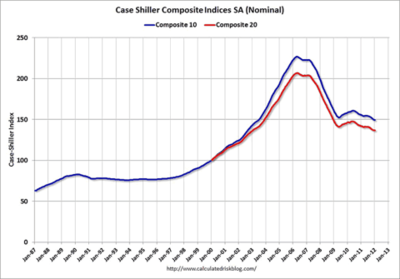

Are We Probing a Bottom With Housing?

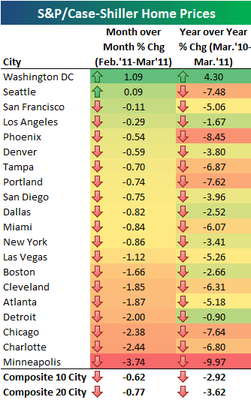

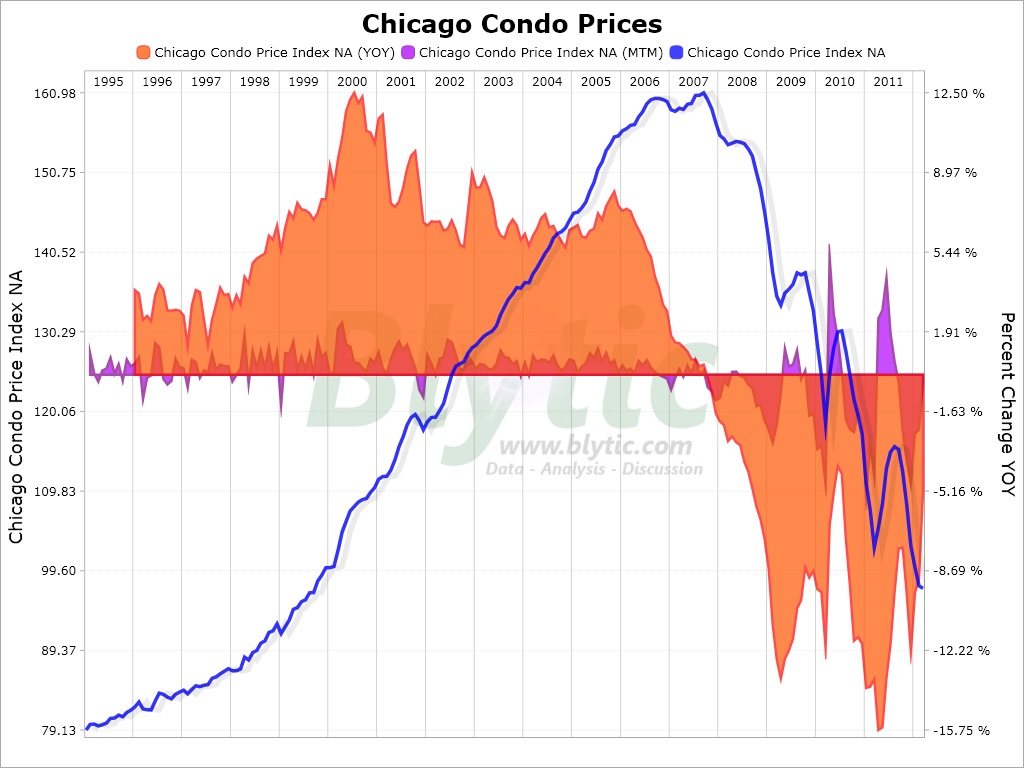

The March Case Shiller Home Price Index is out, showing that the fall in home prices continues unabated, paring -2.6% on a YOY basis. Detroit delivered the biggest drop, down a shocking -4.4%, followed by Chicago (-2.5%), and Atlanta (-0.9%). But 14 out of 20 markets managed increases in prices. The national index is still declining, but at a slower rate. Given that this indicator lags real time by about three months, is there something going on in housing that we should be anticipating?

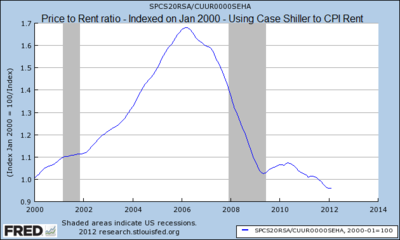

Don?t get your hopes up and rush out and place a deposit on a new home. I think that the strength that we are seeing may be only a short term anomaly of the marketplace. So much hedge fund and private equity money poured into the foreclosure market recently that we suddenly ran out of inventory. Up to 60% of recent home sales have been in the foreclosure area. This explains the sudden pop in the average cost of homes sold.

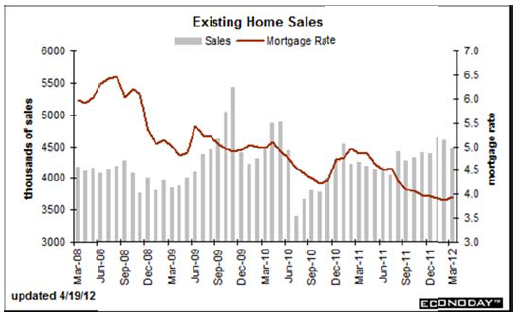

These funds have set up local management companies to rent out properties and are soaking up 1,000 homes at a throw, looking to sit on them for a decade until the demographic headwind turns to a tailwind. They are encouraged by negative real interest rates, the 30 year mortgage now plumbing an unbelievable 60 year low of 3.75% that made this investment a no brainer for the patient and deep pocketed. The goal is to eventually securitize these holdings and sell them for a premium.

We are not by any means out of the woods. Pending home sales plunged by 5.5% in April, and March was revised down sharply. The west showed the steepest decline, down 12%. The banks also have a seemingly limitless ability to produce new foreclose inventory.

The demographic headwind is still at gale force strength, as 80 million baby boomers try to sell houses to 65 million Gen Xer?s who earn half as much money. Don?t plan on selling your home to your kids, especially if they are still living rent free in the basement. There are six million homes currently late on their payments, in default, or in foreclosure, and an additional shadow inventory of 15 million units. Access to credit is still severely impaired to everyone, except, you guessed it, the 1%. Many deals fall out of escrow at the last minute over appraisal issues which fail to meet the banks? new, more demanding requirements.

I think the best case that can be made for housing here is that we may finally be coming into an uneasy balance that sets up a bottom for prices which we will bounce along for five to ten more years. This has been made possible by the arrival of an entire new class of buyers, the opportunistic hedge funds.