Trade Alert - (UNG) - BUY LEAPS

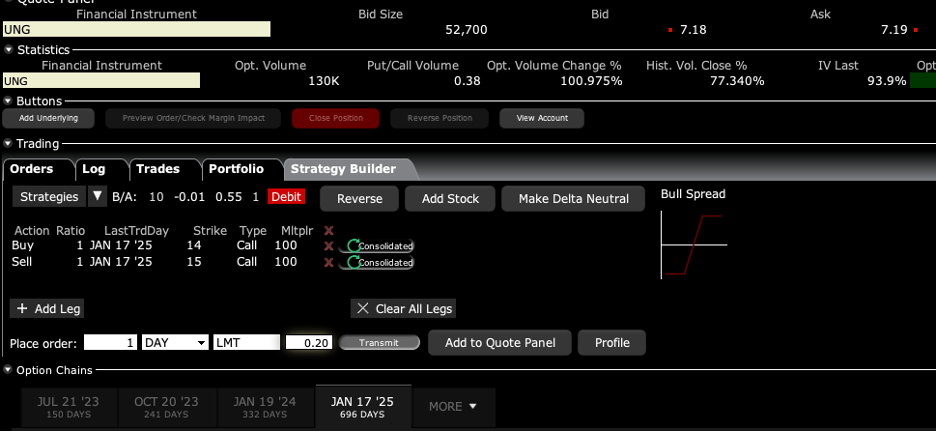

BUY the United States Natural Gas Fund (UNG) January 2025 $14-$15 deep out-of-the-money vertical Bull Call debit spread LEAPS at $0.25 or best

Opening Trade

3-9-2023

expiration date: January 17, 2025

Number of Contracts = 1 contract

Natural gas has just given up half of its recent gain today and is now down 14%. Forecasts of mild spring weather and falling demand are the reasons. So, I am diving back in.

Natural gas at one point fell some 80% since it peaked in June of 2022. It is now down so much that you have to buy it even if you hate it.

The much-predicted nuclear winter in Europe never showed. Instead, the continent enjoyed one of the warmest winters on record, with some ski resorts completely devoid of snow. To save Europe’s bacon, the US government ordered the diversion of dozens of natural gas carriers from China to Europe. The Middle East also ramped up its gas exports.

Now, we have recession fears. Storage in both Europe and the US is near all-time highs.

What happens next is that Covid burns out in China, allowing the economy to recover and sending the demand for natural gas through the roof. The Freeport McMoRan’s export facility in Quintana, TX that blew up a few months ago is coming back on stream.

That screeching sound you hear is natural gas wells being shut down, which happens every time we approach the $2.00 price in gas. That is sowing the seeds of the next shortage. That sets up an easy double for gas from here. While gas may not yet have hit its final bottom, it is close enough to do a trade here.

While the chance of winning a real lottery is something like a million to one, this one is more like 10:1 in your favor. And the payoff is 300% in little less than two years. That is the probability that (UNG) shares will rise over the next 23 months.

I have been through a half dozen energy cycles in my lifetime, and I can see another one starting up.

I am therefore buying the United States Natural Gas Fund (UNG) January 2025 $14-$15 deep out-of-the-money vertical Bull Call debit spread LEAPS at $0.25 or best.

Don’t pay more than $0.50 or you’ll be chasing on a risk/reward basis.

I think all carbon energy sources eventually go to zero over the next 20 years as they are replaced by alternatives, but we will have several doubles in price on the way there. This is one of those doubles.

But don’t ask me. I only drilled for natural gas in Texas and Colorado for five years in the late 1990s using a revolutionary new technology called “fracking.” I moved on after making a fortune, buying gas for $2 and selling it on for $6 or $7.

To learn more about the United States Natural Gas Fund (UNG), please click here.

Please note that these options are illiquid, and it may take some work to get in or out. Executing these trades is more an art than a science.

Let’s say the United States Natural Gas Fund (UNG) January 2025 $14-$15 deep out-of-the-money vertical Bull Call debit spread LEAPS are showing a bid/offer spread of $0.10-$0.90, which is typical.

Enter an order for one contract at $0.10, another for $0.20, another for $0.30, and so on. Eventually, you will enter a price that gets filled immediately. That is the real price. Then enter an order for your full position at that real price.

A lot of people ask me about the appropriate size. Remember, if the (UNG) does NOT rise by 85.9% in 23 months, the value of your investment goes to zero.

If by chance (UNG) rises quickly, which it might, you don’t have to wait the full two years. You can take profits at any time.

The way to play this is to buy LEAPS in ten different companies. If one out of ten increases ten times, you break even. If two of ten work, you double your money, and if only three of ten work you triple your money.

You never should have a position that is so big that you can’t sleep at night, or worse, need to call John Thomas asking if you should sell at a market bottom.

Keep in mind that (UNG) has a substantial “contango” of 35% to overcome. That means the futures one year out are selling at a 35% discount. So, gas has to rise by 35% in a year for you just to break even. The contango covers gas storage charges and the cost of carry for borrowed money.

Notice that the day-to-day volatility of LEAPS prices is miniscule since the time value is so great. This means that the day-to-day moves in your P&L will be small. It also means you can buy your position over the course of a month just entering new orders every day. I know this can be tedious but getting screwed by overpaying for a position is even more tedious.

Look at the math below and you will see that an 85.9% rise in (UNG) shares to $15 will generate a 300% profit with this position, such is the wonder of LEAPS. That gives you an implied leverage of 3.5:1 across the $14-$15 space.

I have done the math here for a single contract. You can adjust your size accordingly.

If you want to get much more aggressive on the natural gas trade, you can buy the ProShares Ultra Natural Gas ETF (BOIL), a 2X long leveraged ETF. Keep in mind that 2X ETFs have much higher costs, wider dealing spreads, and greater tracking error. This is really designed for short-term or even day trading. (BOIL) is down a staggering 97% from its June high.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

This is a bet that the (UNG) will not fall below $15 by the January 17, 2025 options expiration in 23 months.

Here are the specific trades you need to execute this position:

Buy 1 January 2025 (UNG) $14 call at………….………$2.60

Sell short 1 January 2025 (UNG) $15 call at….………$2.35

Net Cost:………………………….………..………….....….....$0.25

Potential Profit: $1.00 - $0.25 = $0.75

(1 X 100 X $0.75) = $75, or 300% in 23 months

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Debit Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.