Ministry Comments Demolish the Yen

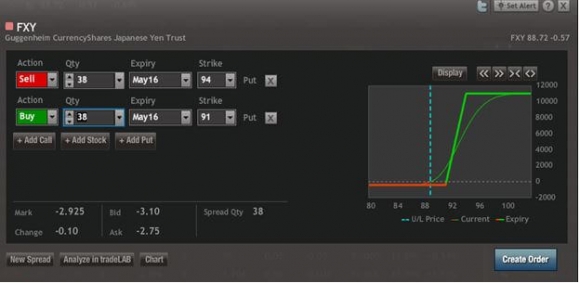

We are pretty much home free on our short position in the Japanese yen.

At this morning?s mark of $2.92 we had captured 73.33% of the maximum potential profit, earning a tidy 8.15% in only eight trading days.

As soon as this position expires on May 20, I?ll be rolling out to the June options.

Better than a poke in the eye with a sharp stick, as they say.

Rather than pay the commissions to come out here at $2.92, I am going to hang on to the May 20 expiration in eight trading days.

Yesterday, Japanese Minister of Finance, Mr. Taro Aso, said that he was ?prepared to undertake intervention? to weaken the Japanese yen.

Of course, it was a big help that someone in the ministry called me last Wednesday to give me a heads up that something like this was in the pipeline, and would be made public as soon as everyone came back to work from Japan?s Golden Week holidays.

Knowing the Finance Minister?s father back in the 1970?s when I covered Japan for The Economist magazine probably had something to do with it.

Did I mention that I was the first foreigner ever to have an office in the Japanese Ministry of Finance, just down the hall from the head guy? I remember the lack of heating and those cold, ill lit marble hallways with creaking wooden parquet floors like it was yesterday.

The news was more than enough to crush the yen and send all of the short term longs packing.

There never was a fundamental argument to own the yen whatsoever. It was technical and high frequency day traders all the way.

What else would you expect with the beleaguered country?s negative interest rates, dying economy, the worlds worst demographic outlook, and a business philosophy firmly rooted in the last century.

Did you know that 20% of the Nikkei Average listed companies are zombies with a negative net worth kept alive so they won?t default on their debt? It?s not an accounting system I have any great faith in.

Look for the move down to be just as ferocious as it was on the way up. My bet is that the yen has put in its high for the year.

Another round of aggressive quantitative easing has to be just around the corner.

If you own the ProShares Ultra Short Yen -2X ETF (YCS), keep it. We have much lower to go for the yen, and much higher to go for the (YCS).