August 24, 2011 - The Method to My Madness

SPECIAL MODEL PORTFOLIO ISSUE

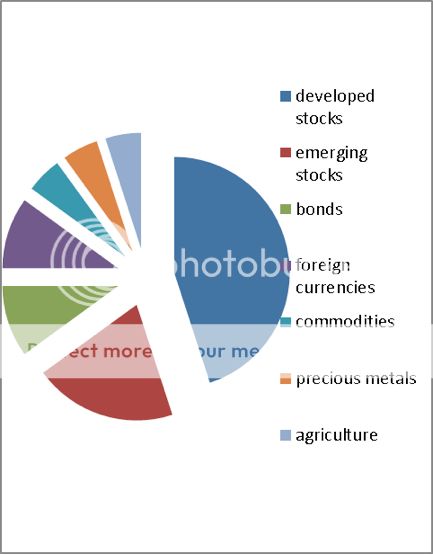

3) The Method to My Madness. The portfolio that I have assembled here capitalizes of the major long term trends that will dominate the global economy for the next decade. Long term followers of this letter will know the names well, as these were the ones we rode up from the March, 2009 bottom, with spectacular results. Those trends include:

*The growth of the global population

*The rise of the emerging market middle class

*The scarcity of essential natural resources

*The shift from paper to hard assets

*Demographic investing

*The rise of technology

*Deflation and then inflation

Let me go through my picks on an industry by industry basis, and I will explain the logic behind them.

Energy-This is no longer a commodity, but a financial asset with a near perfect correlation with risk assets around the world. This is a 'peak oil' play that particularly targets the growth of demand in energy hungry China. Don't forget that they're not making the stuff anymore. For a speedy, leveraged position, buy the (DIG) ETF.

Autos-This industry is seeing demand climb from a low of 9 million units in 2008 to 15 million by 2013. This gets us back to just above the scrapage rate of 14 million. There is also a ton of deferred purchases still in the pipeline, holdovers from the 2008 recession. I picked Toyota because they have a triple comeback to price in from the economic cycle, the brake problems, and the tsunami.

Technology-This is what American does best, is our lead over the rest of the world, and is what everyone wants to buy or steal from us. These are our best of bread companies. If you want a quickie short cut to get in, then just buy the ETF (QQQ).

Rails- You need to transport the coal, iron ore, and food that we are shipping o China. When you weren't looking, this became one of the most efficient industries in the country. It takes one gallon of fuel to move a ton of freight 400 miles. This is a great emerging market demand play. Warren Buffet likes this industry so much that he bought his own railroad to play with, Burlington Northern.

Heavy Machinery-This is how you play the global commodities boom by staying at home. It also gets you into the shift out of paper assets into hard assets. And if you buy a bulldozer, they give you this cool, yellow baseball cap with a big black 'C' on it.

Banks-So you were looking for proof that I really am Mad? Bank of America has a book value of $10 a share. The problem is that no one believes them, so the stock is trading at a 40% discount. Move a patient out of a coma into intensive care, and the stock is good for a 50% dead cat bounce. 'RISK ON' will be the catalyst, along with a selloff in the bond market that widens their spreads.

Emerging Markets-So which do I choose, the country that is growing at a 6% rate, or the one that is plodding along at 2%. I'll let you figure this one out. The answer is a heavy weighting in emerging markets. I have listed the best four here.

Bonds-'RISK ON' means dump bonds. The (TBT) could nearly doubly from here if the ten year Treasury gets back to the 4% yield we saw six months ago.

Foreign Exchange-Dump the flight to safety currency, the Swiss franc, and buy the global growth currency, the Australian dollar. Don't touch the yen, which lives in a world of its own, and the operating manual is still written in Japanese.

Commodities-Recession fears have beaten copper like the red headed step child that it is. (FCX) is the leveraged play on the recovery of industrial metals.

Precious Metals-With gold at euphoric levels, it is ripe for a $200 pull back, even if the long term trend stays intact. Limit your risk through buying out of the money puts only.

Agriculture- We are making people faster than the food to feed them and this is a global problem. Also look at (JJG) and (DBA) for a more diversified play.