May 10, 2011 - Lunch With Leslie Hinton of Dow Jones

Featured Trades: (LUNCH WITH DOW JONES)

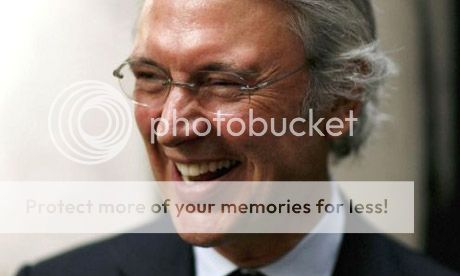

1) Lunch With Leslie Hinton of Dow Jones. I managed to catch a lunch with Leslie Hinton, the CEO of Dow, Jones, Inc. as he swung through San Francisco to meet with major advertisers. Hinton was installed in the top job by Rupert Murdoch after his $5 billion takeover of the family owned paper on the eve of the financial crash in 2007. The deal was a controversial one, as some 123 journalists have since left the Journal, populating competitors far and wide.

A 40 year veteran of News Corp, Les dates back to a long passed era of London's Fleet Street, back when papers were staffed with enormous teams of intrepid journalists, were printed with cold rolled type, and the Times was called the 'Thunderer' because its presses ran so loud. I might point out that I am another such dinosaur. Chatting with Les was a visit to a previous lifetime for me. During the seventies, when I was based in Tokyo, I was a regular contributor to the Asian Wall Street Journal, and occasionally, the mainland edition would pick up my pieces.

Hinton has much to be happy about these days. With a daily circulation of 2.1 million, the Wall Street Journal is now the top newspaper in the US, surpassing USA Today at 1.8 million and the New York Times at 900,000. While many of the paper's big ticket advertisers fled or went bankrupt during the Great Recession of 2008, much of the loss was offset by great strides made with new online products.

Les has a great perch from which he can watch the increasingly accelerating changes going on in the media. Not only does he have at hand the massive research resources of the Dow Jones organization, he has the firm's own halting, trial and error forays in the online world to learn from.

Les has the opinion that the Internet is throwing up information faster than we can digest it. Last year, more information was posted online than was accumulated during the previous 100 centuries of human history. If you printed out all of this on paper it would amount to a staggering 40 tonnes for every person on the planet.

While the personal computer opened the door to the web, the tablet is taking us further down the road. Mobile is changing everything, and some believe that by 2015, more will be accessing the Internet through their hand held telephones than by computers. However, Les disagreed with me that the online juggernaut is so unstoppable that it will wipe out print newspapers within five years.

Les listened intently while I detailed The Diary of the Mad Hedge Fund Trader's own online strategy. In two years, I took a second hand PC that I bought at a garage sale for $10, and used it to build a site that is now drawing 30,000 visitors? a day. My total investment in this business has only been $500 for hosting fees. I spent nothing for advertising, and did all the website development myself. Here, the business model is 'the gross is the net'.

For me, the challenge was to see how much I could build out of nothing. Apparently, the answer is quite a lot. Do a Google search on Mad Hedge Fund Trader in China, and you get two million hits. Les admitted that blogs terrified him, as everyone has such a low cost entry. Les has to cut down a forest to print a single issue. I just click a mouse and send out a few trillion bytes for free. He was somewhat amazed by my numbers, and responded with a 'good for you.'

We spent the rest of our time together reminiscing about old friends, the many who died, either from incoming artillery rounds or chronic alcoholism. The early days at the Australian, the 1981 London Times strike, the challenges of filing with teletype tape, and our late mutual friend, Murray Sayle, all came up (click here for my obituary of the great man).

When the discussion came to modern day ethics in journalism, or the lack thereof, Less revealed a decision he once agonized over. As the editor of another paper he had to decide whether to run a photo of Lady Diana Spencer in the back seat of her Mercedes after her fatal car crash in Paris. If she were dying it would have been appropriate to run the picture, but if she were already dead it would have violated taboos. Since it wasn't clear what state she was in, he spiked it.

I pointed out that while Murdoch paid $5 billion for Dow Jones and achieved a Google rank of eight, my $500 investment earned me a ranking of six. That means that in terms of online presence, my investment was 100,000 times more profitable than Rupert's and has no overhead. Less laughed. Welcome to the world of Internet economics.

Dow Jones Has Much to be Happy About These Days