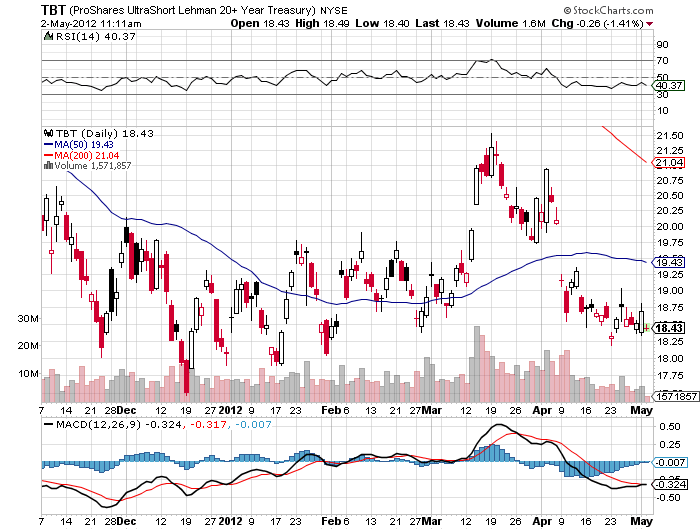

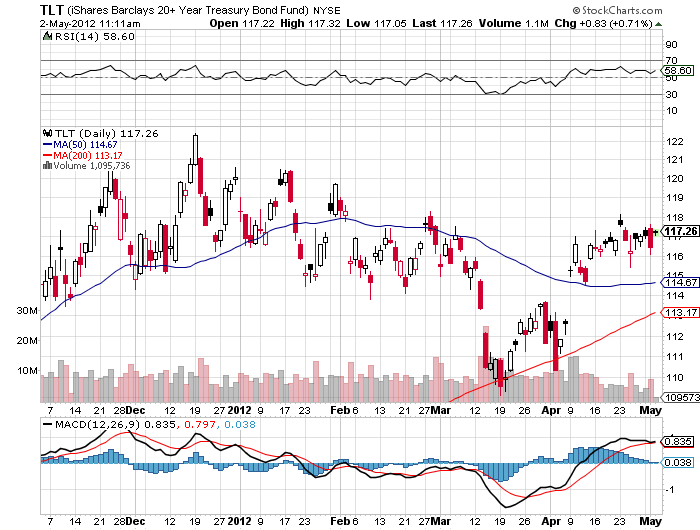

In order to enjoy your coming weekend, I thought you'd like a technical update of your positions, so feast your eyes on the two charts below. They say that a picture is worth a thousand words, so here is 2,000 words worth. If you have been negative on bonds as I have, these charts should enable you to sleep much better.

Virtually every fixed income product is peaking now. Let me draw a simple picture for you laymen out there. That means you should sell every major bond market rally for the next ten years. Whether the final bottom in yields for the ten year Treasury bond is the 1.80% that we have already seen, or 1.60% coming this summer is anyone?s guess. The technical set up is now so dire, that bonds are going to have a really tough time rallying from here. The momentum players will soon smell blood in the water, and they'll be jumping in with both feet at every opportunity. The lost decade for bonds has begun!

Of course, you knew this was coming. It doesn?t help that the budget proposals for both political parties going forward will engineer a dramatic increase in the deficit. The bond market is not laughing. Of course putting in the final top in a 30 year move could be a multiyear process. But it is time to dump that old investment guidline where you own your age in bonds. From here on, the bond/equity ratio should be o% in bonds and 100% in equities, whatever your age.

Is the Lost Decade for Bonds Beginning?