Another Call From Texas

I received another one of those scratchy, barely audible cell phone calls from my buddy at the Barnet Shale in Texas this morning.

Cheniere Energy (LNG) is has obtained three of the four permits it needs to begin construction of a gas liquifaction plant in Louisiana. This will enable the company to export natural gas (UNG) to Asia, where it is selling for prices eight times higher that here in the US. The project will be a major step towards dealing with the enormous glut of natural gas dumped on the market by the new ?fracking? process that has taken prices down to under $2/MM BTU?s, a new 12 year low.

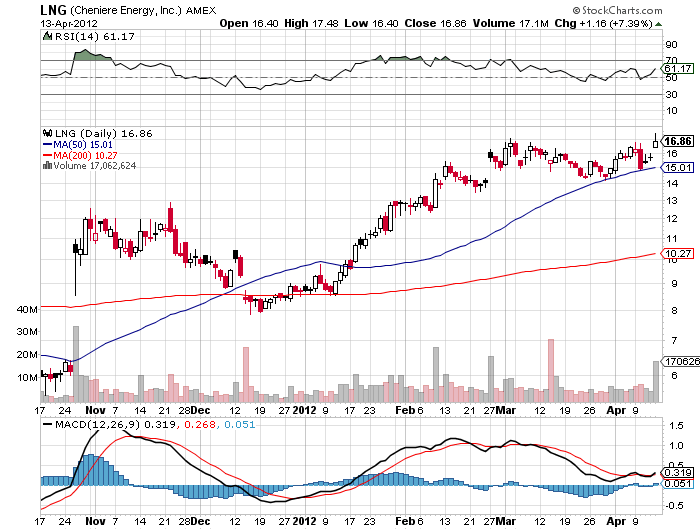

Today we learned that (LNG) made it on to the calendar for a Federal Energy Commission (FERC) hearing on April 19 to consider this last license. That news alone was enough to drive the share up 7% today to a new high for the year. There the company will be opposed by the usual anti carbon alliance of environmentalists.

You may recall that I recommended this stock to readers back March 7 when it was trading at $16.10 a share (click here for ?Take a Look at Cheniere Energy (LNG)?). Today, the stock hit a high of $17.48, a gain of 8.6% since then. If Cheniere get the permit, as it is likely to do, the shares are likely to double. If it doesn?t, it will halve. I?ll leave it up to you to decide how best to play this.