Enduring the Pain in Spain

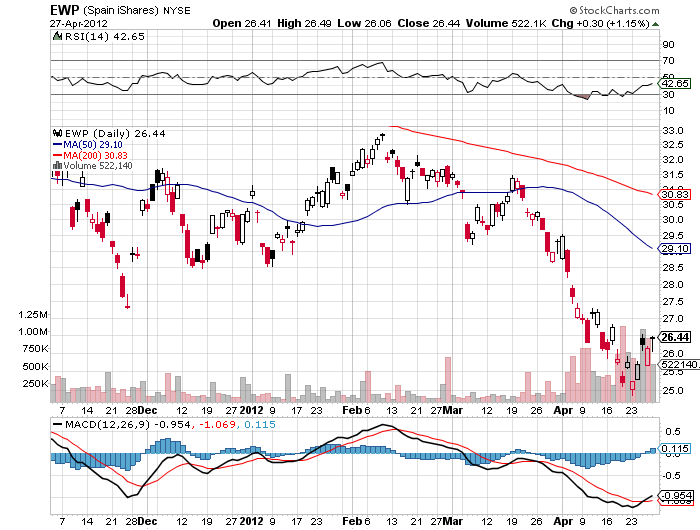

There is no doubt that the crisis in Spain is getting worse, threatening to drag down the rest of Europe, and ultimately the US, with it. Over the weekend, Standard and Poor?s downgraded the debt of 11 Spanish banks, after downgrading the country?s sovereign debt weeks earlier. Further downgrades are a given so expect them in your regular Monday morning headlines. Expect more deposit flight from banks and spiking of sovereign bond interest rates.

The country is now officially in recession, as are seven other countries, including Great Britain. Spain?s unemployment rate is now at 24%, the peak seen in the US during the great depression, and is 50% for those under 25. It all adds up to more deposit flight from banks and spiking of Spanish sovereign bond interest rates.

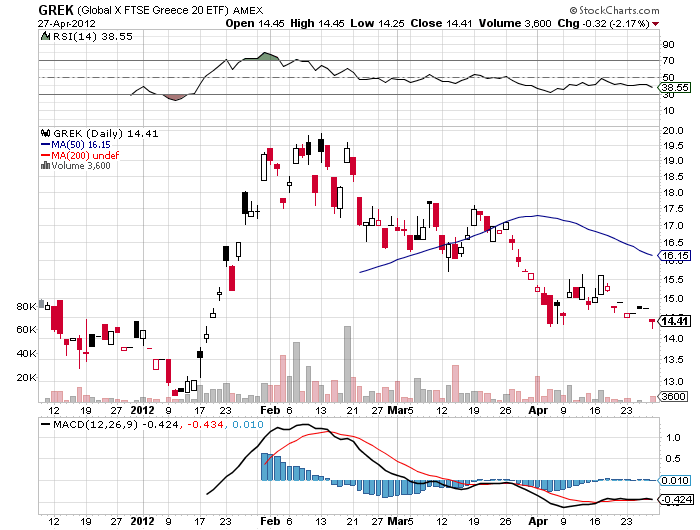

It was easy to dismiss the long, tortuous descent into the Greek bond default as irrelevant and just a favorite topic of a few journalists, as it only accounted for 1.3% of European?s $16.7 trillion GDP. That makes Greece as about as important to the continent?s total fiscal health as the bankrupt cities of Vallejo, CA, Harrisburg, PA, Central Falls, RI, and Birmingham, GA, combined, are to the US.

Spain is another kettle of fish, with the fourth largest economy accounting for 6% GDP. Spain is an even larger portion of the European financial system, with bank assets at $3.7 trillion.

Don?t expect an improvement in the Spanish economy any time soon. It just passed one of the most austere budgets in European history, attempting to roll back decades of over spending and under taxing in one shot. While austerity is great for balancing the budget for the short term, it also triggers recessions which create longer term structural problems, as it has already done in Great Britain and Greece.

The only possible growth strategy for Europe is for the private sector to ramp up spending while the governments are cutting back. In Europe, that means getting rich countries like Germany to spend more to create end demand for poor countries. However, in reality, companies run the opposite direction, hunkering down during times of economic uncertainty.

There is also an additional internal conflict afflicting Europe in that the debt heavy counties of south need inflation to devalue their debt, but deflation to restore their international competitiveness and growth. It all means that the Spanish downturn will be longer and weaker than previously thought.

In December there was a big splash when the ?500 billion LTRO was announced to take distressed sovereign debt off the hands of the banks at extremely generous prices. That has since fizzled. Now hedge funds are betting that the other shoe will fall. A second LTRO is a given, but how long will it take them to realize this and how far will bond prices plummet until we get there?

Don?t count on any US bailouts to ease Spanish pain, especially during an election year. Treasury Secretary, Tim Geithner, personally told me last week that Europe was a rich continent and had adequate resources to solve its own problems. Translation: no cash for the beleaguered continent.

It all makes my short position in the Euro through the (FXE) look pretty interesting. Some of the weaknesses mentioned above are already well known and priced into the currency markets, but not all of them. And the Europeans have a seemingly endless talent for discovering new structural problems as time goes on. Those unintended consequences can be a bitch.

With eight governments having fallen since the crisis began, and a ninth in France certain to go this weekend, who will be next is anyone?s guess. We have all become Spanish bond traders, whether we want to or not. Watch those screens.

Austerity?s Unintended Consequences