May 17, 2011 - Airline Stocks Are Cleared for Takeoff

Featured Trades: (AIRLINES STOCKS ARE CLEARED FOR TAKEOFF)

3) Airline Stocks Are Cleared for Takeoff. The checklist is complete, the IFR clearance is in hand, and it is now time to push the throttles to the firewall for the airline stocks. I almost never remind readers of past trade recommendations which came good, but this time I think I'll make a rare exception.

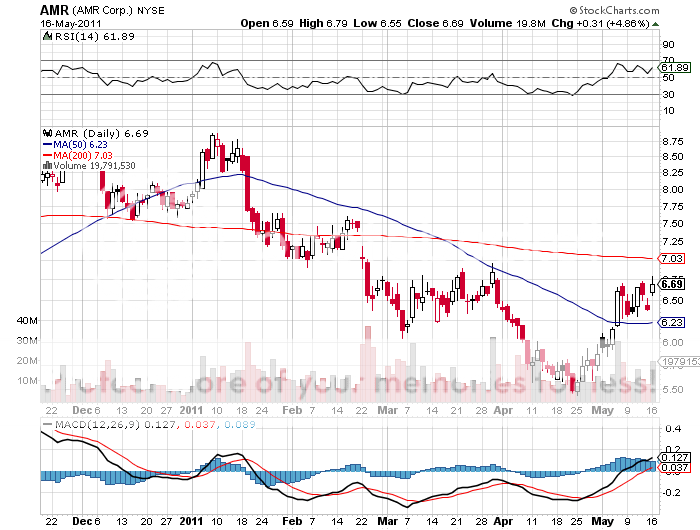

I recommended airline stocks six weeks ago as a cheap undated put on the price of oil in my piece 'Airline Stocks Could be Ready for Takeoff' (click here for the link) . Since the April peak in oil at $115, airline stocks have been on an absolute tear, while the rest of the stock market has been plummeting to the ground in a death spiral. My pick in the sector, legacy carrier American Airlines (AMR) has roared ahead by a heady 20%.

What is amazing is the industry's robust performance, compared to the last oil spike three years ago. Airlines have undergone one of the most rapid, and painful restructurings in American industrial history. When oil was last at these triple digit prices, it was hemorrhaging red ink. Today it is largely profitable. The $20 price drop we have seen in the past three weeks has added a further $3.5 billion in profits.

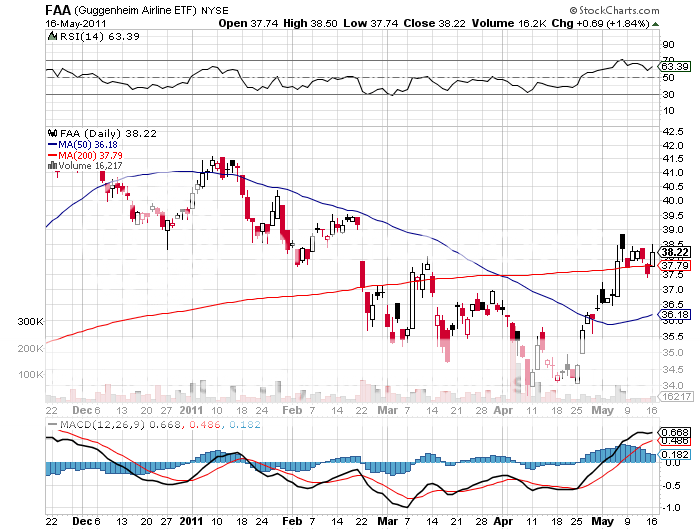

I am generally loathe to own stocks here. Airlines have already had their bear market. Use further spikes in the price of crude to add to your long positions through stock or the airline sector ETF (FAA). And no, I am not getting free frequent flier points for writing this piece, but I'll take an upgrade and some free pretzels if offered.

-

-

Up, Up, and Away!