Why Dr. Copper is Looking Ill

Traders like to refer to the red metal as Dr. Copper because it is the only one that has a PhD in economics. This year it has been proving its credentials as a great predictor of future economic activity once again.

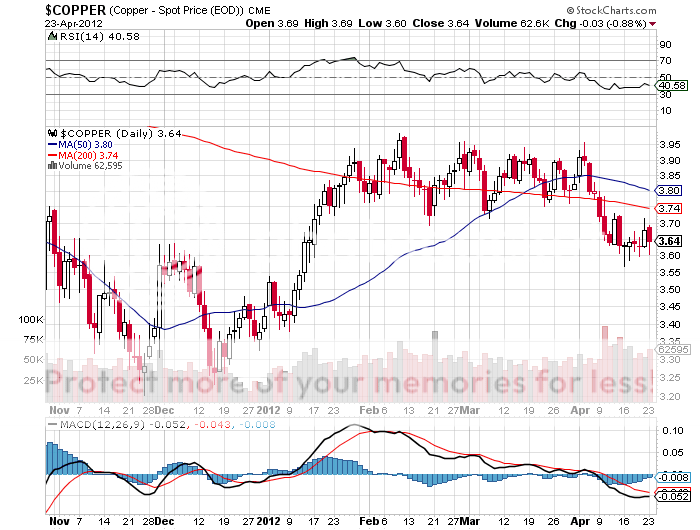

Copper has been leading the downside charge for all risk assets since it peaked on February 10. After looking at the latest trade data for the red metal, it is clear that it has a lot more bleeding to do. This does not bode well for risk assets anywhere.

The harsh truth is that copper stockpiles in China, which accounts for 40% of global consumption, are the highest in history. Estimates for the size of current stockpiles in country run as high as 3 million tonnes, with a stunning 918,000 tonnes coming in during the last six months. Consumption totaled only 1 million tonnes in Q1, 2012, and could fall to as low as 1.7 million tonnes over the remaining three quarters. The mismatch is huge, and makes the current price of $3.64 a pound look pretty expensive.

This imbalance is occurring in the face of a slowing Chinese economy. Only yesterday, the Chinese purchasing managers index for April came in at 49.1, well below the boom/bust level. Residential real estate, the largest consumer of copper in the Middle Kingdom, has clearly been in a bear market since last year.

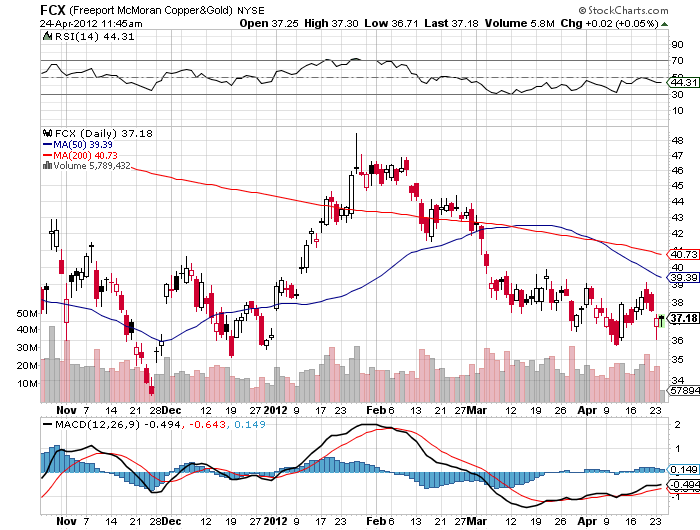

The grim outlook is expected to make a serious dent into the profits of major producers, BHP Billiton (BHP), Freeport McMoRan (FCX), Rio Tinto (RIO), and Anglo American (AAUKY.PK), and Xstrata (XTA.L).

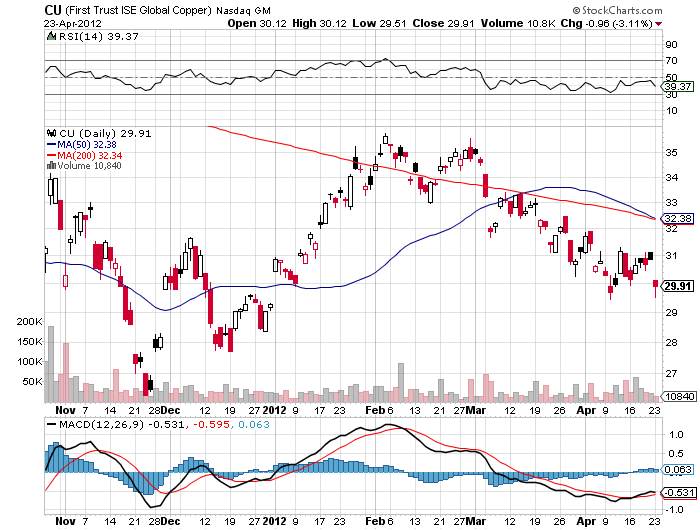

If the risk off scenario continues through the summer, then a $3.25 downside target is a chip shot. Remember that the 2009 low was positively subterranean $1.25 a pound. Bring in a real summer slowdown, and lower prices are within reach. Professionals will be selling the futures on any decent rally. Individuals can sell (CU) on market, are buy near money puts.