Trade Alert - (FXE) February 16, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Trade Alert - (FXE)- BUY

Buy the Currency Shares Euro Trust (FXE) March, 2016 $103-$106 in-the-money vertical bull call spread at $2.60 or best

Opening Trade

2-16-2016

expiration date: March 18, 2016

Portfolio weighting: 10%

Number of Contracts = 38 contracts

I think the Euro (FXE) is in a new uptrend against the US dollar (UUP).

We have spent over a year putting in a bottom for the beleaguered continental currency at $103, which right now, looks like it is holding like the Rock of Gibraltar.

You can pay all the way up to $2.70 for this spread and it still makes sense. If you can?t trade options here, just buy the (FXE) outright for a move to $116 in coming months.

We broke through the 200-day moving average to the upside two weeks ago, and are falling back to test that line. The old resistance at $108.49 is the new support.

ECB president, Mario Draghi, has once again threatened further stimulus in March to keep the continent?s meager growing rate growing. That gave us a 2.4-point pull back today from the recent top, and a nice entry point for this call spread.

However, past experience has proven that Mario is a better talker than a doer.

Not only that, what quantitative easing Mario Draghi has already implemented seems to be working. The latest Euro Zone GDP growth rate came in at 0.30%, not exactly robust, but better that the negative numbers we saw last year.

All we need now is for China, Europe?s biggest customer, to post some better economic numbers, and it will be off to the races for the Euro.

The Currency Shares Euro Trust (FXE) March, 2016 $103-$106 in-the-money vertical bull call spread is a bet that the Euro won?t fall below $106 by the March 18 expiration.

Now that the prospect of further interest rates rises by the Federal Reserve has been thrown out the window, the dollar has run out of appreciation fuel.

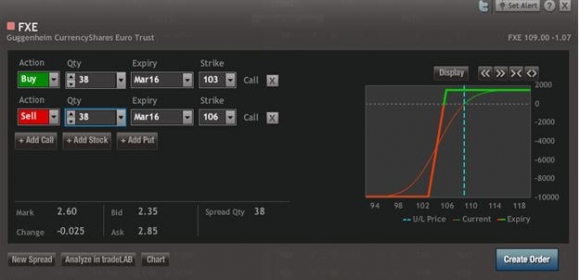

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking here at https://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 38 March, 2016 (FXE) $103 calls at????.?.??$6.10

Sell short 38 March, 2016 (FXE) $106 calls at.????..$3.50

Net Cost:???????????????????......$2.60

Potential Profit: $3.00 - $2.60 = $0.40

(38 X 100 X $0.40) = $1,520 or 1.52% profit for the notional $100,000 portfolio