A Century Forecast on Emerging Markets

I love making very long term forecasts, because they give tremendous insights into the future of the global economy, and because at my advanced age, I won?t live long enough to see if I am right or wrong.

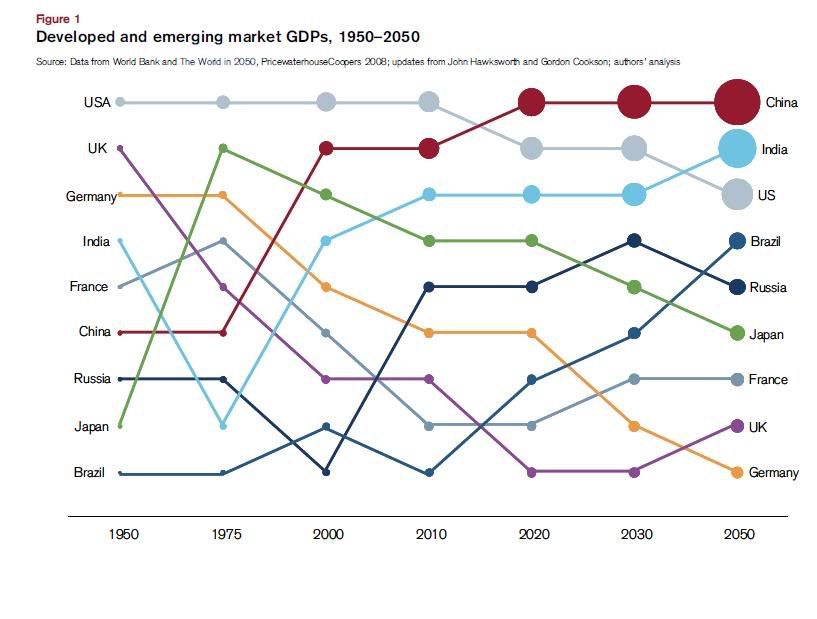

Check out the chart below which shows predicted GDP growth rates for a 100 year period from 1950 to 2050. It shows why you should be infatuated with emerging markets (EEM) like Brazil (EWZ), China (FXI), and India (PIN), lukewarm about the US (SPX), and avoiding Europe and Japan (EWJ) like the plague. It also gives the underlying argument behind my long term currency calls to stay short the yen.

The basic trade is to be long countries and currencies with high growth rates, and be short, or at least stay out of, countries and currencies with low growth rates. As exciting as this chart is, I really don?t see myself living another 38 years to 2050. But who knows? Isn?t 100 the new 80?