AbbVie’s Battle for Arthritis Dominance

You would think that a company with 60% of the arthritis market would see a soaring stock price. But you would be wrong.

Based on its 2019 performance to date though, AbbVie (ABBV) seems to be on the brink of a disaster. From an impressive 54% gain way back in 2017, the giant pharma stock started to lose ground this year with its share price falling by double-digit percentages. Nevertheless, staunch believers of this stock remain steadfastly optimistic about the company's future.

Here are pretty good reasons why they might be right.

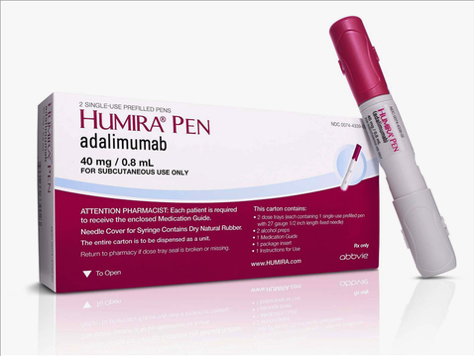

A lot of investors have been wary of AbbVie due to the company's dependence on their blockbuster drug, Humira, which is marketed as a treatment for rheumatoid arthritis, psoriatic arthritis, ankylosing spondylitis, Crohn's disease, ulcerative colitis, psoriasis, hidradenitis suppurativa, uveitis, and juvenile idiopathic arthritis. Since AbbVie derives 60% of its total revenue from the sales of this drug, it's understandable why its shareholders are getting nervous over its declining performance in the market along with the emergence of competitors across the globe.

Surprisingly, AbbVie isn't the least bit worried about Humira.

One of the main reasons for their confidence in Humira's continued dominance in the market is the fact that biosimilar drugs won't be available in the US until around 2023. Given that two-thirds of Humira's sales or roughly $20 billion of its global profits come from the American market, this timeframe gives AbbVie a couple more years to rake in profits from its top drug. In fact, Humira is projected to keep earning as much as $15 billion up until 2024.

Notably, AbbVie has been labeled as a ruthless competitor with its latest move to mark down Humira by up to 89%. This "market poisoning" tactic, as its critics would dub it, has resulted in exits from a number of competitors and would-be competitors aiming to target the Dutch market as well. Hence, Humira might just be able to assert a renewed monopoly in the European nation via their aggressive discounts.

On top of that, AbbVie has lined up a couple of potential blockbuster drugs to take the baton from their beloved Humira. Plaque psoriasis drug Risankizumab along with rheumatoid arthritis treatment Upadacitinib are anticipated to boost AbbVie’s revenues this year as well.

In fact, both treatments are expected to gain FDA approval this year. These drugs, which are estimated to bring in incremental yearly sales of approximately $10 billion, are expected to pick up additional approvals to cater to other autoimmune diseases as well. Using a back-of-the-envelope calculation to add these two potential blockbuster drugs, therefore, puts AbbVie’s incremental risk-adjusted sales at around $35 billion by 2025.

Meanwhile, the company’s other promising products such as blood cancer treatments Imbruvica and Venclexta as well as endometriosis drug Orilissa are doing good in the market.

AbbVie has been exploring the possibility of expanding the indications for Venclexta to cover chronic lymphocytic leukemia (CLL), multiple myeloma, and acute myeloid leukemia (AML). As for Orilissa, this drug is slated to become yet another blockbuster product for AbbVie as it attempts to win approval for the treatment of uterine fibroids. Should Orilissa succeed in this, AbbVie would be poised to become one of the leading companies in the women's health category.

With all these developments and consistent sales from AbbVie, the company is anticipated to post an earnings per share of $2.05 by the next earnings report. If that happens, then the figures would indicate a 9.63% YOY growth for the company.

In managing my portfolio, I always bear in mind the wise words of Warren Buffett: "If you aren't willing to own a stock for 10 years, don't even think about owning it for 10 minutes." At the moment, AbbVie is sold at a bargain with shares trading at lower than eight or nine times its expected earnings. Looking at the company’s pipeline and history of aggressively protecting its moneymaking drugs, it’s clear that AbbVie is poised to provide a significant boost in anyone’s portfolio in the future.

Buy AbbVie on the next market selloff.