Trade Alert - (GLD) April 29, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (GLD)- BUY

Buy the SPDR Gold Trust (GLD) May, 2016 $115-$118 in-the-money vertical bull call spread at $2.67 or best

Opening Trade

4-29-2016

expiration date: May 20, 2016

Portfolio weighting: 10%

Number of Contracts = 38 contracts

BUY THE BREAKOUT!

That has been the lesson for gold for all of 2016.

You can pay all the way up to $2.75 for this spread and it still makes sense.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

It is a bet that the (GLD) will not trade below $118.00 at the May 20 options expiration in 15 trading days versus the current $123.38.

If I am right, you will make a 12.35% profit on your investment in 15 trading days. It is a great low risk, high return way to approach this kind of frenetic algorithm driven market.

Gold is one of the very few investments that absolutely everyone wants to own this year.

Almost all economic scenarios going forward are gold positive.

Two and a half months of flat line price action in gold gives us a reasonable entry point in the new bull market. If it can?t go down, it surely must go up.

If you can?t buy options, just pick up the (GLD) outright. Don?t touch the Market Vectors Gold Miners (GDX) on pain of death. It has run too far, too fast.

Worst case, gold will grind sideway from here as we digest the recent gains. The SPDR Gold Trust (GLD) May, 2016 $115-$118 in-the-money vertical bull call spread will still expire at its maximum profit point.

Best case, gold breaks out to a new one year high on the next stock meltdown, which could be only days away. This would make (GLD) the perfect hedge for any long stock positions you may have.

Remember, the reasons we like the yellow metal now are that it is the biggest beneficiary of a NIRP (negative interest rate) world, production will fall 20% over the next four years, and China and India are ramping up their reserve buying.

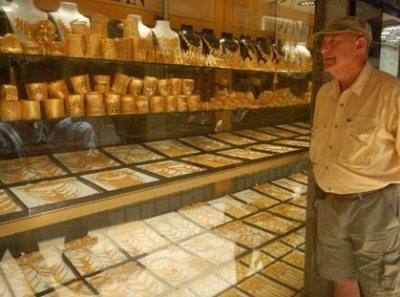

What we are seeing now is the unleashing of 67 years of repressed gold consumption by a newly rising middle class in China. It is highly reminiscent of the 39-year flood of gold buying let loose by president Richard Nixon removal of the US from the gold standard in 1972.

As you may recall, that stampede lasted for eight years and took gold up from $34 to $900 an ounce. I was found standing in line in Johannesburg unloading by stash of krugerands right at the market top.

China is already the world?s largest gold producer, how much is anyone?s guess. It is also the second largest importer, after India, unable to sate domestic demand.

The yellow metal is a natural target for Chinese flight capital. We are still close to the bottom of a five-year bear market in gold created by an unremitting seven-year bull market in global stocks.

Only five months ago, the Federal Reserve was threatening eight consecutive quarters of 25-point discount rate rises, according to former governor Richard Fisher.

When the stock market threatened to commit suicide as a result, that was taken off the table. The latest rally will allow the Fed to give us one, or possibly two more quarter point rate rises this year, but no more.

In the meantime, the rest of the developed world, like Europe and Japan, have moved to negative interest rates, in some cases quite impressively so. Overnight cash deposits in Europe are now charging negative 40 basis points a year.

This is fantastic news for gold, has given us some meteoric moves in both the barbarous relic and the miners.

There is more good news to come. Slowing global growth, the prospect of more sudden Yuan devaluations, and rising energy debt defaults in the US have all made gold sparkle more than ever.

Followers of the Mad Hedge Fund Trader Trade Alert service have already coined it three times this year with my bullish calls on gold. More are to come.

All that is needed is a good entry point, always the million-dollar question.

It?s a trend even my cousin Milton can spot.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking here at https://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 38 May, 2016 (GLD) $115 calls at????.?.??$8.60

Sell short 38 May, 2016 (GLD) $118 calls at.????..$5.93

Net Cost:???????????????????.....$2.67

Potential Profit: $3.00 - $2.67 = $0.33

(38 X 100 X $0.33) = $1,254 or 12.35% profit in 15 trading days