Why I Have No Positions

For the first time in three years, the model trading portfolio of my Trade Alert service has no positions. It is 100% in cash.

I took a small profit on my last remaining position on Friday, a long in the ProShares Ultra Short 20+ Year Treasury ETF (TBT), a bet that Treasury bond prices would fall and yields would rise. Call it rocketing back up to breakeven.

It?s not that I have suddenly fallen in love with the bond market. Au Contraire, I think this is the beginning of a move in Treasury bond yields that could take the ten year yields up from last month?s lowly 2.32% all the way to 3.0%, possibly by yearend.

That would boost the (TBT) by another 35% from here. However, discretion is the better part of valor, and it is better to allow markets to breathe, especially after bonds have made a whopping great six point move down in a week.

That last tactical move left me up 30.36% for 2014. This compares to the average hedge fund that is up only 7%, a Dow average that has appreciated by a mere 3%, and 90% of managers are underperforming even these arthritic benchmarks.

I have to tell you, I kind of like being up 30.36%. In fact, I like it so much that I have taken to standing back and admiring it.

I like to drive it around the block at least once a day. I have had a temporary tattoo made for my forearm that says ?30.36%.? I now wear a button on my lapel that says ?30.36%.?

At my club I have moved my locker to number 3036, although the members there are getting sick of me talking about it all the time and are thinking of having me blackballed.

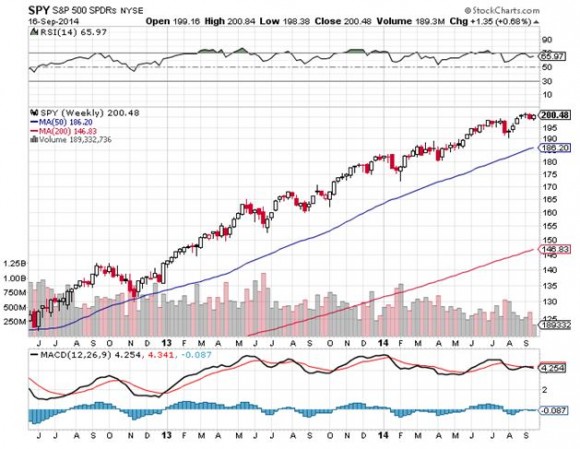

One reason I am out of the market is that everything I have done over the past four months has worked. The Euro (FXE) and the Yen (FXY), (YCS) collapsed against the US dollar as I expected. Stocks went to new all time highs, despite the abuse that my bullish predictions invited. The bond market peaked and began a precipitous slide.

Apple rallied into the iPhone 6 announcement, right on schedule. Oil crashed, and gold died a slow death. Only a snakebite from General Motors (GM) prevented this from becoming a perfect quarter.

It?s not like I am going to stay out of the market forever. You can?t rest on your laurels for long in the financial advisory business. You really are only as good as your last trade, and readers constantly want to know what I have done for them lately.

Markets are coming to the end of their ?TIME? correction, and there are two important triggers looming ahead of us. Today, Janet Yellen clarifies Fed policy for the next six weeks, and on Friday, the Alibaba IPO starts to trade.

You know that great sucking sound you?ve been hearing all month? That is the sound of managers selling other stocks to make room for their allocations on this gargantuan $20 billion issue.

First went other Chinese Internet companies (BIDU), then Apple (AAPL), then technology in general, then other highflyers in health care (XLV), biotech (IBB), and energy (XLE), then the main market as a whole (SPY).

That sucking sound ended five minutes after yesterday?s market opening. Then it was back to business as usual, shutting out underweight mangers trying to get in. I think this story continues for the rest of the year.

I worked so late last night that I ended up doing my daily ten-mile hike mostly in the dark. What do I come upon but an entire hind leg of a deer (see photo below). The draught in California is so severe that many animals are starving and becoming unusually aggressive.

So I called my mother, a true daughter of the old American West and one eighth Cherokee Indian. I asked ?Hey Mom, can a coyote take down a deer?? ?No, son,? she answered. ?They eat mostly small animals like rabbits. Only a mountain lion can take down a deer.?

I said ?Thanks Mom, call you later.? and hurried down the hill.

Don?t Become Someone Else?s Dinner

Don?t Become Someone Else?s Dinner