August 16, 2011 - A Visit to the Insane Asylum

Featured Trades: (A VISIT TO THE INSANE ASYLUM)

2) A Visit to the Insane Asylum. Watching the ten year Treasury bond tickle a 2.00% yield yesterday, I thought it would be propitious to revisit the insanity that is going on in this market.

Historically, ten year bond yields matched the nominal GDP growth rate. So an average 3.5% GDP growth for the past decade added to a 2.5% inflation rate gave you a bond yield trading around 6%. Today the math is from a different universe. A 2.0% GDP rate added to 0% inflation is giving you the 2.0% yield you see glaring at you from your screen today. The market is essentially betting that inflation will remain at zero for another decade.

There is one honking great problem with this scenario. Rampant inflation has already broken out in great swaths of the global economy. Anyone who purchases precious metals, commodities, energy, food, health care, user fees of any kind, or a college education can tell you, not only that inflation is alive and well, it is flourishing. Residents of China (FXI), India (PIN), and Turkey (TUR) and other emerging markets, and the commodity producing countries of Australia and Canada, can also tell you a lot about inflation.

The last place you can expect this stealth inflation to appear is in government statistics, a deep lagging indicator. And don't ever expect inflation to show its ugly face where you want it the most, in your wages, pension benefits, or 401k returns.

Given the strongly positive yield curve, where 30 year yields are trading at a 3.5% premium to overnight rates, this is probably the best time in four decades to sell Treasury bonds. With rates this low, the market is not telling the government that it is issuing too much debt, but that it is not issuing enough. Personally, I don't understand why the Treasury isn't floating more paper at the long end. Maybe it has something to do with politics. At this point I have to replay John Maynard Keynes most famous quote, which I keep glued to my computer monitor, 'markets can remain irrational longer than you can remain liquid.'

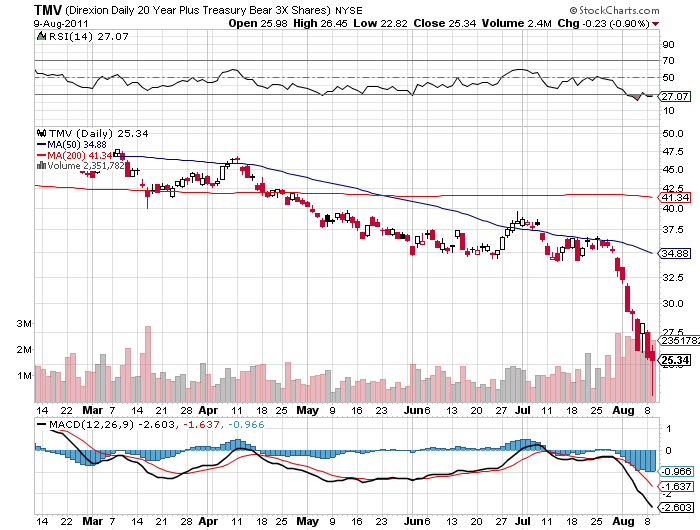

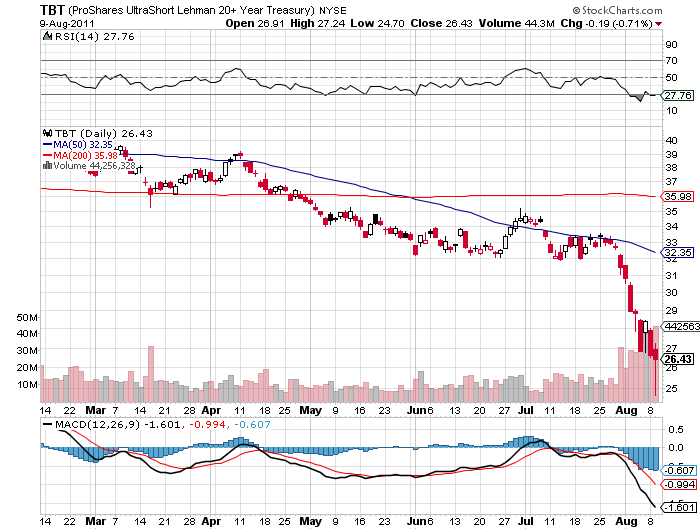

So, I wouldn't be betting the ranch on Treasury bond shorts just yet. Better to limit yourself to cleaning out any last remnants of Treasury longs from your portfolio. When the turn does come, you'll be wanting to jump with both feet into the 2X leverage short Treasury ETF (TBT), and day trade its younger, more athletic cousin, the 3X (TMV).

-

-

Meet Your New Bond Fund Manager