July 22, 2011 - Time to Flip to the Short Side in the Treasury Bond Market

Featured Trades: (TIME TO FLIP TO THE SHORT SIDE ON THE TREASURY BOND MARKET), (TBT)

2) Time to Flip to the Short Side in the Treasury Bond Market. The first thing that I noticed this morning is that the long end of the bond market was getting absolutely creamed. 'RISK ON' has returned with a vengeance, at least for a few weeks.

If you assume that the real inflation rate is close to 3%, then most of the Treasury bond spectrum is paying negative interest rates, including two, five, and ten year paper. Only the 30 year is offering a small single digit real return. That is amazing, given the huge inflationary prospects that Ben Bernanke has created with his vast money printing exercise, on top of the huge price increases we have seen in food, commodities, energy, and metals this year. This makes Treasury bonds terrible investments, and great shorts.

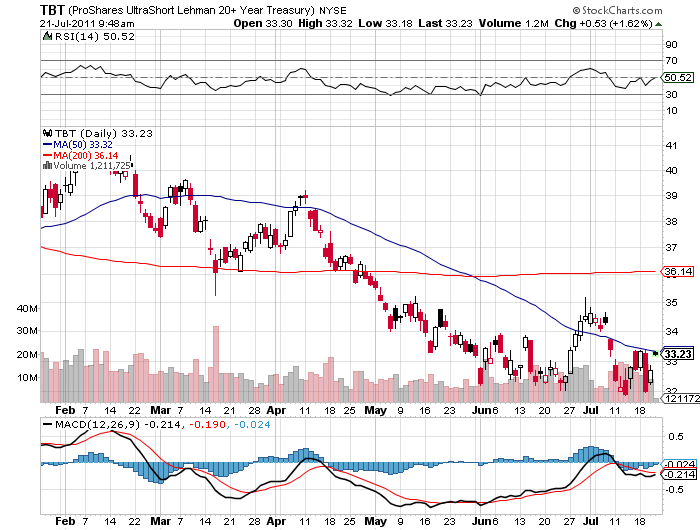

Today's terrible price action puts a chink in the armor of the bull market in Treasuries which has now run for nearly five months. I have been milking this for all it has been worth, but it is now time to get more aggressive on the other side. It sets up a double top on the long bond charts. The flipside of that is a double bottom for the (TBT), the double short inverse ETF that profits when longer dated Treasury bond prices fall.

I will increase this position when I see another entry point, as I believe that falling bond prices will be one of the key developments running up to the year end. They don't ring a bell at the top, so it's now or never. This could be the banner trade for the rest of 2011.

-

Time to Flip to the Short Side in the Treasury Market