August 22, 2011 - Why This is Not 2008

Featured Trades: (WHY THIS IS NOT 2008), (SPX), (SPY)

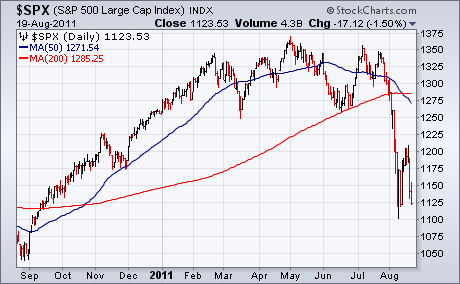

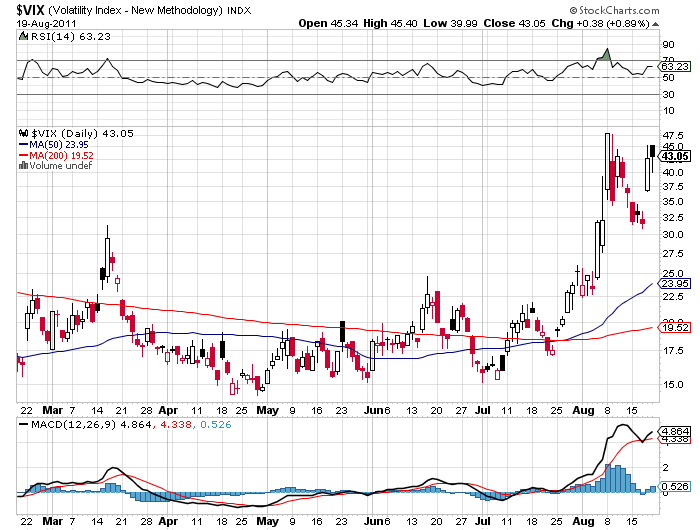

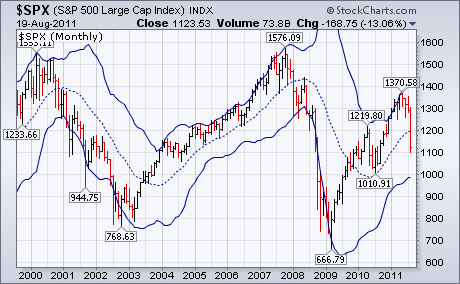

3) Why This is Not 2008. Much of the investment community is now bracing for a repeat of the 2008 crash, when the S&P 500 plunged by a gut punching 52%. For proof, look no further than last week's dramatic selling, when traders could not unload equities fast enough.

Unfortunately for those puking out positions here, this is anything but a replay of the melt down from three years ago. Much like the military, they are over preparing for the last battle, and blind to the one ahead of them. Let me tell you why those capitulating now, have got it all wrong:

*In 2008, banks were essentially insolvent. Since then, they have raised over $50 billion in primary capital.

* Nonfinancial companies are sitting on the highest cash mountains since 1955, some $2 trillion, or 11% of total assets.

*In the last three years, the consumer savings rate has leapt from 1% to 5.4%.

*Public interest coverage is at a ten year high.

*Business inventories have gone from bloated to fighting lean.

*Debt/GDP has fallen from 100% to 90%.

*The cheap dollar is fueling surging exports.

*Short term interest rates have fallen from 3% to 0%, and will remain there for two years.

*Junk bond yields have plunged from 25% to 8%, opening up financing avenues for many subprime corporate borrowers.

*Companies have announced buyback programs of $550 billion, and some $450 billion of this may be executed.

If you were an automaton, and only saw these numbers, you would be loading the boat with equities right here. But you're not, and are probably still nursing scars from 2008 which only recently healed, and still need to be scratched whenever there is a sharp change in the weather. One can never underestimate emotion when it comes to stock market valuations.

My late friends, who traded the 1929 crash and continued on throughout the thirties, told me the experience was so traumatic, that many customers stayed out of the stock market for decades, if not for the rest of their lives. We may be seeing a repeat of that now.

-

-

-

-

History is Not Repeating Itself