May 12, 2011 - Trade School

Featured Trades: (TRADE SCHOOL) , (SPY),

1) Trade School. I fielded a lot of questions at yesterday's Macro Millionaire webinar on how I was able to make so much money with small positions. As of today, the year to date theoretical returns for the model portfolio is 34%, putting it in the top 1% of all hedge fund performance, and most of the time I have been 80%-90% in cash.

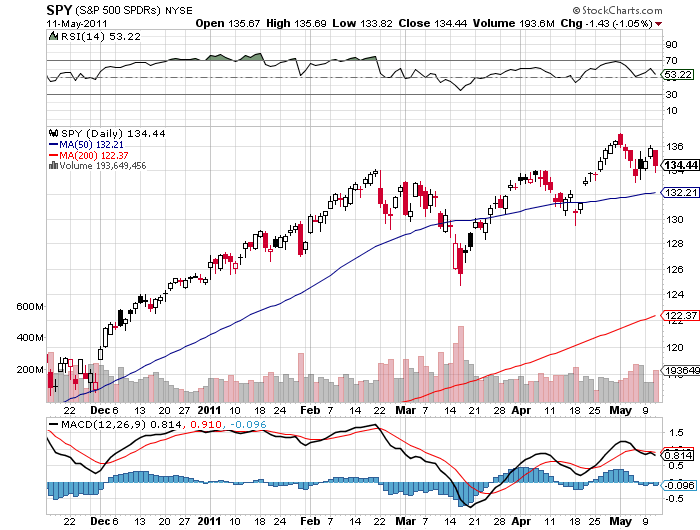

Let me tell you how it's done. You are about to learn about the wonderful world of leverage. I currently am 95% in cash and 5% in the (SPY) August, 2011 $130 puts, a bet that stocks on the S&P 500 are going to fall. I usually don't allocate more than 5% of my capital to a single position. If I am completely wrong because I have been smoking the wrong stuff, or am finally succumbing to my advanced age, the most I can lose is 5%, or $5,000 in a notional $100,000 portfolio.

If I am right, then things get real interesting real fast. When the (SPY) drops below $130, I am suddenly short a whole load of stock. To be more precise, the 5% weighting in the put translates into 16 contracts with an underlying value of $208,000 (16 X $100 X $130). If the market reaches $127, then I reach my breakeven point, covering the $3 premium I initially paid for my put.? When the (SPY) drops to $124, I have doubled my initial capital, gaining a profit of 100%. If the stock market then drops 10% from my breakeven point to $114, then I make a mind numbing $20,800, or a 416% return on capital. That would add 20.8% to my $100,000 portfolio. That is not an outlandish target. That would simply take us back to where the index started the year.

The bottom line here is that the risk reward is overwhelmingly in my favor, that I am risking a little to make a lot. Mix this in with some old fashioned fundamental analysis, top rate technical analysis, and some of my own secret sauce, and you have a winning strategy. You could make your asset class selection with a coin toss, and still make money with this approach. This is why 22 out of the last 24 trades for Macro Millionaire have been profitable, and why big double digit, or even triple digit returns are within reach.

This is how the best performing hedge funds do it. This is how you can do it. You just have to sit up and pay attention. Just thought you'd like to know.

-