Another Nail in the Euro Coffin

The only surprise in the downgrade of nine European sovereign borrowers was that it took so long. It is a classic case of locking the barn door after the horses have bolted.

The only unknown is how many more downgrades remain. The marketplace is already valuing this paper at CCC levels, with ten year yields violently fluctuating around the 7% handle. So the BBB+ awarded to Italy, down from A, seems generous in the extreme.

The downgrades have created far bigger headaches for European authorities beyond wounded pride. By downgrading big contributors to the bailout package for Greece, like Italy and France, the funds available have been effectively cut by nearly half. This comes on the day when direct negotiations for restructuring Greece foundered on the rocks.

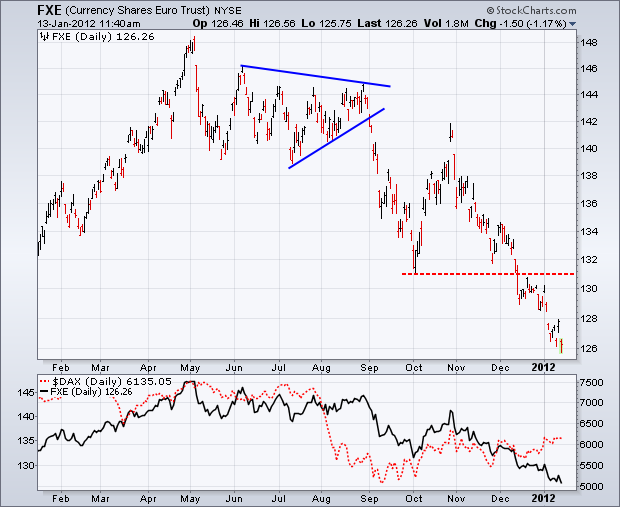

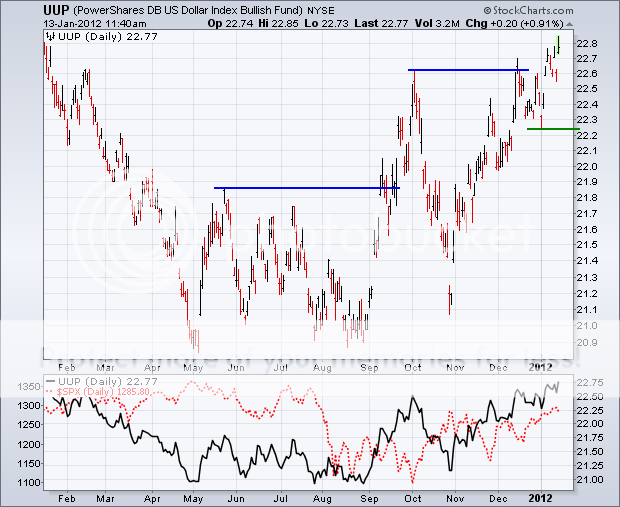

Friday?s action has emboldened hedge funds to double up shorts in the beleaguered European currency (EUO), (FXE), (UUP) from already record levels. The head and shoulders topping formation is now so clear on the charts that I am sure it will be used for some future, yet to be written, book about basic technical analysis. Whereas $1.19 looked like a safe bet, $1.14 is now coming into play.

Is This the Euro?s Future?