Trade Alert - (SPY) September 25, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (SPY)- BUY

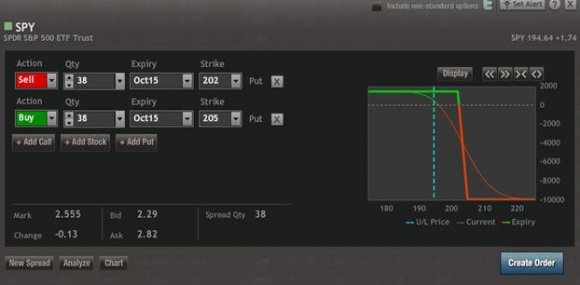

Buy the S&P 500 SPDR?s (SPY) October, 2015 $202-$205 in-the-money vertical bear put spread at $2.55 or best

Opening Trade

9-25-2015

expiration date: October 16, 2015

Portfolio weighting: 10%

Number of Contracts = 38 contracts

You can pay all the way up to $2.75 for this spread and it still makes sense. If you are unable to do options trades, stand aside.

It is a bet that the (SPY) does not trade above $202 in the next 15 trading days. And this is going into the notorious month of October.

Keep in mind that we have ?fast trading? conditions now, so the prices can be anywhere.

I?m working on the assumption here that the (SPY) keeps working at building a sideways wedge going into October that eventually resolves itself in a classic capitulation, throw up on your shoes type selloff.

That means buying every dip and selling every rally until the cows come home. Think ?RISK ON?, ?RISK OFF?, ?RISK ON?, ?RISK OFF.?

If this is occurring so fast, it makes you head spin, don?t worry. You won?t have any problem figuring out how to spend all the money you are making.

This is how my September has come in as one of my best months in years, up more than 9% so far.

For those who have just subscribed to my service, well done. Your timing is perfect!

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 38 October, 2015 (SPY) $205 puts at????.??$10.90

Sell short 38 October, 2015 (SPY) $202 puts at????..?$8.35

Net Cost:?????????????????????.....$2.55

Potential Profit at expiration: $3.00 - $2.55 = $0.45

(38 X 100 X $0.45) = $1,710 or 1.71% profit for the notional $100,000 portfolio