Trade Alert - (GLD) January 27, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (SPY)- TAKE PROFITS

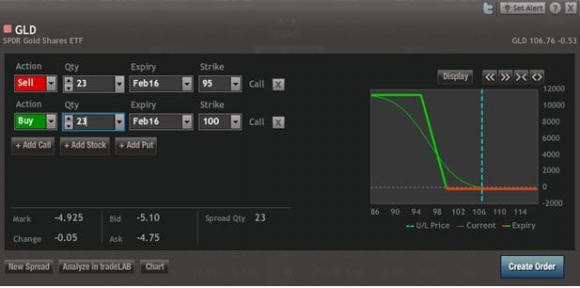

SELL the SPDR Gold Trust (GLD) February, 2016 $95-$100 in-the-money vertical bull call spread at $4.92 or best

Closing Trade

1-27-2016

expiration date: February 19, 2016

Portfolio weighting: 10%

Number of Contracts = 23 contracts

With 90% of the maximum potential profit at this morning?s opening, I am going to take profits in the SPDR Gold Trust (GLD) February, 2016 $95-$100 in-the-money vertical bull call spread.

In this kind of highly volatile market you don?t let winners sit around and grow hair. You take the money and run. Better to have dry powder so we can buy this position back on the next dip.

The recent price action saw gold rise when stocks rise, a rare event. It underlines my argument that we may be entering a new long-term bull market for the barbarous relic.

For more depth on this issue please read ?The Coming Bull Market in Gold? by clicking here at https://www.madhedgefundtrader.com/the-coming-bull-market-in-gold/

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking here at https://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Sell 23 February, 2016 (GLD) $95 calls at????.?.??$11.80

Buy to cover short 23 February, 2016 (GLD) $100 calls at...$6.88

Net Proceeds:???????????????????.....$4.92

Profit: $4.92 - $4.22 = $0.70

(23 X 100 X $0.70) = $1,610 or 1.60% profit for the notional $100,000 portfolio