Coffee With the Treasury Secretary

I knew that Treasury Secretary Tim Geithner was early for our meeting at the San Francisco Mark Hopkins Hotel, as the line of silver Secret Service GM Suburbans was illegally occupying some of the most prime parking places on Nob Hill. I?m glad they changed the color. I was getting tired of the perpetual black. Perhaps it?s an unknown leading economic indicator?

As the agent pawed through my briefcase, I asked if death threats against the president were still up 400%. He said there was a big jump when Obama first came into office, but threats have since petered out, although they are still running much higher than the George W. Bush days. ?People dislike change,? he said. ?So true,? I replied.

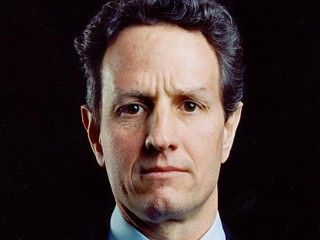

The 50-year-old Geithner was fit and trim as always, and probably could still squeeze into his old high school graduation suit if he still had it, a goal that has so far eluded me. That?s what jogging every day of the year gets you, no matter how crushing the schedule or how crucial the priorities. The two Secret Service agents who accompanied him this morning on his run from the Oakland Bay Bridge to the Marina Green and back are also probably up to an Olympic standard of fitness. But he had also noticeably greyed since our last meeting.

I always catch Tim when he stops in San Francisco on his way to China. I knew him in Tokyo during the late eighties when he was the young, up and coming, hotshot economic attach? at the embassy there. I spoke to him briefly in Japanese just to see if he was still up to snuff. He was. He also speaks Chinese, which I imagine will be a requirement for every future Treasury Secretary, as they own $1 trillion of our national debt.

Without any prompting he launched straight into his canned campaign stump speech. When Obama came into office the economy was shrinking at a -9% annualized rate and shedding 600,000 jobs a month. Today it is growing at 2% and adding jobs. Exports are up 34% since 2009, and private investment is rapidly increasing. Real estate is still tough, but is showing signs of life.

We moved on to Europe, and I asked him if the Treasury had any plans to participate in a Spanish bailout, where the real estate and construction collapse has been far worse than our own. He pointed out that Europe was a rich continent and had plenty of resources to solve its own problems. He then backed up a bit and wryly said, ?Let me evade that question differently.?

The Federal Reserve was intervening where it could in the most cost effective way, such as through the provision of $400 billion in swap lines which are guaranteed by the European Central Bank. That will create a safety cushion between Europe and the rest of the world. A precipitous move towards austerity will only prolong the length and depth of their recession.

I asked how he personally felt when he first stepped in to oversee a financial system that was in complete collapse, with classic bank runs and frozen financial markets. Instead of sitting back and ordering a raft of study groups or waiting for recalcitrant Republicans to join him, Obama took immediate, decisive action, pushing through the stimulus bill and bailing out AIG and General Motors. He confided in me that he was not at all confident that the emergency rescue plan would work, but told the president that it was certainly better than all the other alternatives.

The bailouts were very controversial, highly divisive, but a necessary evil. The passage of the TARP in 2008 was in fact the last bipartisan bill to pass congress. Although the initial estimate of the cost ran into the trillions of dollars, the government will end up making a $20 billion profit from all of the programs. Geithner wants to unload the remaining holdings as soon as possible, while still maximizing taxpayer value. ?We didn?t save the banks for the benefit of the banks, we saved them for ourselves,? he asserted.

Geithner didn?t believe the repeal of Glass-Steagle in 1998 caused the financial crisis, which separated the banking and securities industries. The real trigger was a huge off balance sheet financial system that grew up outside the established regulatory framework and eventually accounted for half of all the credit in the US. It also didn?t help that many existing banking regulations were not enforced by a hands-off Bush administration. The end result was vastly excessive leverage understood by few.

The reforms enacted by Dodd-Frank are intended to force a reduction in leverage so that any future mistakes the banks make do not pose a systemic threat to the financial system. Instead of future bailouts there will be orderly liquidations. If you need proof of the effectiveness of the new rules, look no further than the immense resources the financial industry is pouring into having them overturned.

He said we were right to be concerned about the upcoming ?fiscal cliff,? the tax increases and spending cuts that automatically kick in at year end, which Geithner believes could shave a massive 3.5% off of GDP. He thinks that some sort of agreement around the Simpson-Bowles framework will be reached, similar to the deal that was almost done last summer. Back then, the two sides were much closer than people realize.

While the administration was laying some foundations behind the scenes, congress was not yet ready to clinch an agreement. ?We don?t need to solve all of America?s problems for the next 100 years in six weeks, but we can create a framework for progress,? he averred. While the deficits in Medicare and Medicaid were unsustainable, that was no excuse to drastically cut education and infrastructure spending today.

We spent a lot of time talking about China, which we have both been studying for decades. His goals there were to level the playing field for US companies and help the country move towards a more domestically oriented, less export dependent economy. Since 2009, US exports to the Middle Kingdom have doubled. Its trade surplus has fallen from 8% of GDP to 3%. Currency pressure has eased with a 13% appreciation of the Yuan against the US dollar. But major issues remain in intellectual property rights and tariffs. American consumer goods cost double in Shanghai than they do at home.

The Treasury has undertaken 36 anti-dumping complaints against China, such as in tires, solar, and wind power, compared to none by the previous administration. If China wants to participate in the global trade system they have to play by the rules.

Much of The Middle Kingdom?s strength is not as strong as it seems. A huge demographic headwind will hit the country soon, thanks to the 30-year-old ?one child? policy. China?s productivity is a tiny fraction of America?s.

Geithner has already made known his intention to leave after the end of Obama?s current term. It?s hard to say what he?ll do next. I don?t see him soiling his hands by joining a major bank board, as past Treasury Secretaries have done. My guess is that he will end up on the board of Apple or Google.

As the Secretary scurried out the door to his next appointment, I asked if he would ever consider making a run for public office. ?Not a chance,? he shot back. ?Not even the president of Dartmouth College?? I persisted. ?No way,? he affirmed. I suspect there is an unhappy and undeserved grade of C- hidden somewhere in his distant past.

On my way out the Secret Service agent told me that when he did my background check, he found that I had been in their system since the Ford administration in 1976, well before he was born. I said ?Yes, that Alexander Hamilton was a hell of a guy, a real party animal,? referring to our nation?s first Treasury Secretary. He thanked me for my service and shook my hand. It was the nicest thing anyone said to me all day.

With that, I disappeared out the door and jumped on a moving cable car down nearly vertical California Street on my way home. I knew I would have to backpack three hours up a steep mountain to digest the implications of what Geithner had said.

Such my life has become.