July 28, 2011 - Home Prices Still Dead in the Water

Featured Trades: (HOME PRICES STILL DEAD IN THE WATER)

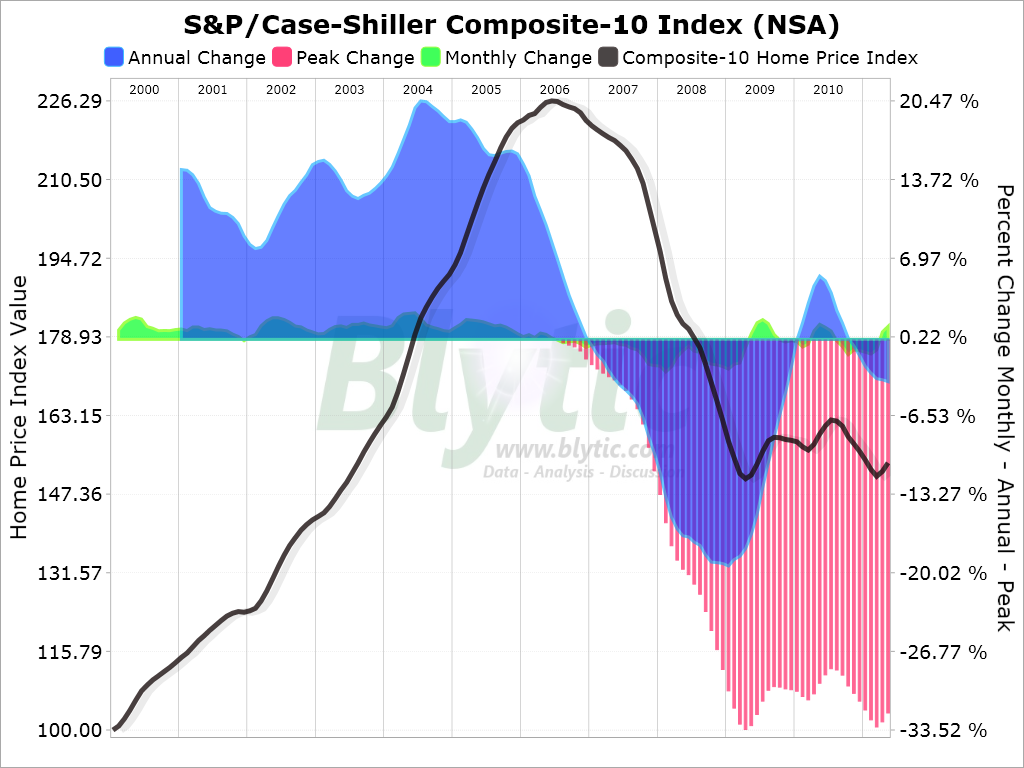

2) Home Prices Still Dead in the Water. Case Shiller released their national home price index for May yesterday, allowing beleaguered real estate agents to let out some feeble, halfhearted cheers. The data showed that prices did not go down last month and are even rising modestly in a few markets, bouncing along some sort interim bottom. The ten market index is up 1.13% since April, while the 20 market index crawled up 1.02%.

Professionals ascribe the modest increases to seasonal strength concurrent with the spring buying season. It is important to note that all of the new housing starts are for multifamily dwellings (apartment buildings), the sector that caters to new, bottom end purchasing families and immigrants.

The declines from the peak on a city by city basis are truly impressive, with the negative equity states well represented. They include Las Vegas (-59.28%), Phoenix (-55.85%), Detroit (51.19%), Miami (-50.65%). And Tampa (-47.46%).

I don't want to cause any of you homeowners out there to lose sleep, but I think that this is simple a calm before the next storm. This is the best that residential real estate can do, despite record low interest rates, massive state and federal subsidies, and affordability at a 30 year high.

What happens next? Another recession hits, the few private lenders out there withdraw from the market, Fannie Mae and Freddie Mac disappear, forcing home loan interest rates up,? desperate baby boomers cut prices further to reclaim what little equity they have left, and prices drop another 25%. Would I buy a house here? Not on pain of death.

-

Doesn't Look Like a Buy to Me