Mad Hedge Fund Trader Hits 38.37% Gain in 2015

I am back at my mountain top aerie near the city of San Francisco.

Drifting smoke from the enormous forest fires up north have turned the skies a pale rust brown, taking visibility down to a few hundred yards. Some 100 square miles have burned up near here in the past month, the inevitable result of our four-year drought.

El Nino! Where are you?

I tried going on a hike last night, but found myself coughing and wheezing within an hour. It was like trying to breathe in the smog choked Los Angeles of the 1950?s.

To top it all, as I was writing my Trade Alert to sell short the Euro (FXE) on Monday, I was thrown out of my chair by a 4.1 magnitude earthquake. I was a half-mile from the epicenter, and it sounded like a truck hit a parked car outside at 80 miles per hour.

I knew my Trade Alerts were earth shaking, but not literally so.

Fortunately for followers of the Mad Hedge Fund Trader?s Trade Alert service, a blaze of a different kind has been taking place with their trading and investment performance.

Since returning from my African and European sojourn, every single Trade Alert I issued has been profitable.

I sensed in April that a long rolling top would ensue in the stock markets that would take as long as six months to resolve. Since then that view has been paying off in spades.

I have been using every short-term rally to strap on short positions in the S&P 500 (SPY) through risk limiting vertical bear put option spreads. Those who couldn?t trade options bought the ProShares Ultra Short S&P 500 (SDS) instead.

I have completed five round trips using this approach so far, and just opened a sixth. I am going to continue until we hit a traditional period of equity strength that starts in the fall, after Chairman Janet makes her call.

The really exciting thing about the rest of 2015 is that we have a new batch of leaders to milk. Those include housing (LEN), (HD), (LOW), the banks (JPM), (BA), (C), and consumer discretionary (DIS).

That?s not all I have been doing.

I have scored wins on the long side in Apple (AAPL), Goldman Sachs (GS), and the Volatility Index (UVXY). I came out ahead with short positions in the Japanese yen (FXY), (YCS), and the Euro (FXE), (EUO).

In July, I grew even bolder, selling short the Treasury bond market (TBT), (TLT). I?m sorry, but I just don?t see a humongous bond rally going into the first Federal Reserve interest rate rise in nine years.

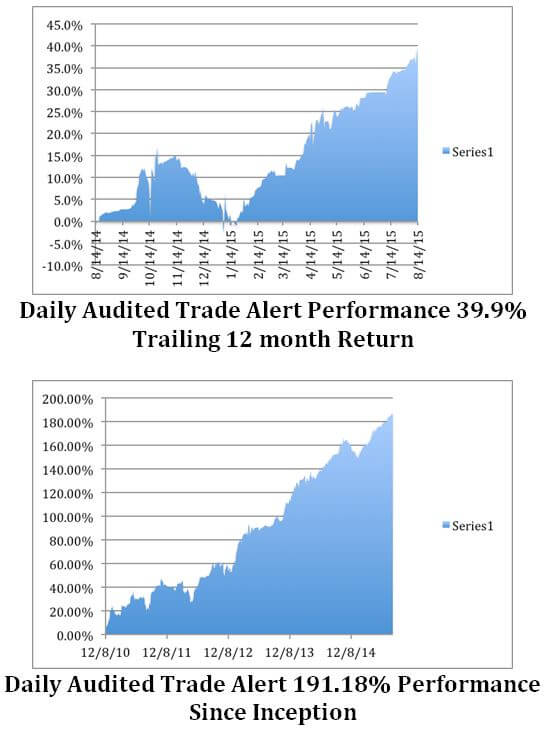

The fruit of these labors was to take the Mad Hedge Fund Trader?s performance for 2015 up to a new all time high at 38.37%. August so far has been as hot at the Sahara Desert that I recently escaped, up 5.24%.

This brings my performance since inception four years and eight months ago to 191.18%. That annualizes out to 40.96% per year, not bad in this upside down world.

It seems like only a Madman can prosper in these hopeless trading conditions.

Some 21 of the last 22 consecutive Trade Alerts I issued since April 29 have been profitable. Followers have found themselves in the green during every month of 2015, and quite substantially so.

It has been a near perfect year.

I started out 2015 with the goal of earning 25% for my readers during the first half, and another 25% in the second half. This latest batch of trades puts me right on track for reaching my yearend goal.

Given the weird dynamic of this market, the shares of best quality names have had the biggest falls. That means the pickings will be especially ripe when I return to single name picks at the next market bottom.

I should take these extended research trips more often! My back office tells me that subscriptions have been falling off in North Korea, Mali has been weak of late, and that a strategy luncheon in Bhutan would be welcome any time.

Under promise and over deliver; it has always been a winning business strategy for me.

This is against a backdrop of major market indexes that are nearly unchanged so far this year, despite sudden bursts of volatility and long, Sahara like stretches of boredom.

The complete collapse of oil, commodities, and precious metals has made the markets even more challenging.

The key to winning this year have been to put the pedal to the mettle during those brief, but hair raising selloffs, and then take quick profits. They don?t call me ?Mad? for nothing.

When the market is dead, you sit on your hands.

After all, you are trying to pay for your own yacht, not your broker?s.

When the market pays you to stay away, you stay away in droves.

Those who have made the effort to wake up early every morning and read my witty and incisive prose have an impressive row of notches on their bedpost to show for their effort.

My groundbreaking trade mentoring service was first launched in 2010. Thousands of followers now earn a full time living solely from my Trade Alerts, a development of which I am immensely proud.

Some 50% of my clients are over 50 and managing their own retirement funds fleeing the shoddy but expensive services provided by Wall Street. The balance is institutional investors, hedge funds, and professional financial advisors.

The Mad Hedge Fund Trader seeks to level the playing field for the average Joe. Looking at the testimonials that come in every day, I?d say we?ve accomplished that goal.

It has all been a vindication of the trading and investment strategy that I have been preaching to followers for the past eight years.

Quite a few followers were able to move fast enough to cash in on my trading recommendations. To read the plaudits yourself, please go to my testimonials page by.

Our business is booming, so I am plowing profits back in to enhance our added value for you.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011, 14.87% in 2012, 67.45% in 2013, and 30.3% in 2014.

Our flagship product, Mad Hedge Fund Trader Pro, costs $4,500 a year. It includes Global Trading Dispatch (my trade alert service and daily newsletter).

You get a real-time trading portfolio, an enormous research database, and live biweekly strategy webinars. You also get Bill Davis?s Mad Day Trader service, which provides great intra day market color.

To subscribe, please go to my website at?www.madhedgefundtrader.com, click on the ?Memberships? located on the second row of tabs.

And now for the rest of the year.

I can?t wait!