Watch out for the New ?RISK ON? ETN (ONN)

Mark Fisher of MBF Asset Management and Dennis Gartman of the eponymous Gartman Letter joined forces today to launch a new exchange traded note, or ETN, that promises to capture the ?RISK ON? trade. The instrument is designed as an improvement over the old Volatility Index ETF where traders attempted to capture short term market swings.

The note has the following makeup:

longs

48% energy

46% equities

30% foreign currencies

18% agricultural commodities

10% metals

shorts

36% sovereign bonds

14% foreign currencies

While the first day trading volume was large and the timing propitious, with the Dow up 300 points at the opening, the note presents several risks. The exact definition of ?RISK OFF? evolves by the day, and the quarterly resets and rebalancing?s may not be frequent enough to catch the changes. This is why the fund sponsors kept gold out of the mix, which morphed from a ?RISK OFF? asset in the first half into a solidly ?RISK ON? one in the second half, and could well change gender once more.

There is also the problem of rolls, backwardations, and contangos, which have long bedeviled ETF?s in the commodities area, such as with the one for oil (USO) and natural gas (UNG). Tracking error can be problematic for these kinds of funds, which offer carry hefty management and administration fees. This could attract opportunistic hedge funds which are already coining it shooting against existing commodity and leveraged ETF?s.

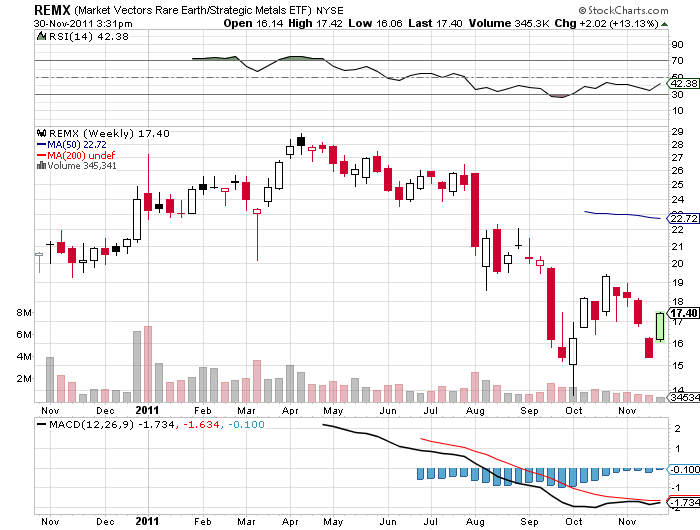

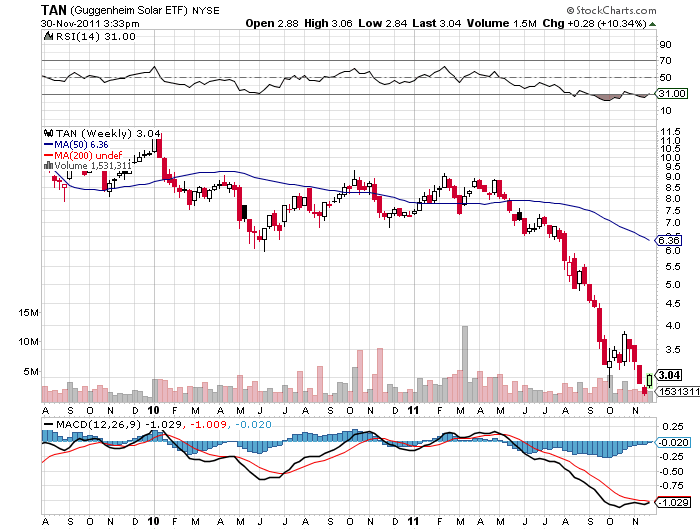

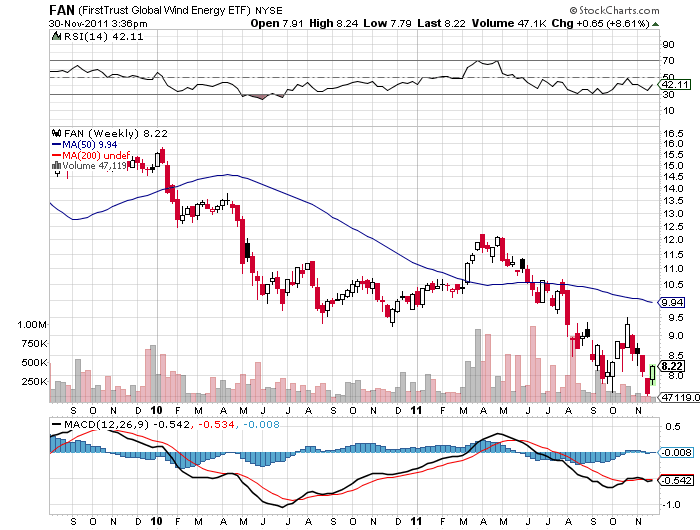

I wish Dennis and Mark the best of luck with their new endeavor. But another thing that scares me is that new ETF?s often come out at market tops to cash in on market fads. Look no further than the disastrous rare earth (REMX), wind (FAN), and solar (TAN) ETF?s, which plunged not long after launch. Could this mark the end of the ?RISK ON?/?RISK OFF? parameter that has served me so well in recent years? Better to execute your own ?RISK ON?/?RISK OFF? trades simply by reading this letter and taking the trade alerts.

Don?t Follow the Lemmings