Central Bank Bazooka Sends Markets Flying

The world?s major central banks launched a coordinated attempt to restore liquidity to the financial markets today, sending risk assets everywhere flying. The group moved to substantially lower interbank dollar swap rates, from 100 to 50 basis points. These swaps involve Federal Reserve dollar deposits with the European Central Bank and offsetting ECB Euro deposits with the Fed.

This eases liquidity concerns inside the European money markets. The action included the Federal Reserve, the ECB, the Swiss National Bank, the Bank of Japan, and the Bank of Canada. Clearly, the Europeans do not have a 2008 style systemic collapse on the menu.

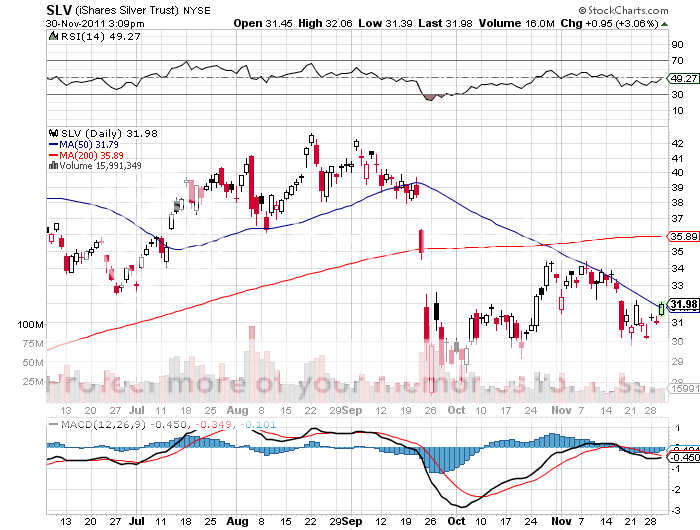

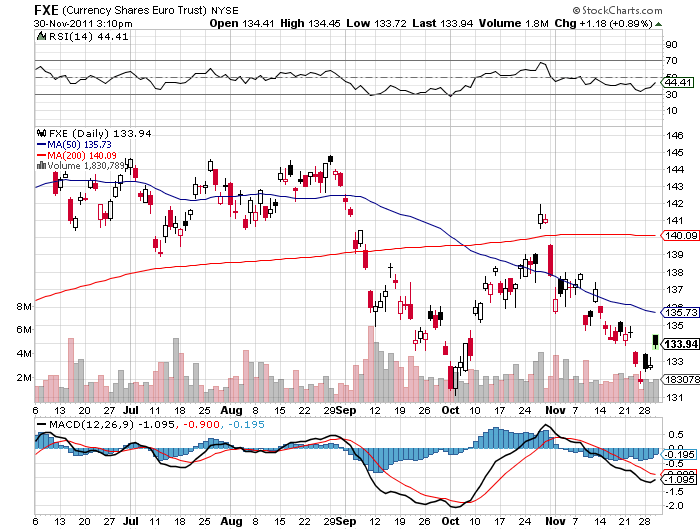

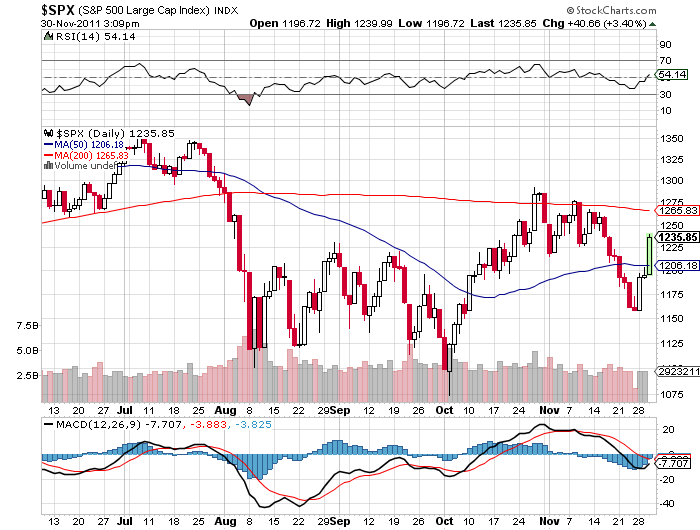

The initiative made sure the bear trap that sprung on Monday bit even deeper into short sellers, as it was intended to do. The Dow (INDU) opened up 300, the (FXE) 1.54%, oil $1.50, silver 1.53%,? Australian dollar (FXA) a stunning 2.5 cents, and copper (CU) 12 cents. Bellwether Caterpillar (CAT) popped 5.3%, while my favorite, Freeport McMoRan leapt by 6.3%. The action assures that my call for a Christmas rally in global risk assets plays out, although earlier than I expected.

You really have to wonder what disaster was imminent to force the central bankers? hands. Many suspect that a major European bank was on the verge of going under, possibly a French one. So far, the major casualties have been American institutions, notably MF Global (MF) and Jeffries (JEF). It will take a few months for the truth to leak out.

The coordinated action puts my short term 1,266 target for the S&P 500 within easy reach. The big moves we were seeing in oil and the Australian dollar gave us plenty of warning that Santa Claus might show up early this year, but it is nice to get confirmation.

As for the Euro, the positive benefits are likely to be ephemeral, as the European bazooka is just a short term patch and does nothing to address the continent?s horrific systemic problems. I am therefore happy to keep running my outstanding euro short position.

Looks Live He Arrived Early This Year