A Great Opportunity For Tech Investors

We avoided the big one.

That’s a common utterance in Japan when the Japanese believe they avoided devastation when it comes to earthquakes.

The same goes for US tech stocks today.

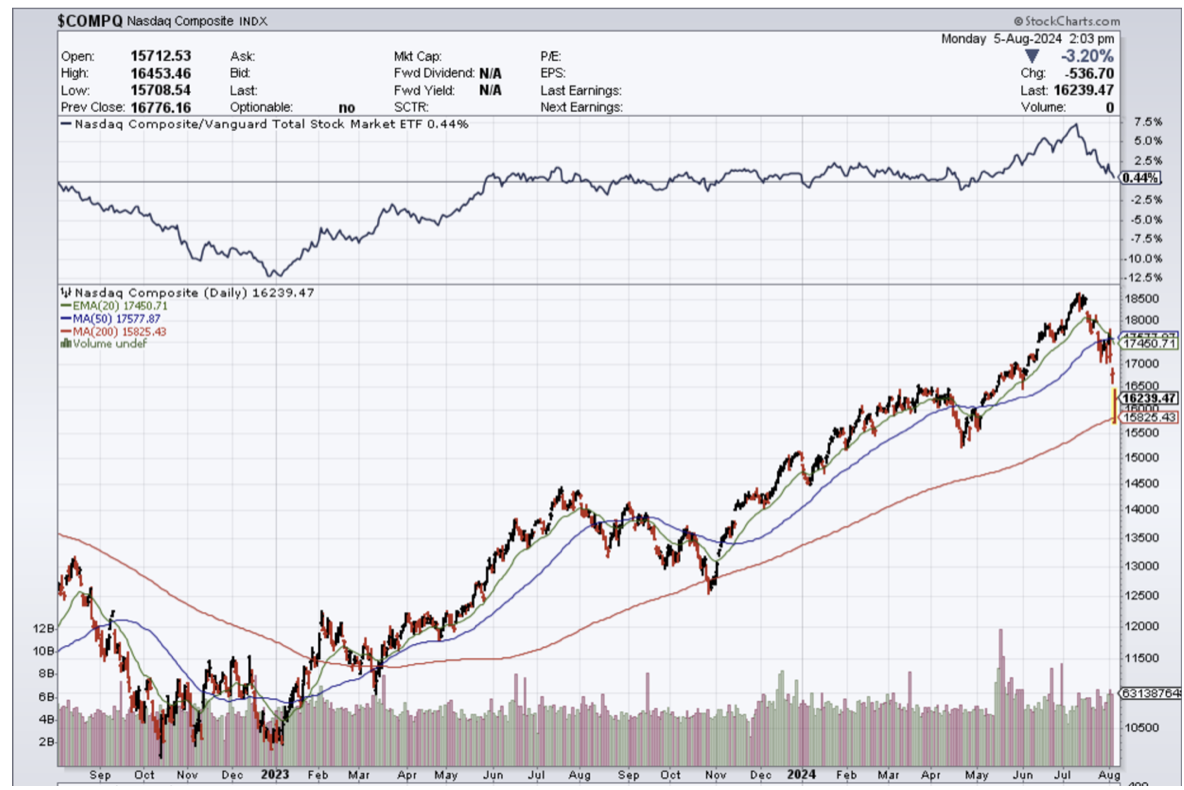

Sure, raising interest rates when the Japanese economy is contracting is something a schoolboy wouldn’t do, but that is what took place and U.S. tech stocks ($COMPQ) are dealing with the devastating aftermath.

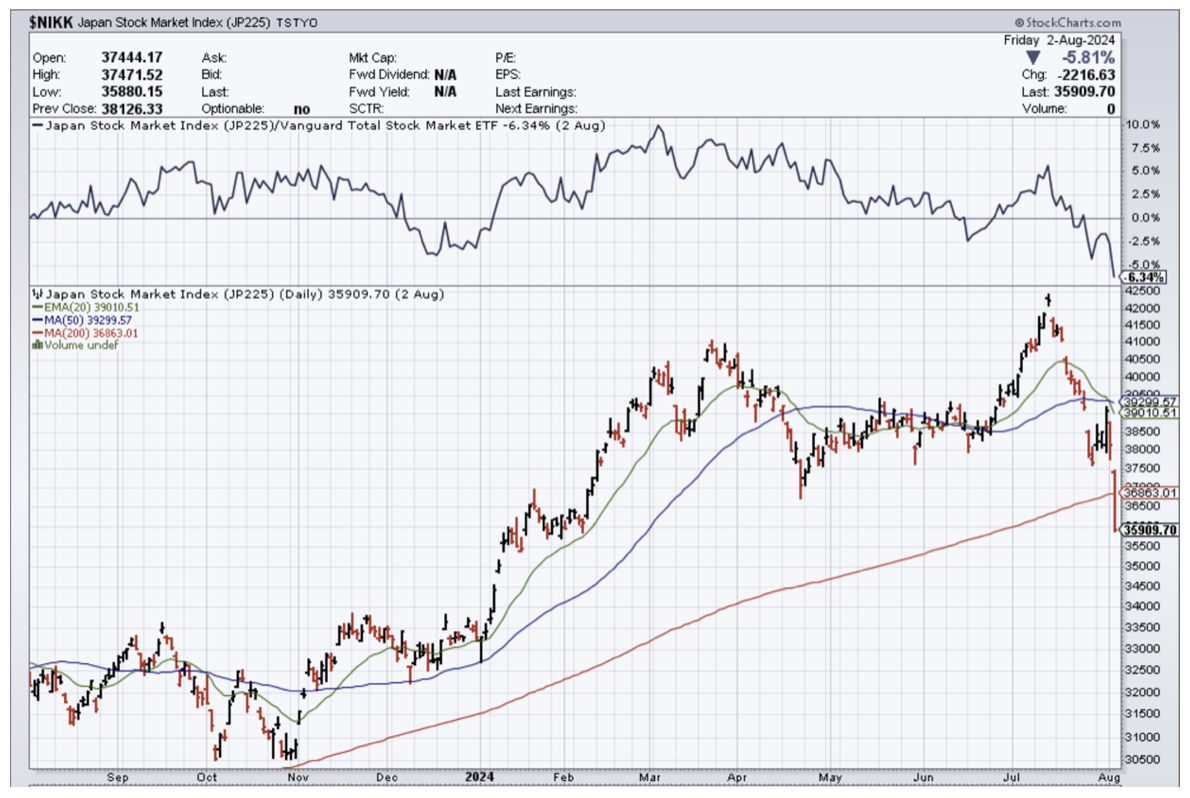

Japan is in a rock and a hard place in terms of monetary policy - orders were sent through to Bank of Japan governor Kazuo Ueda to protect the yen at all costs.

It was a totally political move.

Then the Japanese yen exploded higher after Ueda raised rates a measly 25 basis points, but by mistake crashed the U.S. tech sector and the Japanese stock market ($NIKK) which is down around 25% in the past month.

All this talk about the economy going into recession is too early.

It is also highly positive for US tech stocks that this crash was provoked in Japan and has nothing to do with structural issues to the US economy or tech sector.

I do agree that the US economy is slowing and hiring is getting worse, but the economy is still growing, unlike Japan.

Therefore, this is a swift overreaction from another policy error from the Japanese establishment. The Bank of Japan is also out of bullets on the monetary side of things. One and done.

Japan could be the worst-run country in the world which is why most foreigners want to briefly visit to eat sushi and leave.

The Japanese will soon eclipse the 300% debt per GDP threshold – a practice of pile-driving a country completely into the ground while demoralizing the local youth and their fragile future hopes.

So I’ll get to the meat and bones of it.

This will be a big dip to buy into and the hard landing narrative should be delayed by a few months because data is still too good to ignore.

The major tech companies have been priced for perfection for quite some time now. But doubts over AI, which incurs high costs today for uncertain returns in the future, have crept in and started to unnerve investors.

Chipmaker Intel plans to cut a huge chunk of its global workforce while pocketing $8 billion from the federal government. The transformation into lean staffing continues in Silicon Valley and won’t stop.

Now what?

The tech stock freakout does make it much easier for the Fed to push through a half-point rate hike rather than a quarter-point rate cut in September, which really puts a floor under tech stocks. I could argue that this would inject rocket fuel into a possible winter rally.

I highly doubt that tech stocks will suffer real panic before the US election because imagine a boatload of democratic voters who are the ones mostly owning tech stocks going to the polls grumpy, frustrated, and confused as to why their 401k has been flushed down the toilet.

This is most likely the biggest dip in the best of tech that we will get before the US election. Embrace and execute.

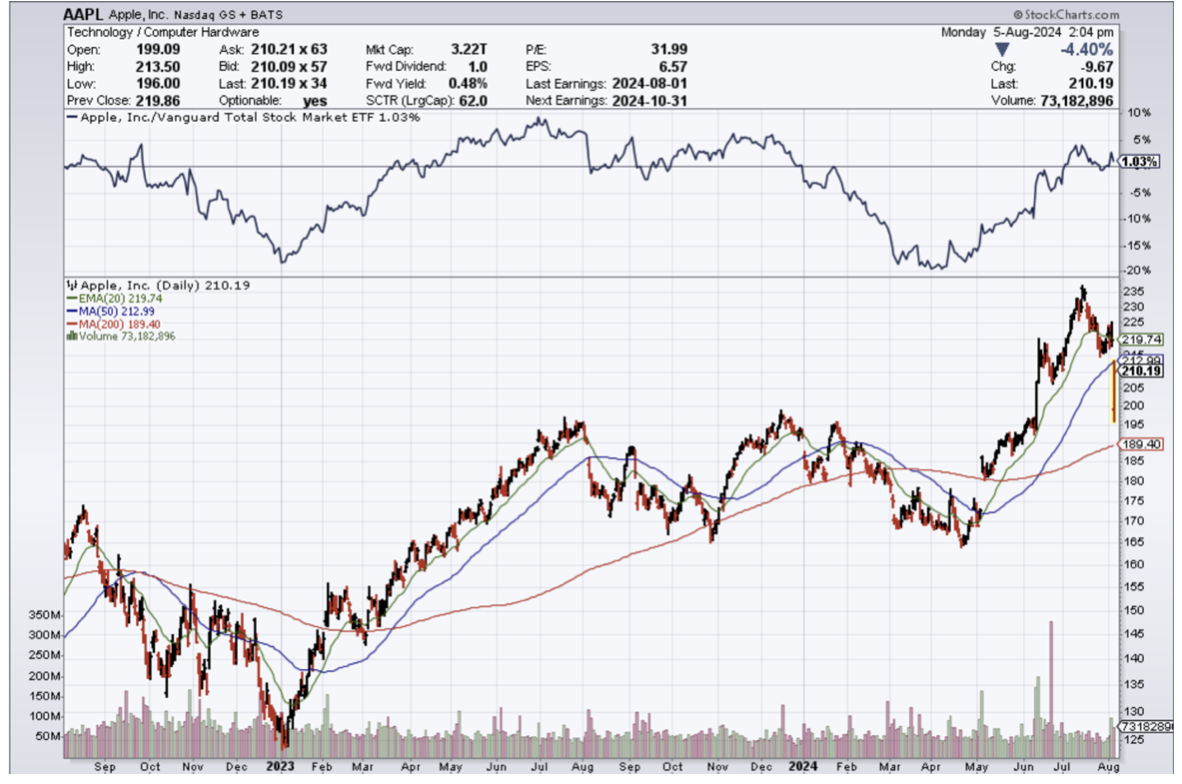

Warren Buffett unloading half of his Apple (AAPL) position almost suggested that he knew something before the rest of us, but I do believe that he will regret selling out so early. He is deep in the know in Japan and stateside.

He will need to buy tech back at a higher price, but he can afford it. Most of the rest of us must execute like a miracle depended upon it and that’s why I am here to guide you through the fog of war.

Buy the dip in tech shares.