Trade Alert - (FXE) November 9, 2016

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

?

Trade Alert - (FXE) - TAKE PROFITS

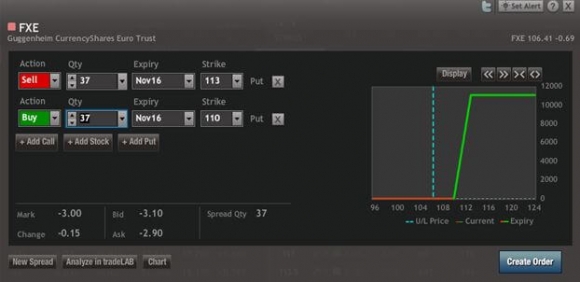

SELL the Currency Shares Euro Trust (FXE) November, 2016 $110-$113 in-the-money vertical bear put spread at $2.97 or best

Closing Trade

11-9-2016

Expiration Date: November 18, 2016

Portfolio Weighting: 10%

Number of Contracts = 37 contracts

The harder I work, the luckier I get.

My short position in the Euro (FXE) was intended as a hedge for my long positions in US equities.

Thanks to Donald Trump?s surprise presidential election win, my shorts went down, AND my longs went up.

That?s because his ambitious spending plans are causing US dollar interest rates to skyrocket, dragging the dollar up, kicking and screaming all the way, at the expense of the beleaguered European currency.

That places the performance of The Mad Hedge Fund Trader at a new all time high at an average annualized return of 37%.

The hot streak continues.

The shocking win has delivered us a Bold New Order for stock selection and brings forward my Golden Age scenario for the 2020s. I?ll go into detail in a future research newsletter.

The options markets are going mad today, and the only price I could find was at $3.00. So I am going to use a notional price of $2.97 to give you a chance of getting this done.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of OptionsHouse.

If you are uncertain about how to execute this options spread, please watch my training video ?How to Execute a Bear Put Spread?

Please keep in mind these are ballpark prices at best. After the text alerts go out, prices can be all over the map. There is no telling how much the market will have moved by the time you get this email.

Paid subscribers, be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage.? In today's volatile markets, individual investors need every advantage they can get.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile with only 7 days left until expiration.

Here Are the Specific Trades You Need to Execute This Position:

Sell 37 November, 2016 (FXE) $113 puts at????.?.??$6.60

Buy to cover short 37 November, 2016 (FXE) $110 puts at...$3.63

Net proceeds:???????????????????......$2.97

Profit: $2.97 - $2.67 = $0.30

(37 X 100 X $0.30) = $1,110 or 11.23% in 2 trading days