The Bad Economic Data Deluge

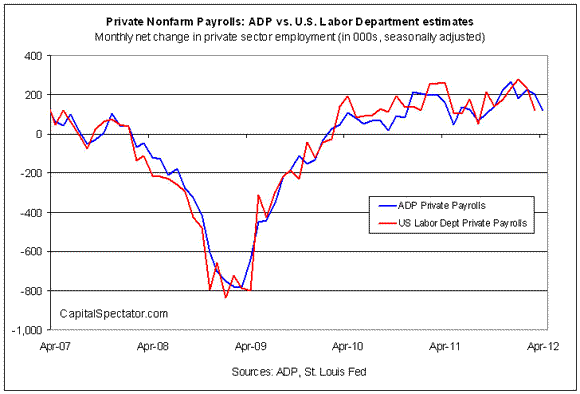

Traders were sucker punched this morning with the release of the April ADP showing that private sector hiring came in at a flaccid 119,000, some 56,000 less than expected. This signals that the Department of Labor weekly jobless claims due out at 5:30 AM EST could be equally grim, and the Friday nonfarm payroll even worse. My sub 100,000 forecast for the latter is looking better by the minute.

They were preceded by European Purchasing Managers Index figures showing that the continental economy is falling off a cliff faster than anticipated. Following was the New York April ISM, plunging from 67.4 to 61.2, and March factory orders shrinking from +1.1% to -1.5%. The economic data are clearly moving out of the frying pan and into the fire. If you want to see what the early stages of a recession look like, this is it, up close and ugly.

What amazes me is how the stock market has been able to hold up against this onslaught of deteriorating fundamentals. I have argued all along that hedge funds have been on a buying strike this year, either sitting on the sidelines or dabbling with minimal token positions. That means there are few left to sell at market tops. The subterranean level of market volatility confirms this view.

It is also true that stock indexes are rising more from a lack of sellers than from any big influx of buyers. That is verified by trading volumes that are half of what they were a year ago. And the few buyers that exist are long term in nature, like pension funds. They seem to be willing to look across any valley crated by a downturn in share prices created by the current weakness in the economy. If they are focused on a yearend share price levels that are at, or higher, than current prices, they don?t care if the indexes take a 15% detour downward, or if individual names give back as much as 30%. These guys only reallocate once a year.

That is all well and good if the summer dip is a little dell, vale, or glen that one might appreciate in a Thomas Kincaid painting. If it turns out to be a Grand Canyon, that is another story. Then they will all be puking out at the bottom, as they have done for the last three years.

Is This Your Summer Trading Strategy?