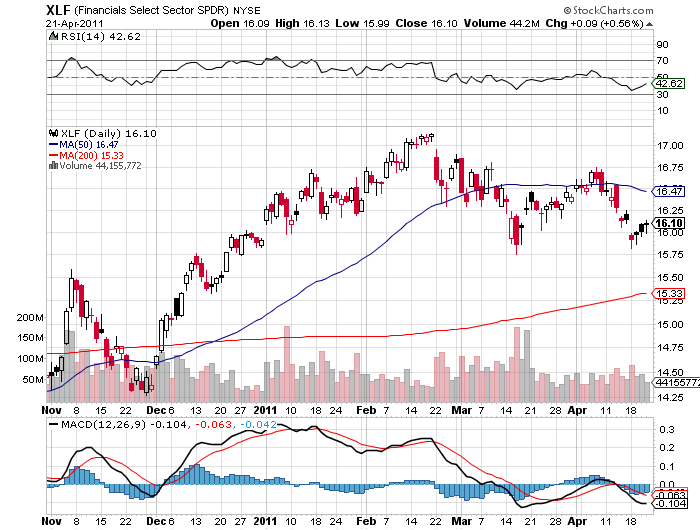

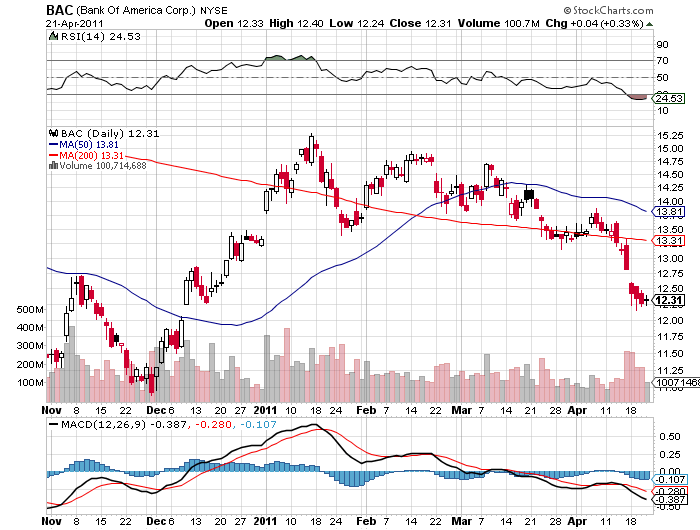

If the bond market continues to stabilize or rise, as it has done for the past month, it will eat into the free lunch that the banks have been feasting on for the past two years. That does not auger well for the financials, whose chart looks like they have already entered a downtrend. A short position or some puts in Bank of America (BAC) stock may net you a few bucks from here.

-

-

-

-

Don't Aim Where the Market is Now, But Where It's Going to Be

-

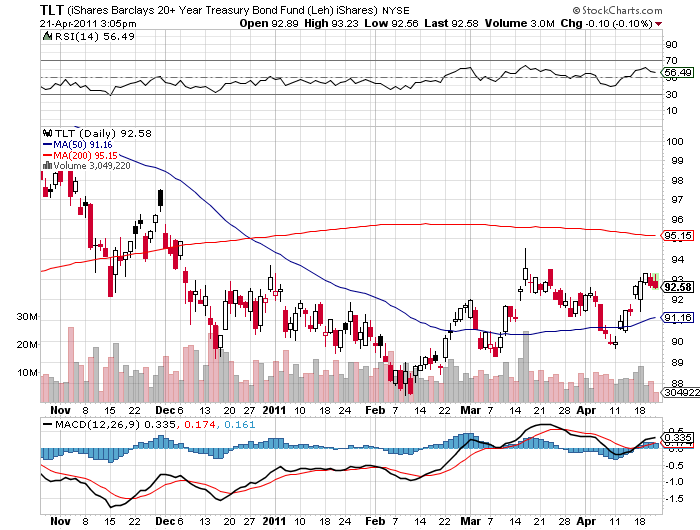

Bonds- US Government bonds have been punished mightily since rumors of QE2 first surfaced among hedge fund traders last summer, taking the yield on ten year Treasury bonds from 2.35% to 3.9%. In the run up to the end of QE2, yields have since backtracked down to 3.40%. The demise of the program will drain $75 billion a month of net buying from the market, prompting many analysts to predict an utter collapse in bond prices.

I think the opposite will happen. Any generalized selling of assets will create a flight to safety bid for Treasuries that will more than offset the Fed absence, stabilizing prices, and possibly driving them higher. I'm not looking for a new bull market in bonds, just a slow grind up of a handful of points. So an intelligent play here might be to use dips in bond prices to sell short the September out of the money puts and take in the premium income. I have already done this with the June puts, and it has been one of my most profitable trades of the year.

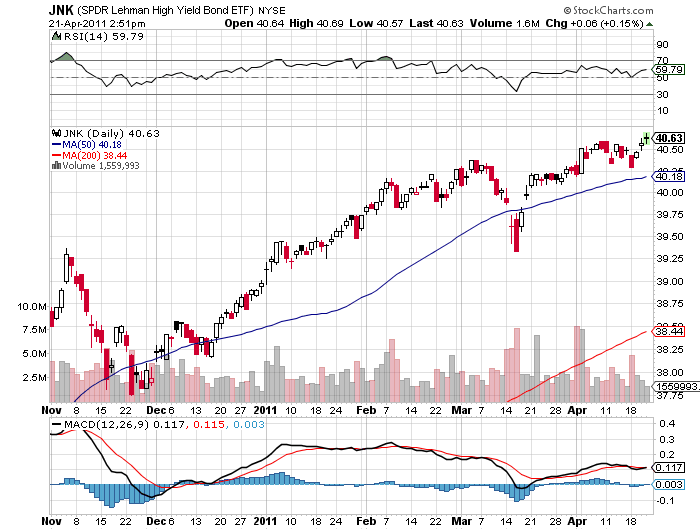

A better idea might be to sell short junk bonds. High yield corporate debt is now selling at a mere 300 basis point premium over Treasuries, close to an all-time low, and a far cry from the 2300 basis point spread we saw in the dark days of 2008. This is a market that has covered an awful lot of ground in a very short time, entering positively bubblicious territory. If the stock market turns to the downside, junk bonds will follow close on its heels.

The no brainer here is to either sell short the (JNK) outright, or buy the September (JNK) $40 puts, which today were selling for $2. My initial target for these would be $37 or more if you get an expansion of put premiums on the downside, which I expect.

-

Junk Bonds Are a Sell Here

-

-

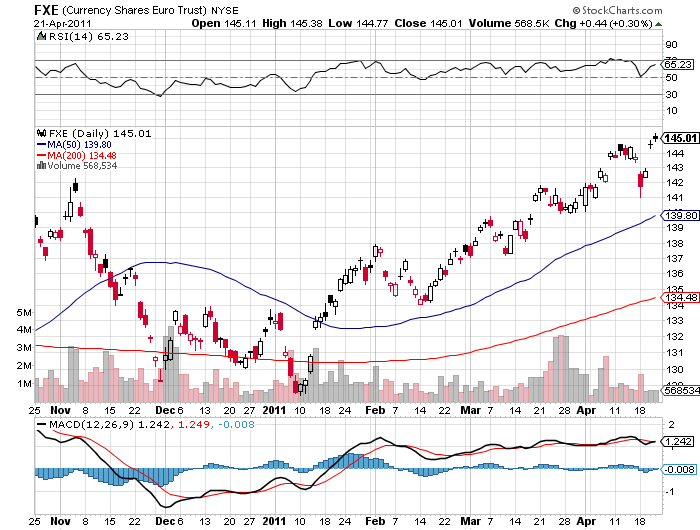

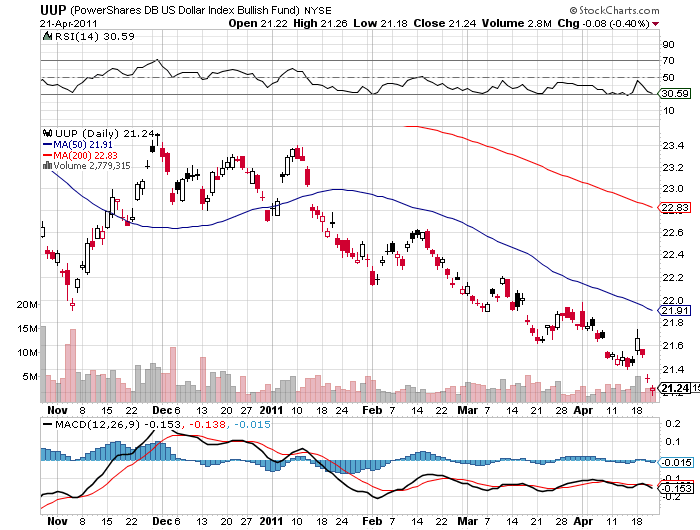

Foreign Currencies-No asset class has suffered more from QE2's massive expansion of the monetary base than the US dollar. Ben Bernanke's decision to freeze the Federal funds rate at near zero, while the rest of the world has ratcheted up rates, has proved a death knell for the greenback. It would be a vast understatement to say that this has become a one sided trade, with positions in the futures markets betting against Uncle Buck at record highs. This has become every trader's free lunch.

We all know how this story ends. When too many traders pile into one end of the boat, it capsizes. Think of stretching a rubber band to its limit and waiting for the snap back. The next chapter in this story has to read that the rest of the world pauses with their rate rises, while the US plays catch up, possibly later in the year. The first round of profit taking in the 'RISK ON' assets of stocks, commodities, oil, precious metals, and foreign currencies is certain to trigger a flight to safety bid for the dollar. Then those huge, hot speculative positions in the dollar come tumbling down.

Most over extended on the upside has been the Euro, which seems to want to go higher as its fundamentals worsen. The move from $1.28 to $1.46 has been accomplished with a mere 0.25% rise in interest rates, and some impressive jaw boning by European Central Bank president Jean-Claude Trichet. Never mind that the PIIGS are at or near bankruptcy, most European banks have a negative net worth when their cross holdings of sovereign debt are marked to market, and that Europe's economy is growing at half America's rate, and a tenth of China's. Short dated out of the money puts on the euro ETF (FXE) make sense here. You can also go long the dollar against a basket of currencies through the (UUP).

-

-

Are These Shorts?

-

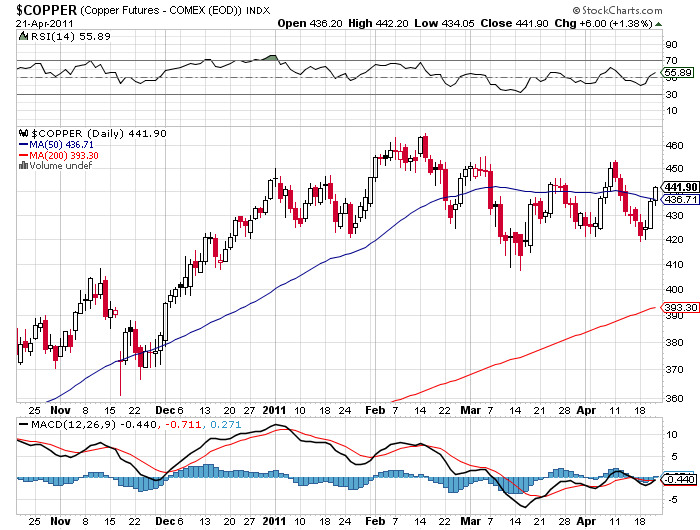

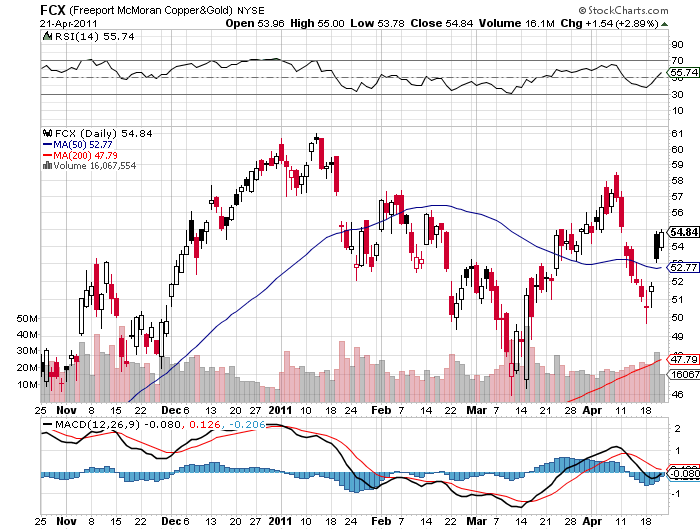

Commodities- Copper has been warning us for some months now that things are starting to roll over in basic commodities land. Traders call the red metal 'Dr. Copper, the only commodities that has a PhD in economics, because its record in predicting the outlook for the economy has been so accurate. Get a decent 'RISK OFF' trade going, and copper prices will plunge. Drop copper prices, and the world's top producer, Freeport McMorRan (FCX) also gets a bloody nose. The play here is to buy puts on a copper ETF like (CU) and (FCX) itself.

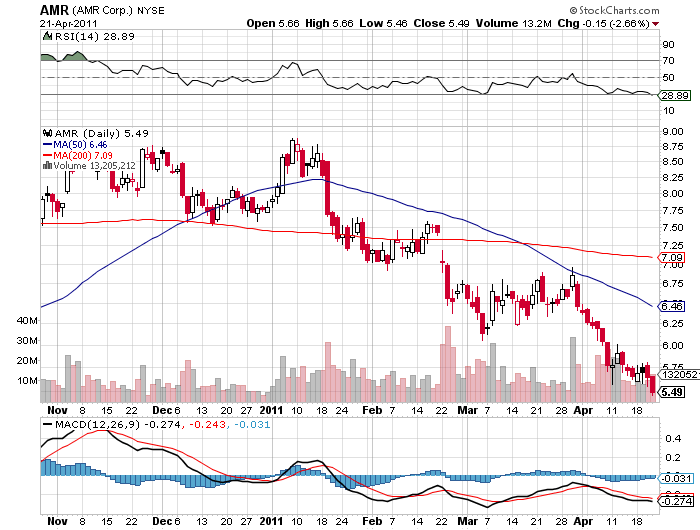

Any serious drop in commodity prices will be followed closely by a drop in oil, too. A large part of today's oil buying is to use it as a dollar alternative. Give a bid to the buck and that buying disappears in a heartbeat, causing the price to give back $30 quickly. Who is the biggest beneficiary of falling fuel prices? I am thinking, 'Fly Me, Jane'. Buy the airlines, especially one that has a low ratio of hedging fuel prices forward in the futures market, and is therefore most sensitive to changes in the prices of Texas tea. That would be the old legacy carrier, American Airlines (AMR), which is amazingly still in business.

-

-

-

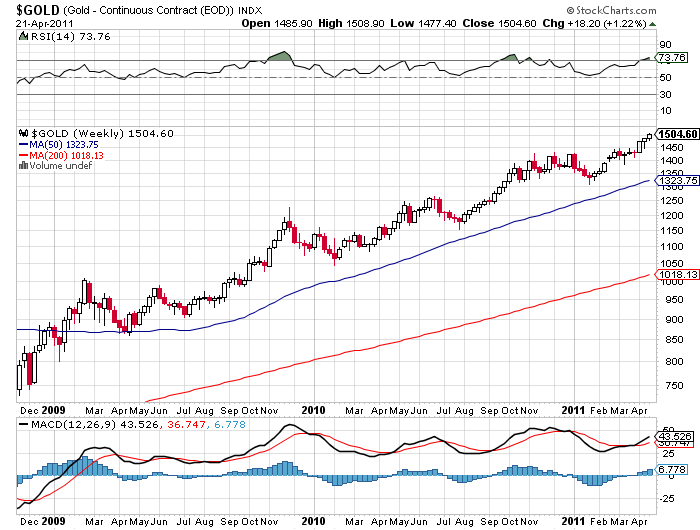

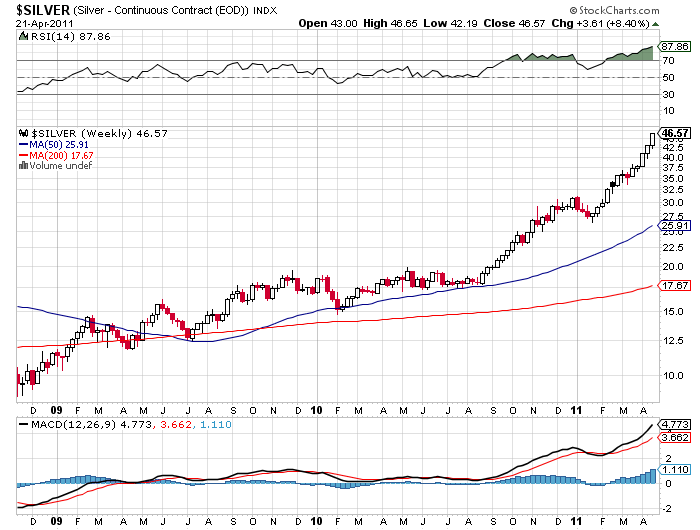

Precious Metals-No asset class has benefited more from Ben Bernanke's profligacy than the precious metals. Since rumors of the program were mulled over last August, gold has risen by 31%, while silver has rocketed by an eye popping 174%. No one has been a bigger fan of the white metal than me, who suffered from boatloads of abuse when I first recommended a buy at $10 in December of 2008.

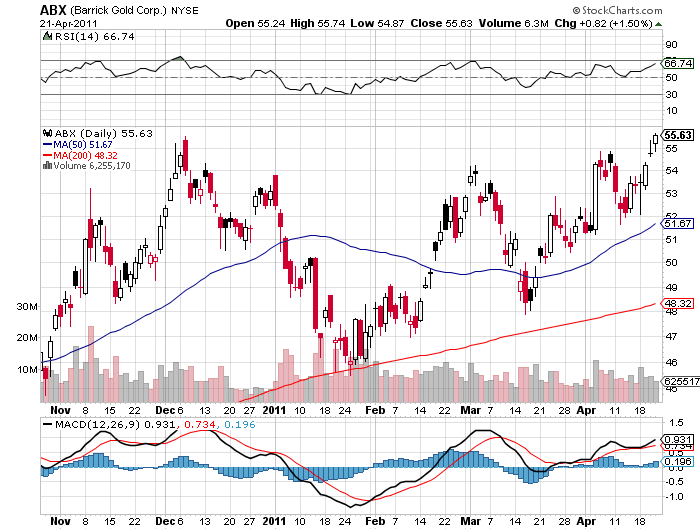

But there is not a trader on the street who doesn't think that the metal hasn't entered the final parabolic stage of its move, and that prices at these levels are insane. No one would be surprised to come into work tomorrow morning and see silver down $10. Look for silver to tickle the old 1979 Hunt brothers high of $50 an ounce, and then suffer a very rapid $10 bout of profit taking. If you don't believe me, check out the chart below, which shows two 20% pullbacks in silver in recent months. Only participate through deep out of the money short date puts, like around the $42 strike, as the risk here is high. If you don't like riding roller coasters with your hands up in the air, buy some puts on leading gold producer Barrick Gold (ABX).

-

Looking a Little Toppy to Me

-

-

-

And Then There's the 'E' Ticker Ride