Trade Alert - (SPY) September 24, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (SPY)- TAKE PROFITS

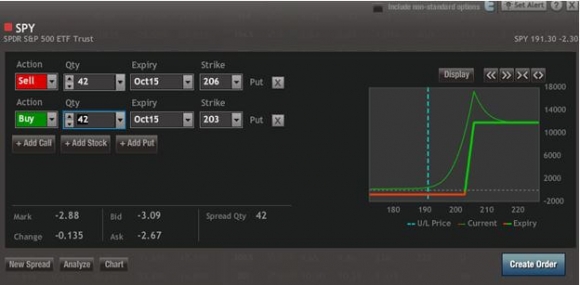

SELL the S&P 500 SPDR?s (SPY) October, 2015 $203-$206 in-the-money vertical bear put spread at $2.88 or best

Closing Trade: NOT FOR NEW SUBSCRIBERS

9-24-2015

expiration date: October 16, 2015

Portfolio weighting: 10%

Number of Contracts = 42 contracts

The technical picture seems to be deteriorating by the day. After obviously failing at the 200 day moving average at $203, the (SPY) is now obligated the test the August 24 flash crash lows at $186.

The question now becomes ?Will the August lows hold, or do we break to new lows and establish a downtrend, creating a bear market.

However, we have already milked the S&P 500 SPDR?s (SPY) October, 2015 $203-$206 in-the-money vertical bear put spread for most of what it is worth.

At this price we have reaped 81.25% of the maximum possible profit from the position, and we still have 16 trading days to go.

Better to grab the money and run so we have plenty of dry powder in case of one those screaming ?rip-your-face-off? short covering rallies ensures.

It is time to take profits, give ourselves a nice pat on the back, and move on to the next trade.

Rolling down and out in strikes and maturity seems to be on order, but I only want to do that on top of a rally of several hundred points, which could happen at any time.

I don?t think we are going into a new bear market, as the economic data reports are still too strong. But the volatility until we prove that point in the meantime could be extreme.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Sell 42 October, 2015 (SPY) $206 puts at????.??$14.82

Buy to cover short 42 October, 2015 (SPY) $203 puts at..?$11.94

Net Cost:???????????????????.....$2.88

Profit: $2.88 - $2.36 = $0.52

(42 X 100 X $0.52) = $2,184 or 2.18% profit for the notional $100,000 portfolio.