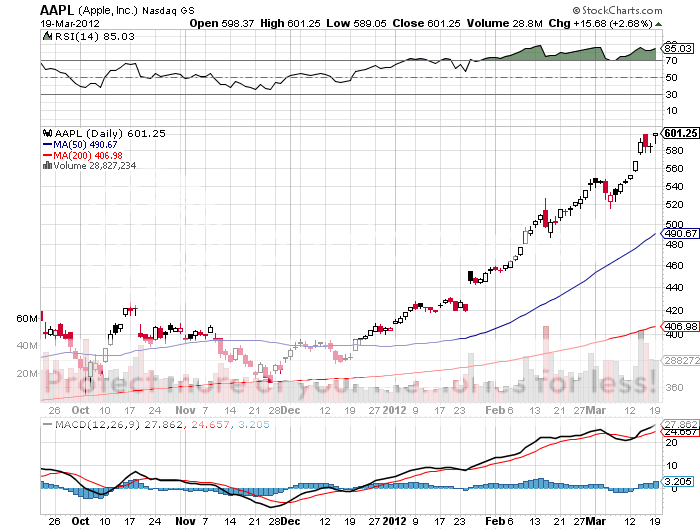

An Apple Dividend at Last!

After a 15 year hiatus, Apple (AAPL) has restored its dividend, announcing a 2% annual yield that exactly matches the average for the rest of the S&P 500. It also announced a $10 billion share buyback. The only thing missing that the cheerleaders were hoping for was a 10:1 share split.

The move now makes Apple eligible to buy for the 40% of US institutions that don?t own it yet, such as dividend funds and pension funds. Hedge funds currently only account for 4% of the Apple ownership.

Apple holds two thirds of its cash overseas in foreign holding companies to keep profits out of reach by the IRS. But it says that it will be able to fund these new commitments purely from US cash flow alone.

The tab for the new policy will only put a small dent in the company?s gargantuan cash flow. Cash on the balance sheet will soon reach $100 billion. The dividend and buy back will total $45 billion over the three years. But the cash mountain will still grow to over $200 billion by then, even after these new expenses are paid out.