Trade Alert - (TLT) Second Chance - August 18, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (TLT)- TAKE PROFITS-UPDATE

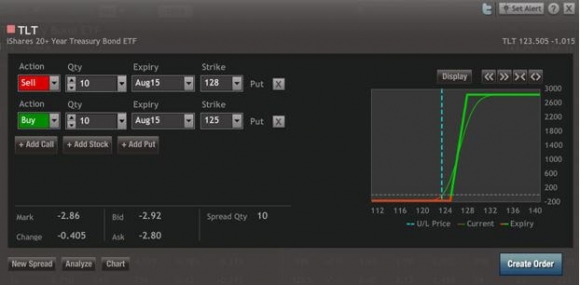

SELL the iShares Barclays 20+ Year Treasury Bond Fund (TLT) August, 2015 $125-$128 in-the-money vertical bear put spread at $2.86 or best

Closing Trade: NOT FOR NEW SUBSCRIBERS

8-18-2015

expiration date: August 21, 2015

Portfolio weighting: 10%

Number of Contracts = 38 contract

In case you missed the window to sell the iShares Barclays 20+ Year Treasury Bond Fund (TLT) August, 2015 $125-$128 in-the-money vertical bear put spread at $2.80 last Thursday, you now have a chance it sell it at a better price, at $2.86.

To verify the price, I have included a screen shot of the most recent price posted on my trading platform below.

Don?t place a market order on pain of death. You?ll lose your shirt. Only place a limit order to sell the spread, and work it down two cents at a time if you don?t get down.

We have an odd situation in the (TLT) options market right now with only three trading days until expiration.

Our $128 strike is so far out of the money that it has gone illiquid.

But the $125 has become a near strike that the expiration game players will focus on Friday.

You don?t want to get caught in a situation where your long $128 put has expired deep in the money, but your short $125 call has expired worthless. The risk would be untenable and the margin call great.

I also happen to know that there are a ton of hedge funds short the August (TLT) $125 calls. So it is better to get out of the way when elephants stampede.

If we do get another panic this week, a possibility, the (TLT) will spike up once again. I want dry powder to buy another (TLT) bear put spread higher up.

For some reason, going into the first Federal Reserve interest rate hike in nine years short the Treasury bond market appeals to me.

In any case, this position was a hedge against our long September (SPY) $214-$217 vertical bear put spread. I doubt we?ll get a new all time high in the (SPY) next week.

Finally, remember that hogs get fed, but pigs get slaughtered (or is it the other way around?).

It is better to take half the potential profit now, rather than hold out for the whole one, and risk another life threatening experience, like the one yesterday, when we were looking at big losses on this position.

(TLT) is now down nearly two and a half points from last Thursday?s high.

It is rare to make money on both a core position and a hedge at the same time. Usually you make a big profit on one and a small loss on the other, to come out ahead.

And you have done this during market conditions that are so difficult that hardened professionals are tearing their hair out. You did this while the (TLT) rose five points in your face. Amazing!

Well done!

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to close this position:

Sell 38 August, 2015 (TLT) $128 Puts at????????$4.50

Buy to cover short 38 August, 2015 (TLT) $125 Calls at..?$1.64

Net Proceeds:??????????????????.....$2.86

Profit: $2.86 - $2.60 = $0.26

(38 X 100 X $0.26) = $988 or 0.99% profit for the notional $100,000 portfolio.

Janet is Coming for You

Janet is Coming for You