A Euro Collapse At Last!

European Central Bank president Mario Draghi pulled the rug out from under the Euro (FXE), (EUO) this morning, announcing a surprise cut in interest rate and substantially adding to its program of quantitative easing.

The action caused the beleaguered currency to immediately gap down two full cents against the dollar, the ETF hitting a 15 month low of $127.40.

Surprise, that is, to everyone except a handful of strategists, including myself. Apparently, I was one of 4 out of 47 economists polled who saw the move coming, beating on my drum out of the coming collapse of the euro for the past six months.

I put my money where my mouth was, slamming out Trade Alerts to sell the Euro short, and sometimes even running a double position.

Of course, it helps that I just spent two months on the continent splurging at 90% off sales, and afterwards feasting on $10 Big Macs and $20 ice cream cones. Europe was practically begging for a weaker currency. Shorting the Euro against the greenback appeared to be a no-brainer.

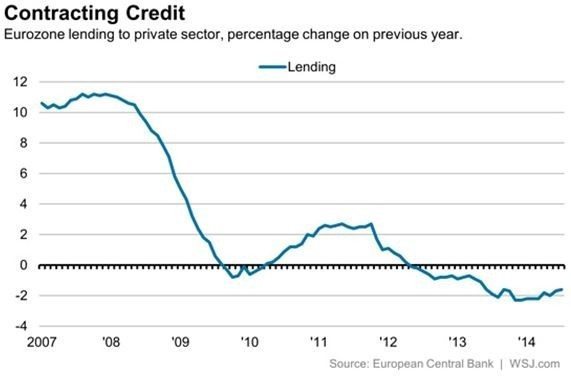

A number of key economic indicators conspired to force Draghi?s hand this time around. August Eurozone inflation fell to a feeble 0.3%. France cut its 2014 GDP estimate at the knees, from 1.0% to 0.5%. Unemployment hovers at a gut wrenching 11.5%. To the continent?s leaders it all looked like a deflationary lost decade was unfolding, much like we saw in Japan.

Call the move an hour late, and a dollar short. Or more like 43,800 hours late and $4 trillion short. The US Federal Reserve started its own aggressive quantitative easing five years ago. The fruits of Ben Bernanke?s bold move are only just now being felt.

A major reason for the delay is that having a new currency, Europe lacks the breadth and depth of financial instruments in which it can maneuver. The Euro will soon be approaching its 15th birthday. Uncle Buck has been around since 1782.

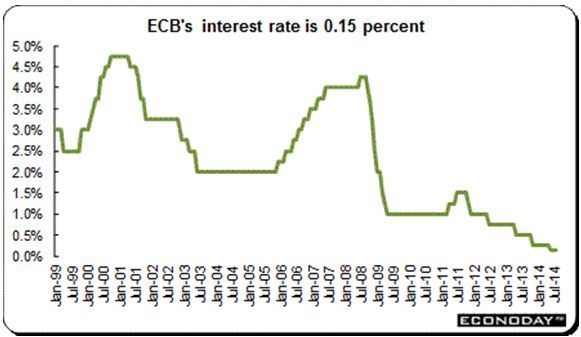

The ECB?s move is bold when compared to its recent half hearted efforts to stimulate its economy. Its overnight lending rate has been cut from 0.15% to 0.05%, the lowest in history. Deposit rates have been pushed further into negative territory, from -0.10% to -0.20%. Yes, you have to pay banks to take your money! A QE program will lead to the purchase of 400 billion Euros worth of securities.

Am I selling more Euros here?

Nope.

I covered the last of my shorts last week, after catching the move in the (FXE) from $136 down to $130. That?s a major reason why my model trading portfolio is up a blistering 30% so far this year.

At $127, we are bang on my intermediate downside target. But get me a nice two or three cent short covering rally, and I?ll be back in there in a heartbeat. My next downside targets are $120, $117, and eventually $100. My European vacations are getting cheaper by the day.

To review my recent posting on the coming collapse of the Euro, please click here ?The Euro Breaks Down, here ?Unloading More Euros? and here for ?The Time to Dump the Euro is Here?.