Follow Up to Trade Alert - (IWM) August 21, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Trade Alert - (IWM)- update

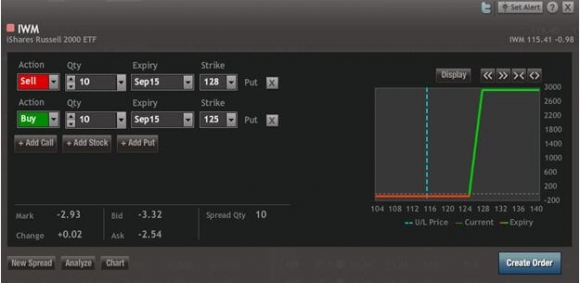

Sell the Russell 2000 (IWM) September, 2015 $125-$128 in-the-money vertical bear put spread at $2.93 or best

Closing Trade: NOT FOR NEW SUBSCRIBERS

8-21-2015

expiration date: September 18, 2015

Portfolio weighting: 10%

Number of Contracts = 37 contracts

I don?t care what the talking heads are saying on TV, I?m going to take a 10% profit by holding a position only two days.

In these horrific trading conditions, I should get the Nobel Prize for trading for this one, if there is such a thing.

Actually there is. It is the Profit & Loss line on my own trading account statement. Yours should reflect the same.

I?m not saying the correction is over. However, we are getting close. It is not the end of the beginning of the move. It is the beginning of the end.

There was no follow through in the Treasury bond (TLT) market rally whatsoever this morning. Nor did the Japanese yen (FXY), (YCS) capitalize on its gap opening.

These are both indicators that we are reaching the tag ends of the giant ?RISK OFF? move this week.

At the very least, we should get a rally this afternoon, as those who got the market right this week, like me, take profits on their well timed shorts.

I predict boredom is about to return to your future.

Keep in mind that in these trading conditions, dry powder is worth ten times more than it usually is.

Cash has option value. Few people understand this, even professional traders.

Stay small and lean. That is the key to weathering this volatility. Let other people do the crying.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Sell 37 September, 2015 (IWM) $128 puts at????.??$12.40

Buy to cover short 37 September, 2015 (IWM) $125 puts at?$9.47

Net Proceeds:??????????????????.....$2.93

Profit: $2.93 - $2.66 = $0.27

(37 X 100 X $0.27) = $999 or 1.00% profit for the notional $100,000 portfolio.