Trade Alert - (GLD) February 19, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Trade Alert - (SPY)- BUY

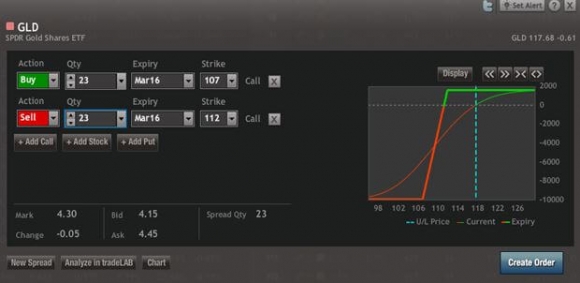

Buy the SPDR Gold Trust (GLD) March, 2016 $107-$112 in-the-money vertical bull call spread at $4.30 or best

Opening Trade

2-19-2016

expiration date: March 18, 2016

Portfolio weighting: 10%

Number of Contracts = 23 contracts

You can pay all the way up to $4.40 for this spread and it still makes sense.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

It is a bet that the (GLD) will not trade below $112 at the March 18 options expiration. If I am right, you will make a 16.27% profit on your investment. It is a great low risk, high return way to approach this kind of frenetic market.

We are already well up on 2016 after the Friday options expiration and now have some profits to play with.

This week?s $5.28 point, 4.3% pullback from the top in (GLD) gives us a reasonable entry point in the new bull market.

If you can?t buy options, just pick up the (GLD) outright. Don?t touch the Market Vectors Gold Miners (GDX) on pain of death. It has run too far, too fast.

This is exactly the sort of position you want to strap on after the (SPX) has reeled in an historic, three day 120 handle move to the upside.

Worst case, gold will grind sideways from here as we digest the recent gains. The SPDR Gold Trust (GLD) March, 2016 $107-$112 in-the-money vertical bull call spread will still expire in four weeks at its maximum profit point.

Best case, gold breaks out to a new one year high on the next stock meltdown, which could be only days away. This would make (GLD) the perfect hedge for any long stock positions you may have.

Remember, the reasons we like the yellow metal now are that it is the biggest beneficiary of a NIRP (negative interest rate) world, production will fall 20% over the next four years, and China and India are ramping up their reserve buying.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking here at https://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 23 March, 2016 (GLD) $107 calls at????.?.??$11.00

Sell short 23 March, 2016 (GLD) $112 calls at.????..$6.70

Net Cost:???????????????????.....$4.30

Potential Profit: $5.00 - $4.30 = $0.70

(23 X 100 X $0.70) = $1,610 or 1.61% profit for the notional $100,000 portfolio

Ready For a Bounce

Ready For a Bounce