Janet Lays an Egg

Financial markets often behave like demanding, spoiled, and fickle children. If they don?t get what they want RIGHT NOW they throw a temper tantrum.

That is exactly what bourses are doing around the world.? The Dow Average rallied 500 points this week in the hope that my former Berkeley economics professor, Federal Reserve governor Janet Yellen, would suddenly turn into an ultra dove.

It was thought that she would totally cave on any interest rate increases for the rest of 2016 at her Wednesday Humphrey-Hawkins testimony in front of a hostile congress.

Instead, Janet laid an egg. Risk markets everywhere suffered cardiac arrest.? The 500-point rally quickly turned into a 700-point loss. Blink, and you lost your last chance to get out.

The Japanese yen rocketed as hedge funds rushed to cover their shorts, which they had been using to fund their rapidly fading ?RISK ON? positions. Panic dumping long positions mean those yen shorts are no longer needed.

What is particularly gob smacking is to see a ten year Treasury yield crater to only 1.50%. As I outlined in last week?s Global Strategy Webinar, the (TLT) is clearly headed for its old all time high of $135, which equates to a parsimonious 1.36% yield.

If you refinanced your home last month to cash in on lower interest rates, better plan on doing it again next month!

Both the Treasury market and global bank shares are now discounting another Great Recession that is absolutely nowhere on the horizon.

It all vindicated my aggressive hedging of my trading book, which I put into place at the beginning of January.? Gotta love those (SPY) April $182 puts! They?re better than Ambien in helping me sleep at night.

February is shaping up to be a very big month for the Mad Hedge Fund Trader?s model trading portfolio.

In the meantime, more data came out this morning confirming the recession that isn?t.

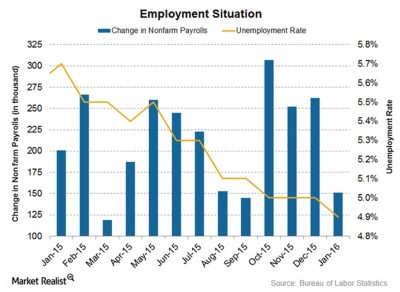

The Thursday weekly jobless claims plunged by 16,000 to 261,000, within spitting distance of a new 14 year low.

This is on the heels on last week?s respectable +175,000 January nonfarm payroll. This compares to a monthly LOSS of -700,000 jobs we saw in 2009.

Sure, the 0.7% US Q4 GDP is nothing to run up the flagpole and salute. But it is still growth. Most industries are reporting record profits.

I have to admit, I have never seen the economy so bifurcated.

In my daily customer calls I hear of Armageddon in the oil patch. But you can?t find office space in the San Francisco Bay area to save your life. And there are several whales looking for a staggering 10,000-20,000 square feet EACH!

These are all operations that started out in a garage only a decade ago. Add up the market capitalization of Google (GOOGL), Apple (AAPL), Facebook (FB), Twitter (TWTR), and Uber and we have created $1 trillion of equity out of thin air in only ten years.

Eventually, all good corrections come to an end. The hot money gets sold out, the margin clerks have taken their pound of flesh, the newbies get wiped out, and we run out of traders willing to chase the move down.

Then the cash rich long-term funds suddenly realize that we have a market that is selling at a 15X multiple in an economy that is about to speed up again. In addition, there is nothing else to buy.

Then it is off to the races to new all time highs by year end.

I am sticking to my New Year forecast of a 15% selloff that takes the S&P 500 down to $1770, which then rallies 20% by the end of December.

Recession? What Recession?

Recession? What Recession?