Follow Up to Trade Alert - (FXE) August 20, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Trade Alert - (FXE)-TAKE PROFITS

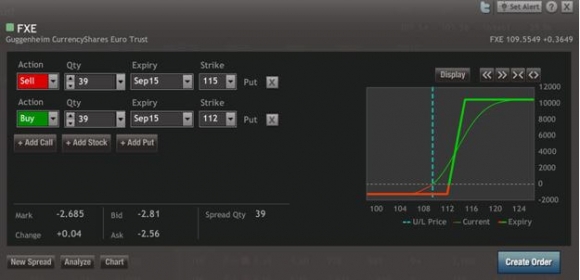

SELL the Currency Shares Euro Trust (FXE) September, 2015 $112-$115 in-the-money vertical bear put spread at $2.68 or best

Closing Trade

8-20-2015

expiration date: September 18, 2015

Portfolio weighting: 10%

Number of Contracts = 39 contracts

What the Federal Reserve gave us yesterday with the release of their July minutes was decisive waffle.

On the one hand, steadily rising employment means an interest rate rise is close. On the other, China, emerging markets and the oil and commodity collapse is scaring the daylights out of them.

The markets responded in kind. The probability of a September rate hike has gone from 80/20 to 50/50.

In other words, it?s a coin toss.

I?m not in the coin toss business. I?ll leave that to my competitors. That is, unless the coin is heavily weighted in my favor and has me come up a winner 95% of the time. That has been the recent success rate of my Trade Alert service.

So I am going to cut my long dollar position by half, selling my Currency Shares Euro Trust (FXE) September, 2015 $112-$115 in-the-money vertical bear put spread at $2.68.

Sure, it?s a small profit. But it is better than a poke in the eye with a sharp stick. This gives me the dry powder to resell the beleaguered Europe currency higher up if the current rally continues.

Don?t worry. I have not suddenly fallen in love with the Euro. This is just a tactical move. The long-term bull market is alive and well.

In any case, we amply squeezed the juice from the short Euro trade during the first half when it was in free fall with multiple Trade Alerts. Since then, its volatility has been muted.

The present trading conditions for all markets are among the worst I?ve ever seen. Not taking a profit is the same as leaving your wallet in the middle of New York?s Times Square at rush hour and expecting to find it there the next day.

There are a ton of other interesting things to do here. As a former student of the US Marine Corps Sniper School at Camp Pendleton, I can assure you that it is far better to lie back and take the careful, measured shot than to engage in hand-to-hand combat with one hand tied behind your back.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

If the price of this spread has moved more than 5% by the time you receive this Trade Alert, don?t chase it. Wait for the next one. There are plenty of fish in the sea.

Here are the specific trades you need to execute this position:

Sell 39 September, 2015 (FXE) $115 puts at???????..?$5.55

Buy to cover short 39 September, 2015 (FXE) $112 puts at.?.$2.87

Net Proceeds:??????????????????.?.....$2.68

Profit: $2.68 - $2.55 = $0.13

(39 X 100 X $0.13) = $507 or 0.51% profit for the notional $100,000 portfolio.