As much as you may think I have just gone MAD, I believe it is time to start dipping your toe in on the short side in the stock market.

I don't want to boast, take credit, or run a victory lap about the Trade Alert I sent out yesterday.

After all, two hours after I sent out the Trade Alert to sell short the Russell 2000, the small cap index has plunged $2, or 1.36%, creating an instant $1,480 profit for my nimbler followers.

No, I won't go there.

Instead, I want to continue on with the finer points of the rationale for doing this trade.

I didn't have time earlier because I was in a rush to get the Trade Alert out while the (IWM) was still rallying to its high for the day.

The new Republican plan floated yesterday to delay corporate tax cuts to 2019 has certainly put the cat among the pigeons with equity investors.

It has reminded them how high stocks have run, and how much now withering unrealized profits are sitting on their books.

The Russell 2000 is actually misnamed, as it now has only 1,700 stocks.

The rest have disappeared over the years through mergers, privatizations, or bankruptcies, and have not been replaced, as happens quarterly with the S&P 500 (SPY).

For you and me this means that the (IWM) is more illiquid that the (SPY). When stock markets fall, the (IWM) falls about 1.5 times faster than the (SPY).

In other words, it's a great short to have in a falling market.

I think stocks markets may be starting to either top out, or roll over here, at least for the short term.

That is especially true of the Russell 2000, which has not participated in the rally for the past month.

An approaching yearend is a big risk for the markets, as are overstretched valuations and prices.

The warning signs of a selloff are absolutely everywhere, but until now, have been ignored.

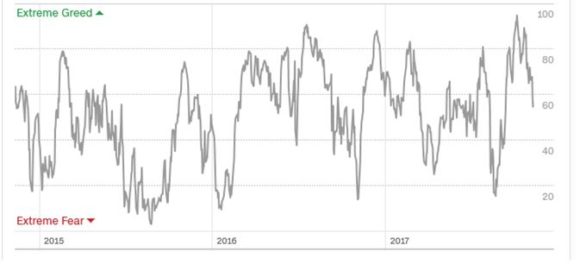

My Mad Hedge Fund Trader Market Timing Index has been living in overbought territory for the past two months. The normal life of a medium-term top is, guess what? Two months.

To see how risky markets are right now, take a look at the three-year history of my market timing index.

It shows that the normal life of a medium-term topping process is two months.

When will that two months end?

About mid-December, two weeks before gigantic deferred tax selling hits the market in January.

Another way to play this is to buy the ProShares Short Russell 2000 ETF (RWM), a bet that small cap stocks will fall.

If you are looking for other ways to hedge your portfolios you might consider the Trade Alert I also sent yesterday to buy gold (GLD).

Look at the chart below for the barbarous relic and you see that we have a sideways triangle formation setting up over the past month that will be a nice springboard for a sudden move upward.

All we need is one more threat to the tax cuts, which these days, seem to be coming out of the woodwork.

Listening to subscribers in all 50 states, I don't know a single individual who is seeing the prospect of lower taxes as a result of the Republican plan.

It appears that those earning between $200,000 and $500,000 a year will bear the entire burden of the package, who make up the bulk of my readers.

The benefits gained through a doubling of the personal exemption don't even come close to offsetting losses from lost tax and mortgage interest deductions.

And where is the cut in capital gains taxes, long a Republican goal?

If you make anything over $500,000 a year, you're golden.