Mad Hedge Fund Trader Hits 31.5% Gain in 2015

Life is good.

Since my last letter to you, I hired a Mercedes and a Moroccan driver, driven the three hours from Tangier to Casablanca, and spent a day touring the architecture of the French colonial art deco center of that storied city.

It turns out that my driver only did his job part time. He was in fact a graduate student in economics studying in Tangier and had a lot to say about his fascinating country?s economy.

Jackpot!

I?ll write up his comments in a future letter, subject to the regular fact checking with the IMF and the World Bank. Until then, we have winnings of a difference sort to discuss.

It has been a pretty prosperous time for followers of the Mad Hedge Fund Trader?s trade alert service as well.

After staying out of the market during a tempestuous, white knuckled month, I finally sense an interim market bottom.

In quick order, I phone Trade Alerts into the head office to buy Apple (AAPL), the S&P 500 (SPY), and to sell short the Japanese yen (FXY), (YCS). I caught a $12 move in (AAPL) and a 4% move in the (SPY).

The yen vaporized, producing a very speedy 16.5% profit, which I quickly seized.

I then sought to protect my gains by adding a new short position in the (SPY) close to the recent highs. To get risk neutral, I then added a short position in Treasury bonds (TLT), (TBT).

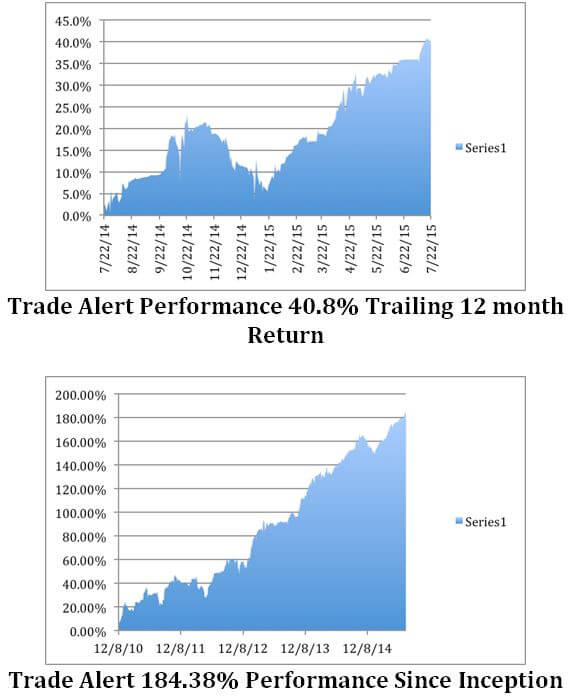

The fruit of these labors was to take the Mad Hedge Fund Trader?s performance for 2015 up to a new all time high at 31.54%. July alone was as hot at the Sahara Desert that I recently escaped, up 4.86%.

This brings my performance since inception four years and eight months ago to 184.38%. That annualizes out to 39.5% per year, not bad in this topsy turvey world. It seems like only a Madman can prosper in these hopeless trading conditions.

Some 15 of the last 16 consecutive Trade Alerts, over the past three months, have been profitable. Followers have found themselves in the green every month of 2015, quite substantially so.

Better than a poke in the eye with a sharp stick. And the best is yet to come!

I started out 2015 with the goal of earning 25% for my readers during the first half, and another 25% in the second half. This latest batch of trades puts me right on track for reaching my yearend goal.

I should take these extended research trips more often! My back office tells me that subscriptions have been falling off in North Korea, Mali has been weak of late, and that a strategy luncheon in Bhutan would be welcome any time.

Under promise and over deliver; it has always been a winning business strategy for me.

This is against a backdrop of major market indexes that are nearly unchanged so far this year, despite sudden bursts of volatility and long, Sahara like stretches of boredom.

The key to winning this year has been to put the pedal to the mettle during those brief, but hair raising selloffs, and then take quick profits. They don?t call me ?Mad? for nothing.

When the market is dead, you sit on your hands.

After all, you are trying to pay for your own yacht, not your broker?s.

When the market pays you to stay away, you stay away.

Those who have made the effort to wake up early every morning and read my witty and incisive prose have an impressive row of notches on their bedpost to show for their effort.

My groundbreaking trade mentoring service was first launched in 2010. Thousands of followers now earn a full time living solely from my Trade Alerts, a development of which I am immensely proud.

Some 50% of my clients are over 50 and managing their own retirement funds fleeing the shoddy but expensive services provided by Wall Street. The balance is institutional investors, hedge funds, and professional financial advisors.

The Mad Hedge Fund Trader seeks to level the playing field for the average Joe. Looking at the testimonials that come in every day, I?d say we?ve accomplished that goal.

It has all been a vindication of the trading and investment strategy that I have been preaching to followers for the past eight years.

Quite a few followers were able to move fast enough to cash in on my trading recommendations. To read the plaudits yourself, please go to my testimonials page by clicking here. Our business is booming, so I am plowing profits back in to enhance our added value for you.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011, 14.87% in 2012, 67.45% in 2013, and 30.3% in 2014.

Our flagship product,?Mad Hedge Fund Trader PRO, costs $4,500 a year. It includes?Global Trading Dispatch?(my trade alert service and daily newsletter).

You get a real-time trading portfolio, an enormous research database, and live biweekly strategy webinars. You also get Bill Davis?s Mad Day Trader service, which provides great intra day market color.

To subscribe, please go to my website, ?www.madhedgefundtrader.com, click on the ?Memberships? located on the second row of tabs.

And now for the rest of the year.

I can?t wait!