A Buy Write Primer

With both market technical and fundamentals going to hell in a handbasket, it’s time to take a refresher course on “Buy Writes.”

I have advised followers to dump the positions they are dating and only keep the ones they are married to. It’s worth enduring a 30% drawdown in a high-quality name to capture a 300% profit over the long term.

If you sell an Amazon (AMZN) or Alphabet (GOOGL) now, I guarantee you that you’re not going to be able to buy them back at the bottom. For a start, when these do bottom out, the universal advice is to sell them because the world is ending….again.

There is always a way to make money in the stock market. Get the direction right, and the rest is a piece of cake.

But what if the market is going nowhere, trapped in a range, with falling volatility? Yes, there is even a low risk, high return way to make money into this kind of market, a lot like the one we have now.

And that’s the way markets work. It’s like watching a bouncing ball, with each successive bounce shorter than the previous one. Thank Leonardo Fibonacci for this discovery (click here for details).

Which means a change in trading strategy is in order. The free lunch is over. It’s finally time to start working for your money.

When you’re trading off a decade low its pedal to the metal, full firewall forward, full speed ahead, damn the torpedoes. Your positions are so aggressive and leveraged that you can’t sleep at night.

Some four years into the bull market, not so much. It’s time to adjust your trades for a new type of market that continues to appreciate, but at a slower rate and not as much.

Enter the Buy Write.

A buy write is a combination of positions where you buy a stock and also sell short options on the same stock against the shares at a higher price, usually on a one-to-one basis.

“Writing” is another term for selling short in the options world because you are, in effect, entering into a binding contract. When you sell short option, you are paid the premium and the buyer pays, and the cash sits in your brokerage account, accruing interest.

If the stock rallies, remains the same price, or rises just short of the strike price you sold short, you get to keep the entire premium.

Most buy writes take place in front month options, and the strike prices are 5% or 10% above the current share price. I’ll give you an example.

Let’s say you own 100 shares of Apple (AAPL) at $140. You can sell short one August 2021 $150 call for $1.47. You will receive the premium of $147.00 ($1.47 X 100 shares per option). Remember, one option contract is exercisable into 100 shares.

As long as Apple shares close under $150 at the August 20 option expiration, you get to keep the entire premium. If Apple closes over $150, you automatically become short 100 Apple shares. Then, you simply instruct your broker to cover your short in the shares with the 100 Apple shares you already have in your account.

Buy writes accomplish several things. They reduce your risk, pare back the volatility of your portfolio, and bring in extra income. Do these write, and it will enhance the overall performance of your portfolio.

Knowing when to strap these babies on is key. If the market is going straight up, you don’t want to touch buy writes with a ten-foot pole as your stock will be called away, and you will miss substantial upside.

It’s preferable to skip dividend-paying months, usually March, June, September, and December, to avoid your short option getting called away mid-month by a hedge fund trying to get the dividend on the cheap.

You don’t want to engage in buy writes in bear markets. Whatever you take in with option premium, it will be more than offset by losses on your long stock position. You’re better off just dumping the stock instead.

Now comes the fun part. As usual, there are many ways to skin a cat.

Let’s say that you are a cautious sort. Instead of selling short the $150 strike, you can sell the $155 strike for less money. That would bring in $79 per option. But your risk of a call away drops, too.

You can also go much further out in your expiration date to bring in more money. If you go out to the January 18, 2022, expiration, you will take in a hefty $6.67 in option premium, or $667 per option. However, the likelihood of Apple rising above $150 and triggering a call away by then is far greater.

Let’s say you are a particularly aggressive trader. You can double your buy-write income by doubling your option short sales at the ratio of 2:1. However, if Apple closes above $150 by expiration day, you will be naked short 100 shares of Apple.

It is likely you won’t have enough cash in your account to meet the margin call for selling short 100 shares of Apple, so you will have to buy the shares in the market immediately. It is something better left to professionals.

How about if you are a hedge fund trader with a 24-hour trading desk, a good in-house research department, and serious risk control? Then you can entertain “at-the-money buy writes.”

In the case of Apple, you could buy shares and sell short the August 20 $140 calls against them for $4.45 and potentially take in $4.45 for each 100 Apple shares you own. Then, you make a decent profit if Apple remains unchanged or goes up less than $4.45.

That amounts to a $3.18% return in 34 trading days and annualizes out at 26%. In bull markets, hedge funds execute these all day long, but they have the infrastructure to manage the position. It’s better than a poke in the eye with a sharp stick.

There are other ways to set up buy wrights.

Instead of buying stock, you can establish your long position with another call option. These are called “vertical bull call debit spreads” and are a regular feature of the Mad Hedge Trade Alert Service. “The “vertical” refers to strike prices lined up above each other. The “debit” means you have to pay cash for the position instead of getting paid for it.

How about if you are a cheapskate and want to get into a position for free? Buy one call option and sell short two call options against it for no cost. The downside is that you go naked short if the strike rises above the short strike price, again triggering a margin call.

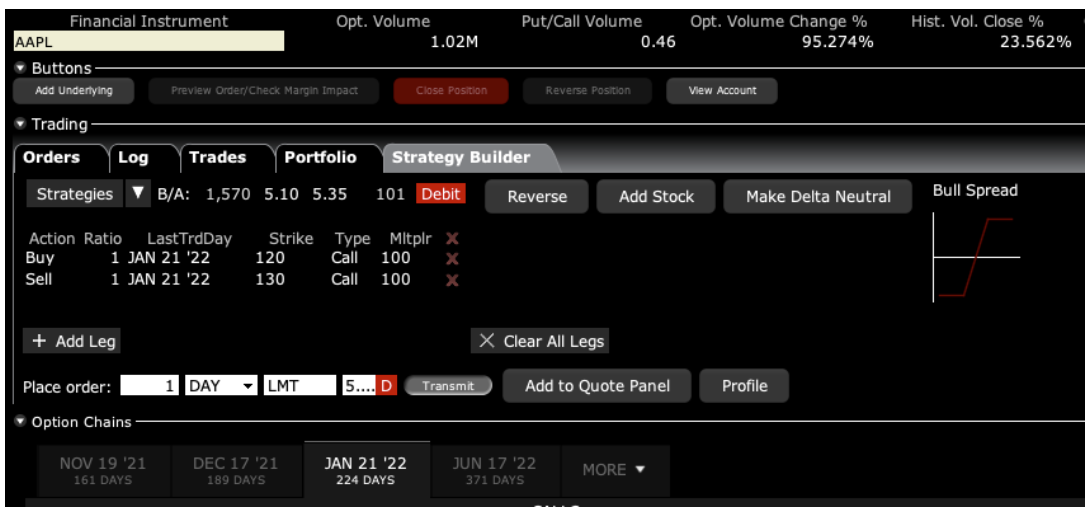

Here is my favorite, which I regularly execute in my own personal trading account. Buy long-term LEAPS (Long Term Equity Anticipation Securities) spreads like I recommended three weeks ago with the (AAPL) January 21 $120-$130 vertical bull call spread for $5.20.

On Friday, it closed at $7.21, up 38.65%.

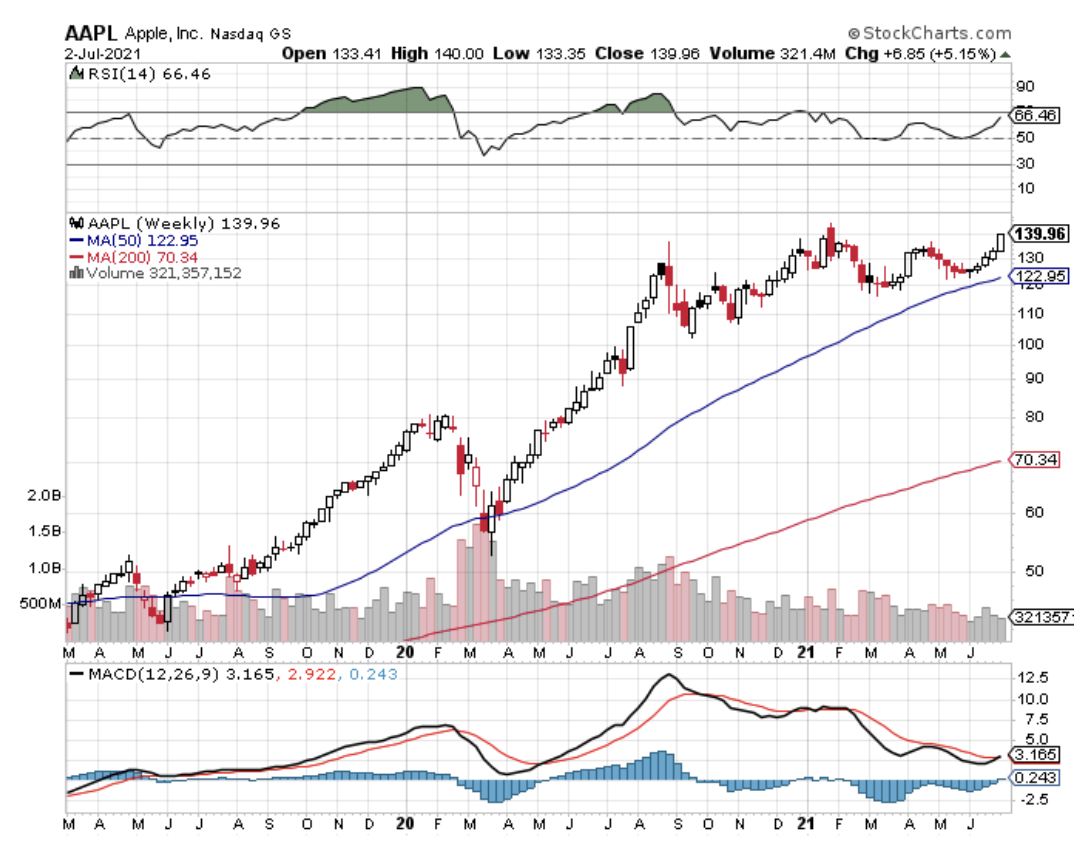

This is a bet that one of the world’s fastest-growing companies will see its share unchanged or higher in seven months. In Q1, Apple’s earnings grew by an astonishing 35% to $23.6 billion. Sounds like a total no-brainer, right?

If I run this position all the way to expiration, and I probably will, the total return will be ($10.00 - $5.20 = $4.80), or ($4.80/$5.20 = 92.31%) by the January 21, 2022, option expiration. This particular expiration benefits from the year-end window dressing surge and the New Year asset allocation into equities.

Whenever we have a big up month in the market, I sell short front-month options against it. In this case, that is the August 20 $150 calls. This takes advantage of the accelerated time decay you get in the final month of the life of an option, while the time decay on your long-dated long position is minimal.

Keep in mind that the deltas on LEAPS are very low, usually around 10%, because they are so long-dated. That means your front month short should only be 10% of the number of shares owned through your LEAPS in order to stay delta-neutral. Otherwise, you might get hit with a margin call you can’t meet.

After doing this for 53 years, it is my experience that this is the best risk/reward options positions available in the market.

To make more than 92.31% in seven months, you have to take insane amounts of risk or engage in another profession, like becoming a rock star, drug dealer, or Bitcoin miner.

I’m sure you’d rather stick to options trading, so good luck with LEAPS.