August 15, 2011 - Treasury 30 Year Auction Bombs

Featured Trades: (TREASURY 30 YEAR AUCTION BOMBS)

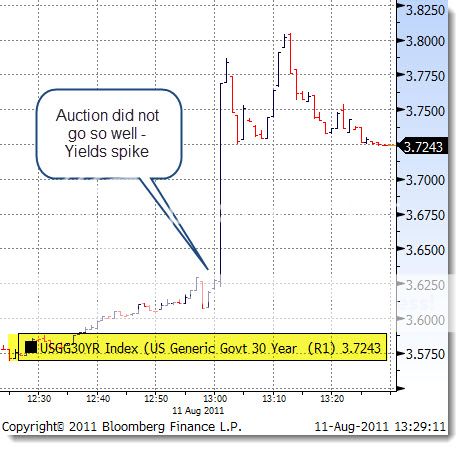

3) Treasury 30 Year Auction Bombs. If you want to see what a failed Treasury bond auction looks like, take a look at the intraday chart for Thursday's sale of 30 year paper, which was a miserable failure. Prices dove and yields soared, from a near 40 low at 3.57% all the way back up to 3.81%.

It looks like investors are unwilling to accept an inflation adjusted real yield of near zero for 30 years. Big surprise. They are already taking a negative real yield of -1.5% for 10 year bonds. In fact, real yields have disappeared around the world, from here to Germany to Japan. Fixed income investment is now globally a mug's game.

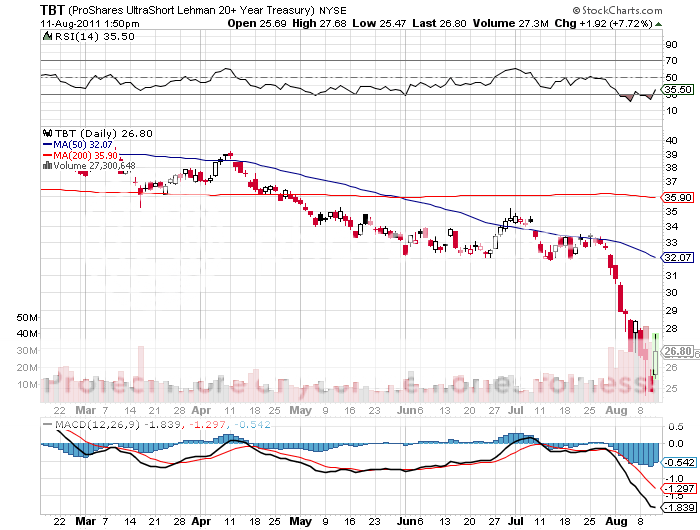

This will give hope to beleaguered investors in the (TBT), the leveraged ETF that profits from falling long bond prices and rising yields. My idea here did not exactly turn out to be the rose garden that I expected. After nibbling at $31 a few weeks ago, the (TBT) swan dived all the way down to $24 and change, a loss of 22%. Thank goodness I never doubled up on the way down. Yes, hedge funds can lose money.

I am afraid that the medium term outlook for the (TBT) is not great. By taking the unprecedented action of pegging interest rates at zero for two years, the Federal Reserve has created an indirect bid all the way down the yield curve which will be supportive of bond prices. Also, if the economy remains feeble, the next round of emergency, last resort Fed measures could include buying longer dated paper, like 10 year and 30 year Treasury bonds. At this point, I am just looking to get out at cost.

-