August 23, 2011 - Those Damn Europeans!

Featured Trades: (THOSE DAMN EUROPEANS!), (AAPL)

1) Those Damn Europeans! I am tearing up my Eurail Pass, returning my espresso machine to Costco, and sending my gelato maker to the recycling center. Next year's summer vacation is going to be at Coney Island, not the Italian Rivera. Those damn Europeans are spoiling everything!

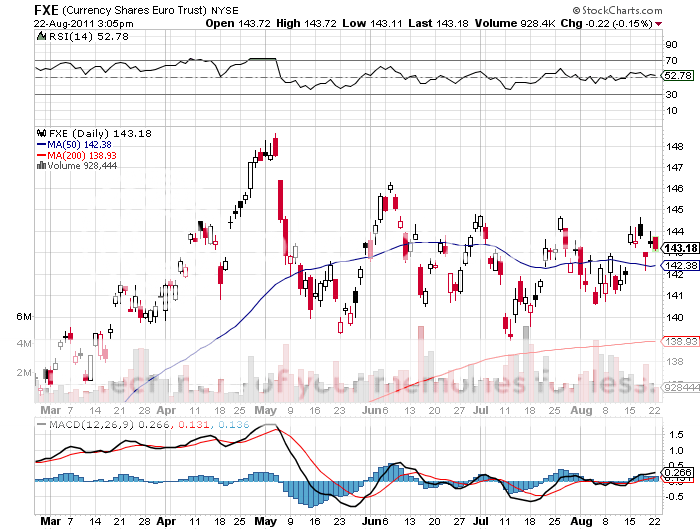

The US stock markets made a determined effort to put in a bottom last week, with the S&P 500 rallying 106 points off the bottom with blinding speed. But the Europeans had other ideas.

First, France and Germany met and agreed to do essentially nothing to solve the current debt crisis. There was no announcement of any bail outs, a Euro TARP, or even the issuance of pan continental Eurobonds. All we are left with are the hemorrhaging effects of austerity. It's as if the Tea Party had learned German and suddenly took over the Bundesbank. Then they tried to staunch market volatility with a short selling ban on all equities, a measure that has a proven history of failure.

Markets understandably gave this dreadful performance a raspberry, followed by a middle finger salute. European banks were particularly trashed, some down as much as 80% in three months. The market capitalization of the entire European banking sector is now less than that of Apple (AAPL), some $340 billion.

The Swiss were even worse. They boosted liquidity in the domestic money markets 400%, from SF30 billion to SF120 billion, in a futile attempt to weaken their own currency. There is talk of pegging the Swiss franc (SFS) to the Euro. Pretty soon, the mountain paradise's largest heavy machinery production is going to be in printing presses.

This comes on the heels of efforts by the Swiss National Bank to intervene in the foreign currency markets, which have so far cost it SF30 billion. I watched the Japanese try to end their bear market in equities via bureaucratic fiat with the end result that the Nikkei made successive new lows.

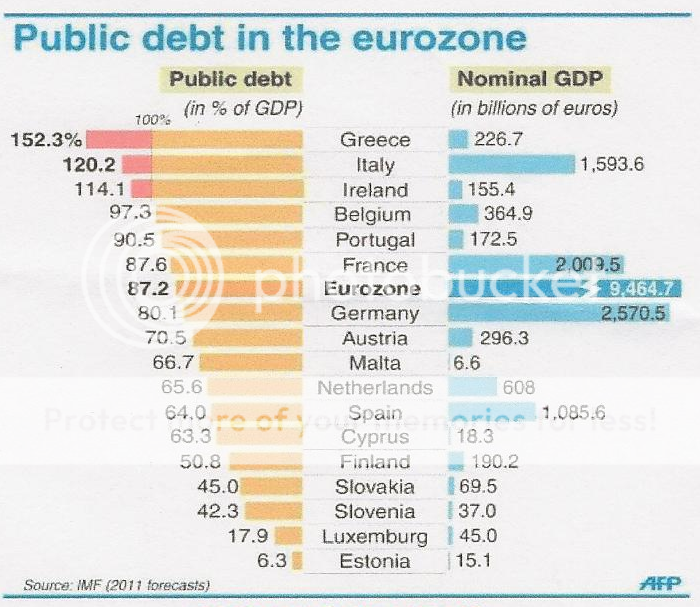

This is Europe's basic problem. They have a common currency, but borrowing is carried out by the 16 individual member states, creating a gigantic asset and liability mismatch. It's as if America had no Treasury Department, Treasury bonds didn't exist, and all of our national commitments were met through borrowing by the individual states. If that were the case, Illinois and California state bonds would be trading at 30 cents on the dollar, while North Dakota state bonds would be going for $3.

The problem is that the Europeans lack the political will to carry out the necessary reforms. No one is really interested in handing over control of monetary matters to Berlin, which would almost certainly administer them with an iron hand. The last time that happened, a certain washed up artist and rabble rouser from Austria was running the country, with unfortunate results.

The bottom line here is that the European debt crisis is going to be like one of those nasty flu's that keeps coming back, no matter how much medicine you take. Write periodic tape bombs from the continent into your trading calendar for the next several years.

By the way, since we're on the topic, hands up from anyone out there who knows who originated the term 'European Community'? Yes, you out there in the back row, wearing the toga. Julius Caesar? Not a chance. The gentleman in the black beret and stripped Breton T-shirt, smoking the Gitane. Napoleon? Nope, but you're getting warmer. You sir, the one wearing the lederhosen and knee socks. Yes, that's right, you got it: Adolph Hitler. Therein lies the problem.

-

-

There Goes Another Load of European Bank Shares

-

The Last Time Berlin Ran European Monetary Policy