July 29, 2011 - What Ford is Telling Us About Platinum and Palladium

SPECIAL AUTOMOTIVE ISSUE

Featured Trades:

(WHAT FORD IS TELLING US ABOUT PLATINUM AND PALLADIUM),

(F), (TTM), (PPLT), (PALL)

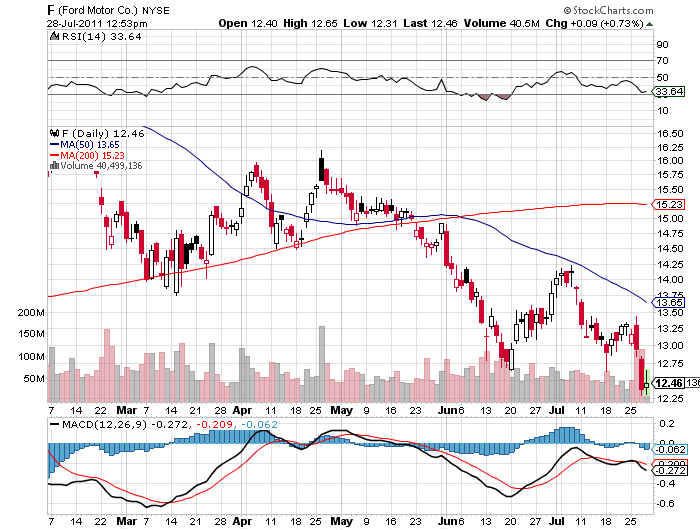

1) What Ford is Telling Us About Platinum and Palladium. Well done to Ford (F), which announced great earnings for Q2, leaving its close call with the junkyard a few years ago well in the rear view mirror. The shocker was in the revenues, which leapt $4 billion to $35 billion.

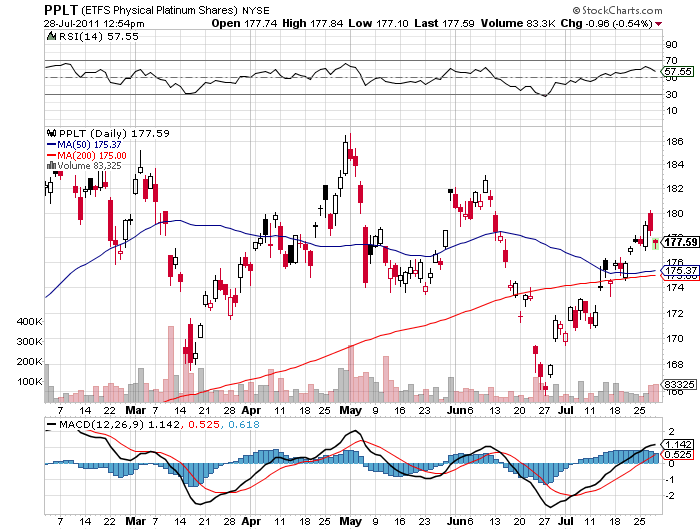

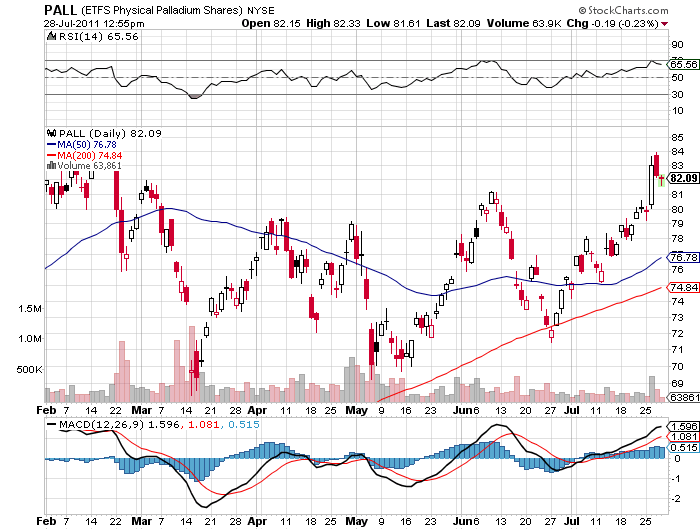

The big movers here were not in the stock of Henry Ford's legacy, but in the semiprecious metals of platinum (PPLT) and palladium (PALL), up 9% and 18% respectively in the past month. These are key components in the catalytic converters that must go into every American made car.

The US car market is rebounding off an annualized rate of 9.5 million units at the 2009 bottom, could reach 13 million units this year, and may rise as high as 15 million units by 2015. This soaring demand promises to keep these white metals on the boil for years to come.

Metals prices generally have benefited from recent strikes in Chile and South Africa. Any gold miner will now tell you that his biggest headache is the rapidly rising cost of production, from labor to the cost of heavy industrial tires.

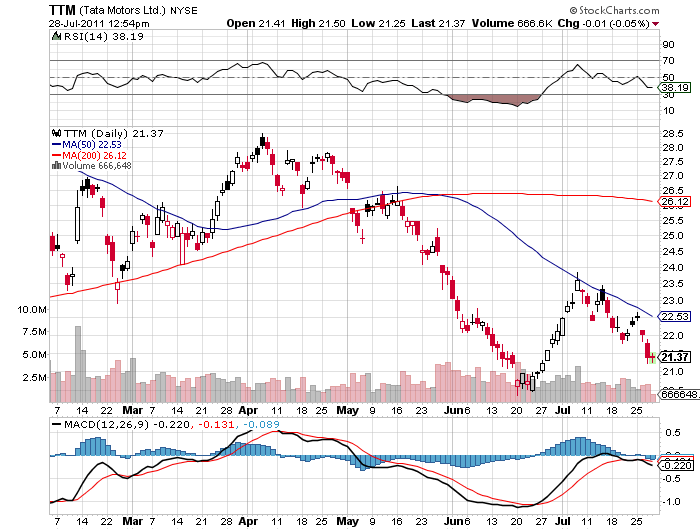

Ford made another interesting announcement. It is investing $1 billion to build low end cars at a new plant in India. One of my old mentors, Carl Van Horn, chief investment officer at JP Morgan, taught me to always watch direct investment, and the stocks will follow. If Ford is making the right call here, then you have to like Tata Motors (TTM), India's largest car manufacturer, whose stock has recently seen a big selloff on inflation fears.

-

-

-

-

Is This the Future?

-

Or This?