Turbulence at Boeing (BA)

Boeing Aircraft (BA) is one of the great icons of American manufacturing, and also one of the country?s largest exporters. I was given a private, sneak preview of the new Dreamliner at the Everett plant days before the official launch with the public, and I can tell you that this engineering marvel is a quantitative leap forward in technology. No surprise that the company has amassed one of the greatest back order books in history.

I can also tell you that my family has a very long history with Boeing (BA). During WWII, my dad got down on his knees and kissed the runway when the B-17 bomber in which he served as tail gunner (two probables) made it back, despite the many holes. It was only after the war that he learned that the job had one of the highest fatality rates in the in the services.

Some 40 years later, I got down on my knees and kissed the runway when a tired and rickety Boeing 707 held together with spit and bailing wire, which was first delivered as Dwight Eisenhower?s Air Force One in 1955, flew me and the rest of Reagan?s White House Press Corp to Tokyo in 1983 and made it there in one piece.

I even tried to buy my own personal B-17 bomber in the nineties for a nonprofit air show I was planning, but was outbid by Paul Allen on behalf of his new aviation museum. Note to self: never try to outbid Paul Allen, a cofounder of Microsoft, on anything.

So it is with the greatest difficulty that I examine this company in the cold hard light of a stock analyst. There is nothing fundamentally wrong with the company. But its major customers around the world are suffering from some unprecedented stress.

US airlines are getting hammered by the high cost of fuel. Delta even resorted to the unprecedented move of buying its own refinery to assure fuel supplies. Europe, where Boeing competes fiercely against its archenemy, Airbus, is clearly in recession. Government owned airlines there are in ferocious cost cutting mode.

China, another one of Boeing?s largest customers, is also slowing down. As for Japan, the economy there is going from bad to worse. All Nippon Airways was awarded the first Dreamliner for delivery because it is such a large customer. It is just a matter of time before this harsh reality starts to put a dent in the company?s impressive earnings growth.

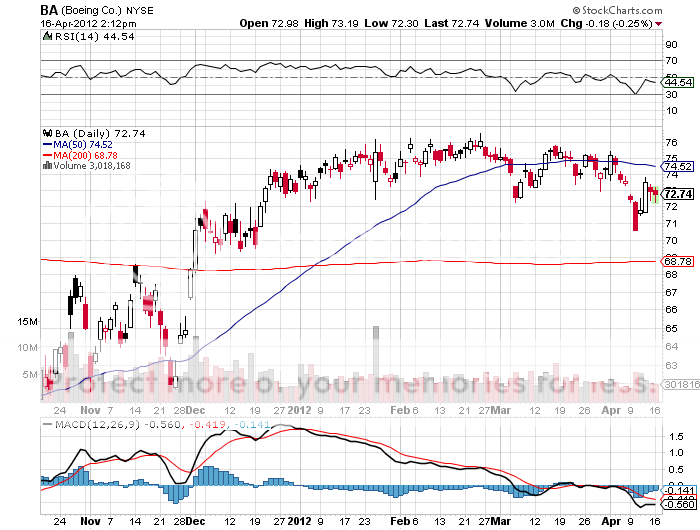

Take a look at the chart below and you?ll see what I mean. Despite having a tailwind of one of the strongest bull markets in history, (BA) shares have continuously bumped up against an invisible ceiling at $76/share. Now that we have some general market weakness, I think the stock is ripe for probing some serious downside.

If the selloff continues for another week or two, we could take a run at the 200 day moving average at $68.75. Break that, and the next support is at $60. Touch $60, and the August, 2012 $70 puts that I picked up for $3.45 could hit $9. Even half of that move would produce a great trade. But you may have to suffer some turbulence to get there. This is not for the weak of heart.

They Build Those Boeings to Last