May 2, 2011 - The Stock Market Suddenly Just Got a Lot More Expensive

Featured Trades: (STOCKS JUST GOT A LOT MORE EXPENSIVE)

3) The Stock Market Suddenly Just Got a Lot More Expensive. The news on Thursday that Q1 GDP growth came in at a piddling 1.8% annualized was a huge disappointment. The number was under the low end of most predictions, and a far cry from the reasonable 3.1% rate we saw in Q4, 2010. However, it is completely consistent with the long term 2.0%-2.5% rate that I have been forecasting in this letter. That is a mere shadow of the 3.9% rate we saw during the last, steroid powered decade.

The stock market is going to have a big problem with this number. It has recently been ascending at a rate that assumes at least a 4% rate. When cooler heads prevail, and traders take their smelling salts, they will realize that the 1.8% rate in no way justifies the current level of stock prices. Those fingers hovering over computer mice will get itchy, and some serious selling will ensure.

How did the markets respond to the news? Stocks, bonds, gold, silver, foreign currencies, and oil all blasted through to new highs for the year. If you needed any proof that the markets have reached the final capitulation bubble stage of their move, this is it.

An analyst friend of mine told me yesterday that this kind of perfect correlation among all assets classes has only occurred a handful of times in the last century, only lasted a quarter, and always ended badly. Even my own Macro Millionaire model portfolio has surged to a new all-time high every day this week, and is now posting a 27% return in five months.

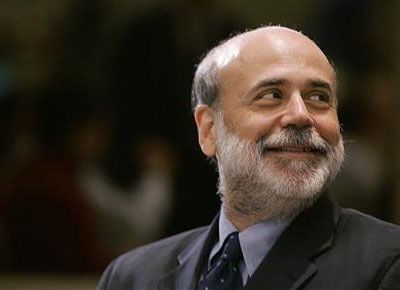

Of course, it is theoretically possible that you can flip a coin and get heads, draw a perfect blackjack, or pull an inside straight, 20 times in a row. But you won't catch me betting my, or your, money on it actually happening. Thank you Ben Bernanke!

Thanks for the Great Run, Ben!