The Death of the Hedge Fund

Without question, this has been the quarter from hell for the hedge fund industry.

It hasn?t helped that the big cap S&P 500 Index (SPY), has cratered by 14% and then immediately rocketed by 14% three times in the last 18 months, with NO net movement overall.

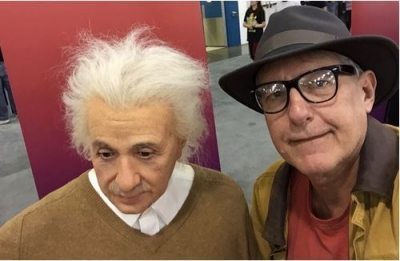

The latest rally has seen the biggest move up in stock prices since Franklin Delano Roosevelt was first sworn in as president in 1933. I remember it like it was yesterday.

This is your worst trading nightmare.

Such is the price of saying bon viage to America?s aggressive monetary policy of quantitative easing.

Speaking to managers and traders around the globe, my compatriots are either having a terrible time, or they are going out of business. I am one of a hand full eking out a small gain in 2016.

See?. after a half century, this business starts to get easy.

According to Hedge Fund Research, a commercial database, last year was the worst for hedge fund liquidations since 2009. Some 979 funds ran up the white flag, compared to 864 in 2014.

New hedge funds are coming to the fore at a declining rate. Only 183 started up during the fourth quarter, versus 269 in Q3. And they are raising smaller amounts of money with tighter terms.

In January alone total hedge fund assets under management shrank by $64.7 Billion, thanks to redemptions and market losses. They fell again in February to $2.95 billion, the lowest since May, 2014, according to eVestment, another research firm.

Hedge funds are not only the victims of the recent extreme market volatility; they are the cause. Far and away the best performing stocks in 2016 are those with the greatest hedge fund short positions.

Those would include holdings in the energy, commodities, industrial, retailing, and precious metals industries.

Of course, everyone in the know was aware that the market was heading for a pasting at the beginning of the year. That's why I started buying naked puts in the S&P 500 (SPY) for the first time in ages.

The problem is that many hedge funds have grown so large that it takes months to shift a position with any decent weighting. They have in effect become victims of their own success.

Activist hedge funds have in particular become the subject of grief. Pershing Square, run by the controversial boy trader Bill Ackman, has seen one of its largest positions, Valeant Pharmaceuticals (VRX) crash by a gut churning 73% this year. This is on top of an eye popping 61.5% plunge in 2015.

With 100 analysts on board they could see this coming. Go figure. The problem is that at least a half dozen other funds have been riding on Ackman?s coattails and are suffering similar grief.

Hedge funds deliver mediocre high single digit, low double digit gains over the long term in exchange for minimizing or eliminating any downside. So far this year, they have overwhelmingly failed to deliver.

As a result, investors are clamoring for their money back. Easier said than done. Many funds, like Pershing Square limit their partners from withdrawing capital to as many as eight consecutive quarters, with long advance notice periods.

It doesn?t help that we have all be forced into becoming oil traders (USO), with no particular advantage.

After a grinding 82.6% decline from the 2011 peak to a subterranean $26, oil nearly doubled to $42, a 61% pop. Not even career traders in the oil patch saw this coming.

What oil does from here is anyone?s guess. My bet is that we retrace to $30 during the spring refinery maintenance period to make a secondary bottom, wiping out all the newfound bulls.

Long-term Trade Alert followers have noticed that I stop out of losers quicker than usual in this kind of environment. That?s because one bad trade can wipe out the profits of three good ones.

Over time, I try to break even when I?m wrong and make a fortune when I?m right. Most investors will take those kinds of returns all day long.

When I joined a tiny hedge fund industry during the late 1980?s, it gave you a license to print money, and we did so by the millions.

Now it sounds more like a club I wouldn?t want to? to join because it has me as a member.